On February 14, Auntea Jenny submitted its listing application to the Hong Kong Stock Exchange, officially joining the tea brand IPO trend. Following in the footsteps of ChaPanda (also known as Chabaidao), GoodMe (also known as Guming), and Mixue Bingcheng, it has become the next tea brand making a move toward a Hong Kong listing.

According to China Insights Consultancy (CIC), as of September 30, 2023, Auntea Jenny stands as the largest mid-priced freshly made tea brand in northern China and one of the fastest-growing nationwide, thereby positioning itself as the fourth largest freshly made tea drink network in China.

Notably, unlike the tea brands that pursued Hong Kong IPOs in previous years, Auntea Jenny, much like choosing to submit its prospectus on Valentine’s Day, carries a romantic hue, with a married couple at the helm.

In the late 1990s, Shan Weijun and his wife Zhou Rongrong worked as senior managers in a foreign-funded enterprise in Shandong, before Shan moved to Shanghai in 2011 to explore broader horizons. According to ZhitongIPO, the couple drew inspiration from classic tea drinks sold in olden Shanghai alleyways to start their business, initially selling grainy milk tea from a 25-square-meter store they set up in 2013 at People’s Square in Shanghai. Later, they expanded out of Shanghai, entering the Shandong market before opening a store in Yantai, the hometown of Zhou.

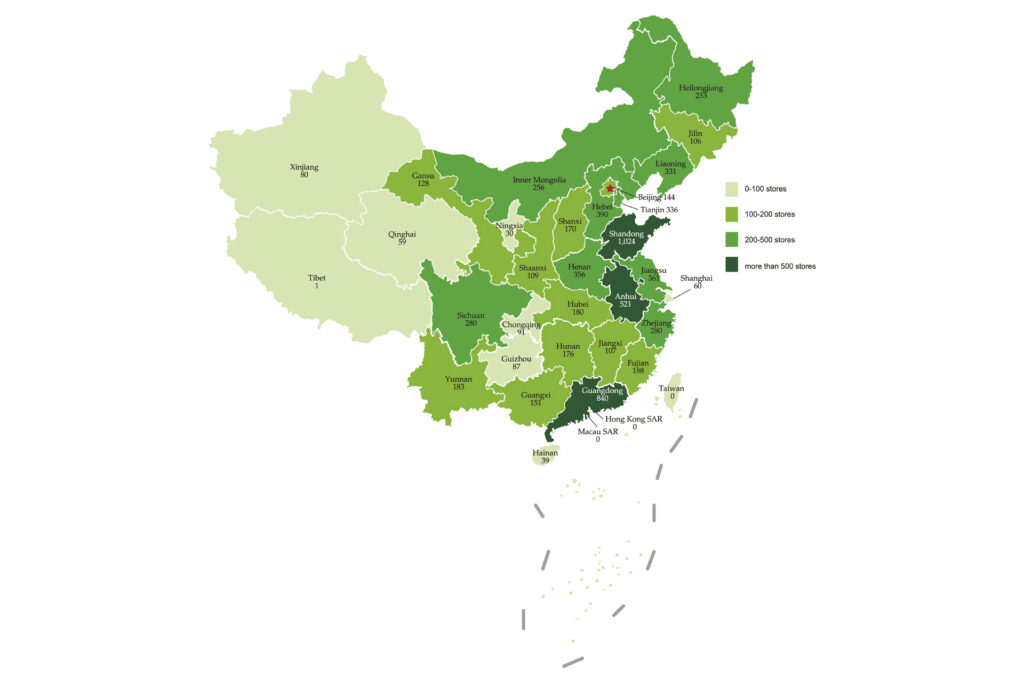

Auntea Jenny subsequently expanded into various regions of China, including Hebei and Tianjin, with a primary emphasis on northeastern China. The brand also diversified its offerings in response to consumer demand, introducing new products such as fresh fruit tea after identifying that its grainy beverages lacked universal appeal across the nation, particularly in lower-tier cities. By September 30, 2023, the tally of their stores had reached 7,297.

With over 7,000 shops established, this couple has now embarked on an IPO journey.

According to the prospectus, Auntea Jenny’s total store count for the period of 2021–2023 was 3,776, 5,307, and 7,297 respectively, with its GMV increasing from RMB 4.161 billion (USD 578 million) in 2021 to RMB 6.068 billion (USD 843 million) in 2022, and further increasing by 57.7% from RMB 4.554 billion (USD 632.6 million) in the nine months ended September 30, 2022, to RMB 7.183 billion (USD 997.9 million) in the nine months ended September 30, 2023.

Its market performance naturally attracted a host of capital:

- In 2020 and 2021, Auntea Jenny completed Series A and A+ funding rounds successively, with Suzhou Yizhong investing RMB 75 million (USD 10.4 million) and RMB 53 million (USD 7.3 million) respectively.

- In 2023, seven investors including Jinyi Capital, Suzhou Xiangzhong, InnoVision Capital, Desai Innovation, Shibei Hi-tech, Nanjing Xiangzhong, and Yiyu Consulting jointly participated in Auntea Jenny’s Series B funding round, which was estimated to have raised RMB 230 million (USD 31.9 million).

- In 2024, before Auntea Jenny submitted its prospectus, Hanshuai Investment, Jinxiao Investment, Shanghai Yipu, and Yinlin Investment joined its Series C round of financing, contributing RMB 121.5 million (USD 16.8 million). Yinlin Investment spent RMB 8 million (USD 1.1 million) to subscribe for new registered capital equivalent to 0.16% of Auntea Jenny’s overall holding, valuing the brand at approximately RMB 5 billion (USD 694.6 million).

From 2020 to 2024, across the various rounds of funding completed by Auntea Jenny, the brand’s share price has surged from RMB 11.96 (USD 1.66) to RMB 50 (USD 6.95), indicating a valuation increase of 3.2 times during this four-year period.

As per ZhitongIPO, prior to Auntea Jenny’s IPO, Shan and Zhou collectively held 80.63% of the shares, while Vision Knight Capital—through Suzhou Yizhong, Suzhou Xiangzhong, and Nanjing Xiangzhong—held 8.15%, making it the largest institutional shareholder.

With Auntea Jenny joining other tea brands in seeking to go public in Hong Kong, inevitably, comparisons will be drawn between the various players:

- Mixue Bingcheng, operates over 36,000 stores at home and abroad, and as of September 30, 2023, the company has more than 16,000 franchisee partners.

- GoodMe’s prospectus showed that, as of December 31, 2023, it had a total of 9,001 stores in its network.

- ChaPanda’s prospectus, as of August 8, 2023, indicated that it had 7,117 stores.

While Auntea Jenny has maintained a generally positive financial performance, it slightly trails behind other industry contenders. In 2021, 2022, and the initial nine months of 2023, Auntea Jenny reported operating incomes of RMB 1.64 billion (USD 227.8 million), RMB 2.199 billion (USD 305.5 million), and RMB 2.535 billion (USD 352.1 million), respectively, alongside corresponding net profits of RMB 83 million (USD 11.5 million), RMB 149 million (USD 20.7 million), and RMB 324 million (USD 45 million).

In contrast, GoodMe achieved notable success, with revenues reaching RMB 5.571 billion (USD 773.9 million) and net profits totaling RMB 1.045 billion (USD 145.1 million) in the first nine months of 2023, boasting a store count of 8,578. Despite a store differential of 1,281, GoodMe’s revenue and net profit were double and triple that of Auntea Jenny, respectively.

Simultaneously, industry players seeking IPOs appear to share a preference for franchising and expansion into lower-tier cities. Data indicates that as of March 2023, 39.4% of ChaPanda’s stores were located in lower-tier cities, a figure that increased to 49% for Auntea Jenny by September 2023, aligning with GoodMe’s proportion by year-end.

This expansion strategy mirrors that of Mixue Bingcheng, leveraging franchising for rapid growth. By September 2023, 99.8% of Mixue’s stores were franchises, with similar trends observed for GoodMe and ChaPanda. Auntea Jenny closely follows suit, with its franchise store percentage rising from 98.28% in 2021 to 99.29% by September 30, 2023.

Franchising not only facilitates territorial expansion but also serves as a significant revenue stream. For instance, Mixue and GoodMe generated revenues of RMB 15.39 billion (USD 2.14 billion) and RMB 5.57 billion (USD 773.8 million), respectively, in the first three quarters of 2023 primarily from sales to franchisees.

As of September 30, 2023, income from Auntea Jenny’s 7,245 franchised stores accounted for 96.1% of its total revenue, with the majority attributed to sales to franchisees, contributing approximately 79.7%.

The prevalence of franchisees and franchise stores significantly influences business operations. As industry leaders capitalize on scale effects, competition for expansion and franchising in lower-tier cities is expected to intensify. As a result, venturing into the secondary market may become pivotal for tea brands aiming to bolster their competitiveness.