On February 7, Alibaba Group unveiled its financial performance for the quarter ending on December 31, 2023.

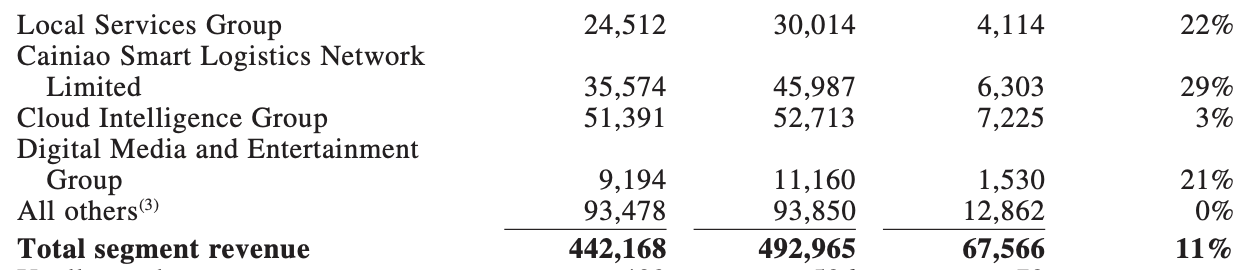

Alibaba’s cloud intelligence business ranks second only to Taobao Tmall Commerce Group (also known as Taotian Group). According to the latest report, Alibaba Cloud’s revenue increased by 3% in Q4 2023 to RMB 28.07 billion (USD 3.95 billion), comprising 11% of Alibaba Group’s total revenue, higher than the 9% recorded in Q1 2023.

“Our top priority is to reignite the growth of our core businesses: e-commerce and cloud computing,” said Eddie Wu, CEO of Alibaba Group, during a conference call held after the release of the report.

It’s worth noting that, if the 3% revenue growth mentioned in the latest report is to exclude revenue contributed by Alibaba Group, then the revenue of Alibaba’s cloud business would have declined year-on-year. This is largely down to the group’s ongoing efforts to enhance revenue quality by cutting back on project-based contracts with lower profit margins.

In recent years, Alibaba Cloud’s revenue growth rate has been steadily declining. From fiscal year 2019 to 2022, its revenue growth rates were 84%, 62%, 50%, and 29%, respectively, indicating a downward trend.

This slowdown in revenue growth corresponds with the decline in Alibaba Cloud’s market share in the Chinese public cloud market since the second half of 2022. The latest IDC report shows that, in the first half of 2023, Alibaba Cloud’s market share in the public cloud infrastructure-as-a-service (IaaS) market was 29.9%, lower than that in 2022 despite retaining its place as market leader. Other major IaaS players include Huawei, China Telecommunications Corporation (CT), Tencent, and Amazon Web Services (AWS), which held 13.2%, 12.2%, 9%, and 8.1% of the market in H1 2023, respectively.

Alibaba Cloud is not the only company facing pressure. Currently, the domestic public cloud market is facing a slowdown in growth. According to the IDC report, in the first half of 2023, the Chinese public cloud IaaS and platform-as-a-service (PaaS) market grew by 15.9% year-on-year, marking a new low in year-on-year growth rate in nearly three years, with the growth rate continuing to cool.

According to IDC, this stems from enterprise IT budgets not growing as expected, while enterprises have gotten more cautious in formulating, spending, and using budgets. On the other hand, internet cloud vendors are shifting emphasis from revenue generation to profitability.

This transition is also reflected in Alibaba Cloud’s profit performance.

In the fourth quarter of 2023, Alibaba Cloud’s adjusted EBITA reached RMB 2.36 billion (USD 331.5 million), equivalent to an increase of 86%, reaching a new high for the fiscal year.

The growth in profits comes partly from cost-saving measures such as layoffs and partly from Alibaba Cloud’s move toward integration and the new strategy of “artificial intelligence-driven, public cloud first.”

In addition, the report also mentioned that the results of DingTalk, an enterprise communication and collaboration platform developed by Alibaba, is not included in the company’s cloud intelligence business segment.

Currently, the main focus of Alibaba Cloud has significantly changed, with public cloud a priority under its revised strategy.

On November 23, Alibaba Cloud carried out a comprehensive organizational restructuring, establishing three major business units: public cloud, hybrid cloud, and infrastructure business. This reform is aimed at promoting the standardization of the public cloud, encouraging government and enterprise customers to prioritize its use of public cloud and reduce their reliance on project-based sales of hardware and software.

For Alibaba Cloud, its present-day focus is no longer solely on pursuing revenue, but profit as well.

As competition among cloud vendors becomes increasingly intense, Alibaba Cloud is using price reductions to compete while investing in large language models to further develop the market.

In terms of product pricing, in the first half of 2023, Alibaba Cloud announced a comprehensive price reduction of up to 50%, applicable to its computing, storage, network, and security products.

Price reduction is a common strategy in cloud market competition. AWS, for instance, stated in 2016 that price reduction is part of its core strategy, cutting its prices 52 times since its launch in 2006. Microsoft Azure and Google Cloud have similarly implemented price reduction measures of their own.

Furthermore, LLMs are shaping up to become new “weapons” for cloud vendors. Alibaba Cloud is seemingly taking the lead in this field by aggressively pursuing the open source route with Tongyi Qianwen to attract more users. On the other hand, it continues to build an open-sourced LLM platform, proclaiming the slogan “the most open cloud platform in the AI era,” seeking further room for growth. However, the contribution of LLM development to Alibaba’s financial performance has not yet been reflected in its latest financial report.

“There is significant potential in using AI to improve search conversion rates and increase profitability, but this is still in the early testing stage despite the tremendous potential,” said Wu.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Jane Wu for 36Kr.