Industries may evolve, trends can shift, but in the ever-changing tapestry of business, one constant reigns supreme: market expansion beyond borders.

In the pursuit of longevity and success, businesses typically look toward foreign markets to unlock new opportunities and diversify their revenue streams. This process is, however, neither simple nor straightforward. It often entails embracing new technology, adapting to evolving consumer demands, while remaining resilient in face of the world’s economic and geopolitical volatility.

The road ahead for companies seeking international expansion won’t be easy, but there are support avenues to tap into that can streamline the process.

On December 12, KrASIA and Alibaba Cloud jointly hosted an online event discussing market expansion in Asia with a focus on Indonesia, Japan, and Hong Kong. The event convened representatives from Invest Hong Kong (InvestHK), the Tokyo Metropolitan Government, the Japan Exchange Group (JPX), and the Indonesia Investment Authority (INA). These speakers collectively offered insights into the dynamics of their respective markets.

In addition, representatives from 6Estates, Pop Mart, Vertex Ventures Southeast Asia and India, and Alibaba Cloud were also present to share their personal experiences and insights on the topic of focus.

The following is a summary of the key insights shared during the event.

An overview of Asia’s emerging markets

Hong Kong as a prime entry point to the broader Chinese market

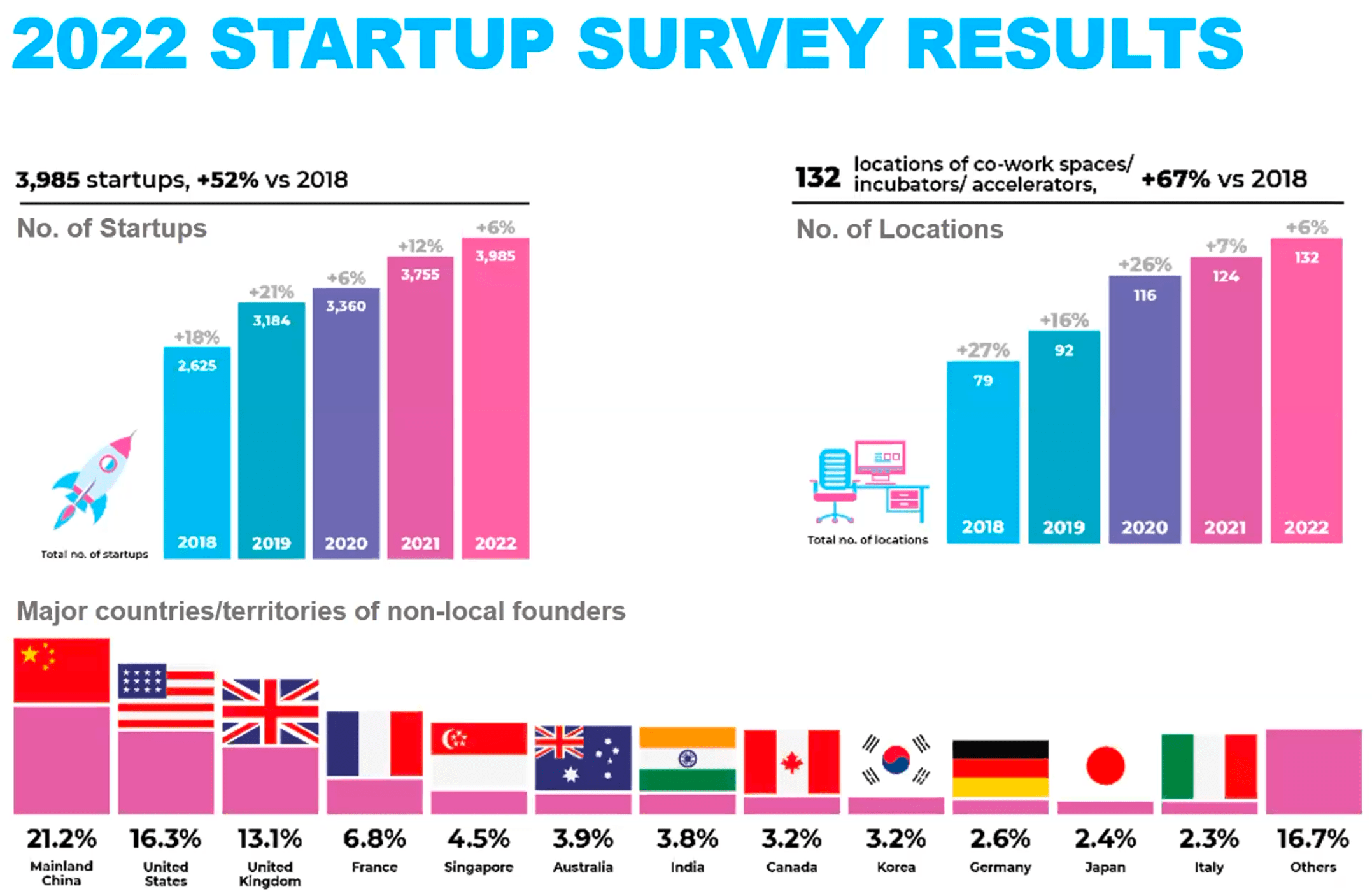

InvestHK is a department under the Hong Kong government that is responsible for foreign direct investment (FDI). It is also one of the catalysts of the territory’s dynamic startup ecosystem since the establishment of its StartmeupHK initiative in 2013. According to a survey conducted by the organization in 2022, close to 4,000 startups currently reside at various co-working spaces, incubators, and accelerators in the territory.

According to Jayne Chan, head of StartmeupHK at InvestHK, diversity characterizes Hong Kong’s startup landscape, with around 25% of entrepreneurs originating from abroad. This infusion of international talent brings fresh perspectives and innovative approaches to problem-solving.

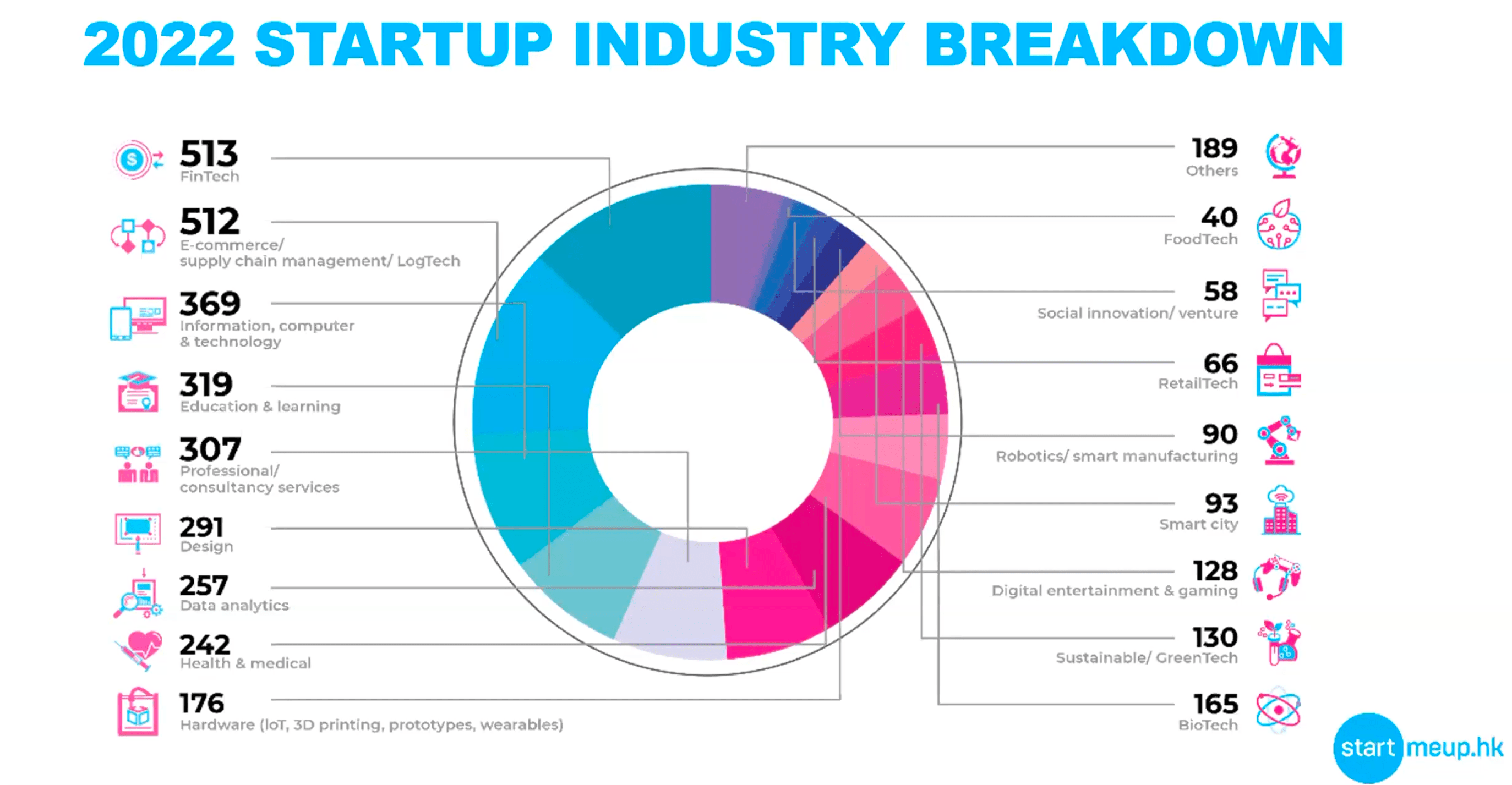

In Hong Kong, fintech leads the charge as one of the thriving sectors, particularly in the areas of digital assets, wealth management, and cybersecurity. Additionally, the e-commerce, logistics, and supply chain sectors are also flourishing, benefiting from the territory’s proximity to mainland China, the world’s largest e-commerce market.

During her presentation, Chan was keen to highlight the qualities of Hong Kong for testing and adapting solutions to fit the broader Chinese market.

“Hong Kong is great for testing out your solutions and adapting it to make it relevant for the market here. And once you’ve tested within this relatively small market of 7. 5 million people, you can actually go and [target] the Greater Bay Area market, which is about 87 million people, and from there you can then move on to the other parts of mainland China and Asia as well,” Chan said.

Notably, the reciprocal trend is equally evident as mainland Chinese companies often establish operations in Hong Kong before venturing into broader Asian and global markets.

Rising industries such as edtech and artificial intelligence underscore Hong Kong’s commitment to technological advancement. For example, Hong Kong’s Cyberport is constructing an AI supercomputer center to provide vital infrastructure for companies engaged in large-scale AI development. This initiative aligns with the Hong Kong government’s supportive policies toward technology and innovation.

Hong Kong boasts a notable track record, hosting 340,000 SMEs and 5,500 corporates, including regional head offices. The city is home to several unicorns, including WeLab, TNG, BitMex (fintech), Klook (travel), Animoca Brands (Web3 and gaming), LalaMove (logistics), and SmartMore (manufacturing). Recent exits, such as DayDayCook (Nasdaq via SPAC), GogoX (on HKEX), and Prenetics (Nasdaq via SPAC), further underscore the city’s vibrant and dynamic business landscape.

Hong Kong’s appeal extends beyond its flourishing industries and diverse talent pool. The city offers attractive incentives, including low taxes—with an 8.25% rate for the first HKD 2 million in profit and a standard corporate tax rate of 16.5% thereafter. Additionally, there are no sales or miscellaneous taxes, positioning Hong Kong as an advantageous hub for businesses seeking a conducive environment for innovation and growth.

Indonesia is bridging its digital divide with tech and innovation

In recent years, Indonesia has emerged as a compelling market for capital, underscored by recent initiatives spearheaded by the INA.

Functioning as a sovereign wealth fund, INA was established with seed capital totaling USD 5 billion from the Indonesian government, subsequently growing its current assets under management (AUM) to more than USD 9 billion. Operating with a dual mandate of investing for growth and attracting co-investment, INA deploys various investment schemes, including direct co-investment, platform models, and general or limited partner (GP/LP) fund structures.

Regardless of the investment model, INA stands as a trusted partner for companies venturing into Indonesia, instilling confidence as a co-investor and providing a pathway to access the local market. Through its extensive network, INA connects companies with both domestic and foreign investors and stakeholders, facilitating their entry into the Indonesian business landscape.

INA’s strategic partnerships further exemplify its commitment to transformative investments. Collaborations with entities such as GDS from China for data center platforms, Masdar in green energy, and more, showcase the diversity of INA’s portfolio. Despite challenges like low technology adoption rates, insufficient funding for mid-sized companies, and a talent shortage, INA seeks solutions through potential partnerships with local and regional partners.

Focusing primarily on Indonesia, INA directs its investments toward key sectors, including transport, logistics, green energy, and healthcare, among others. The authority contemplates forging funding partnerships with local or regional venture capitalists to catalyze growth in the digital and technology sector, addressing challenges and fostering innovation.

The overarching goal of INA’s focus sectors is to bridge the digital divide in Indonesia, emphasizing not only the targeted sectors but also broader solutions for digitalization and automation. With Indonesia boasting 13 unicorns, signaling robust growth in the tech sector, INA identifies an opportunity for increased investment and expansion to further propel the country’s technological advancement.

According to Johan Batubara, director of investments at the INA, digital economy activities in Indonesia have begun to burgeon beyond Jakarta. Notably, Java and Sumatra are gradually evolving into vibrant markets, contributing to Indonesia’s status as a key player in Asia’s digital economy.

Japan as a premier IPO destination beyond home borders

The Tokyo Metropolitan Government (TMG) serves as a strategic ally for businesses, offering global support through offices in San Francisco, Singapore, Paris, and London.

The TMG provides various avenues of assistance to cross-border companies, facilitated by entities like the Business Development Center Tokyo (BDCT), Tokyo One-Stop Business Establishment Center (TOSBEC), and the Tokyo Employment Consultation Center (offered by the Ministry of Health, Labour and Welfare of Japan).

Moreover, the TMG actively promotes technology and innovation, overseeing programs like Sushi Tech Tokyo and Tokyo Innovation Base (TIB), among others.

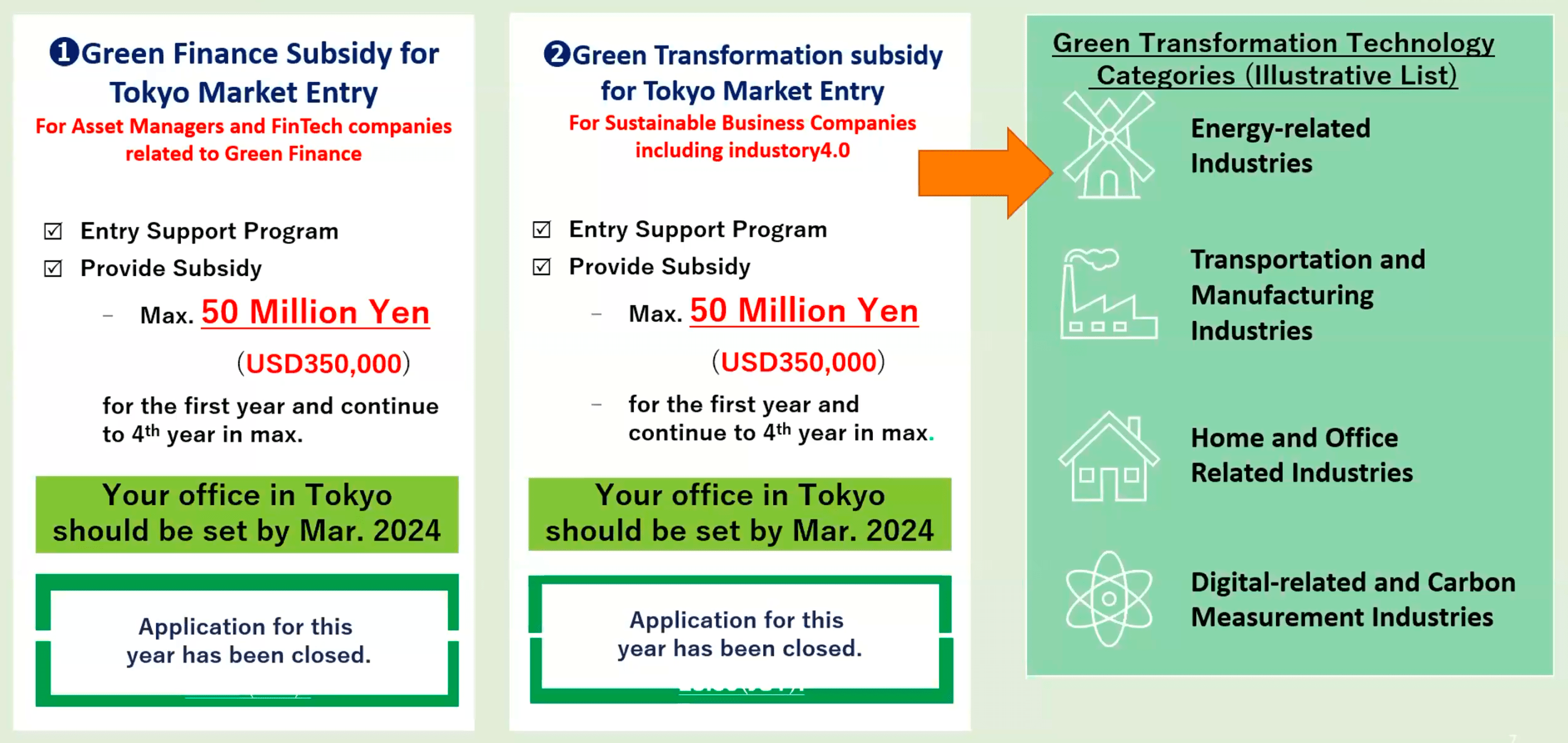

TMG also offers substantial subsidy programs, including green finance subsidies and green transformation subsidies. The former targets asset managers and fintech companies in the green finance sector, while the latter supports businesses focusing on sustainability in energy, transportation, manufacturing, home and office-related, or digital-related and carbon measurement industries. With a maximum allowance of JPY 50 million (USD 350,000) per year for up to four years, these programs are aimed at incentivizing environmentally conscious initiatives to facilitate a transition toward sustainability.

To facilitate the establishment of businesses in Japan, TMG offers various subsidy schemes to offset initial costs, covering aspects such as office space and operating expenses. This comprehensive support framework aims to encourage companies to set up their base in Tokyo and contribute to the city’s vibrant business ecosystem.

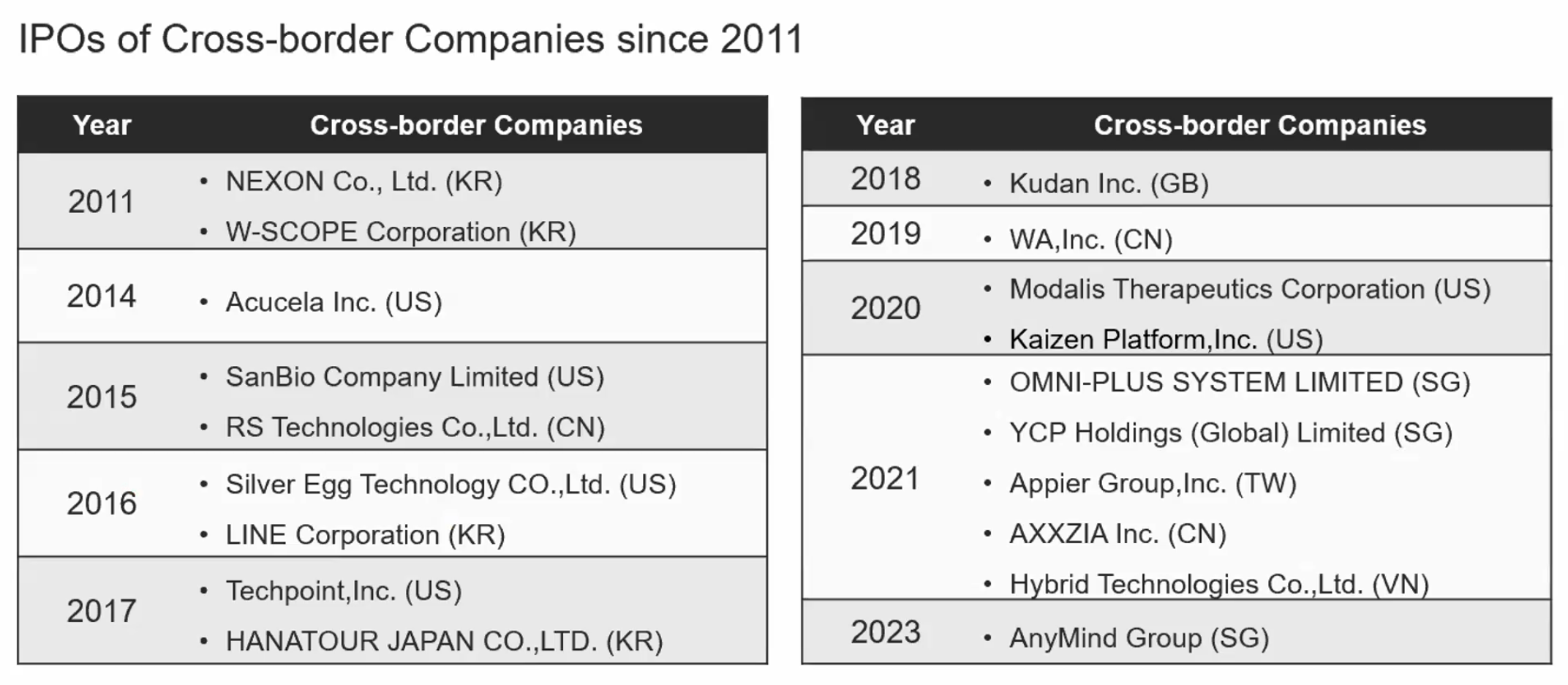

According to Beomsu Son, senior manager at the Japan Exchange Group (JPX), Japan, particularly the Tokyo Stock Exchange (TSE), has also emerged as a premier destination for companies seeking an exit beyond the US or their home market. The TSE has facilitated 19 IPOs of cross-border companies since 2011, including notable entities such as South Korea’s Nexon and Singapore’s AnyMind Group.

TSE, ranked as the fifth-largest exchange by market capitalization and the sixth-largest by annual trading volume, distinguishes itself by not mandating profitability at the time of IPO, especially for startups anticipated to achieve substantial growth in the future. Listing on TSE can therefore be a strategic avenue for foreign companies to establish credibility in the Japanese market, offering a gateway to a vast and sophisticated investor base.

Three key takeaways from the event

Be meticulous (and realistic) when assessing markets

Market assessment is a pivotal aspect of evaluating target markets, a sentiment underscored by Hart Lestari, chief of staff at 6Estates. Recognizing the importance of understanding the intricacies of potential markets, including cultural and business differences, is paramount. In the case of 6Estates, an Indonesian investor served as a catalyst, facilitating product testing and market understanding, particularly in discerning variations in customer behavior and preferences.

This perspective finds resonance in the insights shared by Kevin Zhang, head of strategic partnership at Pop Mart, during their panel discussion. Pop Mart’s vision to evolve into an entertainment and fashion label necessitates a prudent market entry strategy, as explained by Zhang. This approach involves a thorough understanding of local culture and the community’s outlook on art, toys, and fashion before venturing into a new country.

Zhang provides further context by emphasizing Pop Mart’s strategic focus on foreign markets boasting robust Chinese communities, encompassing residents and overseas students. The emphasis extends to countries with established pop culture phenomena, such as Japan and South Korea. Additionally, Singapore has been targeted as a launch pad into Southeast Asia, driven by cultural similarities, the presence of local Chinese communities, and its strategic location.

Despite these strategic considerations, Lestari stresses the importance of adopting a practical approach to the market assessment process. While 6Estates has been fortunate to collaborate with supportive partners, Lestari acknowledges that not all companies may have access to such resources. In instances where external support is limited, companies might need to assign representatives from their management team to physically engage with the market, instilling confidence and building credibility—especially crucial for smaller-scale startups. This complexity is heightened for smaller teams lacking the resources for extensive travel arrangements.

Nevertheless, Lestari also recognizes the inherent uncertainty in the market assessment process. While advocating for practicality, she suggested that companies, whenever possible, should focus on conducting proof of concepts in their target markets, preferably with an initial anchor customer. This measured approach allows for a balance between strategic market entry and the pragmatic challenges faced by companies, particularly those in the startup landscape.

Be objective about the expertise needed

When venturing into new markets, hiring and cultivating local talent is crucial. During the event, Zhang suggested that local employment is crucial to understanding the culture and preferences inherent in newly targeted markets.

In a related vein, Chan Yip Pang, executive director of investments at Vertex Ventures Southeast Asia and India (SEAI), shared insights into Grab’s early expansion phase. Vertex Ventures SEAI was Grab’s first investor.

During this period, Anthony Tan, co-founder and CEO of Grab, strategically hired local talent as a key element of its ambitious expansion into various parts of Southeast Asia. Leveraging his Harvard connections, Tan sought out top students in each respective country, recognizing the need for individuals capable of effective communication with stakeholders and regulators on the ground. According to Pang, this approach facilitated Grab’s rapid scaling in Southeast Asia, having established local teams to run the business in Indonesia, Thailand, the Philippines, and beyond.

Building upon Pang’s insights, Zhang underscored the vital importance of compatibility not only between the company and its target markets but also internally among core and local teams. Within Pop Mart, much of the internal communication occurs in Chinese. To ensure effective communication, the acquisition of local talent fluent in the native language is imperative. Additionally, local teams should ideally include members capable of communicating with the company’s international teams, ensuring consistency in strategy and execution.

In scenarios where such expertise is not readily available, Zhang recommended prudent approaches to market testing without excessive resource commitment. For example, Pop Mart deploys its “robo-shops” in foreign markets to assess accessible traffic and public perception of its brands and products. In such cases, the company also utilizes existing sales channels to distribute its products, opting for a cost-effective approach compared to establishing independent channels or using a D2C model to serve local customers.

Be clear about relevant legal considerations

In addition to conducting comprehensive market assessments and procuring the necessary expertise, Aditya Yoga, senior business development manager at Alibaba Cloud, said that it is paramount to obtain licenses and certifications in markets where they are deemed crucial and necessary. According to Yoga, this should be one of the top priorities because, without proper authorization, even if a company invests heavily in hiring and other areas, the inability to sell its products will render the overall effort futile.

Relatedly, Lestari shared her experience from the viewpoint of 6Estates, citing a specific initiative undertaken to navigate the complexities of the Indonesian market. She recounted the company’s participation in a program with Plug and Play Tech Center, which provided insights into the intricate legal considerations and practical aspects related to setting up operations in Indonesia. According to Lestari, such programs can not only enhance understanding of the regulatory landscape in target markets, but also offer practical knowledge crucial for a successful market entry.

This article was written in partnership with Alibaba Cloud.