Xefco secures AUD 10.5 million in extended seed round

Xefco, an Australian sustainable manufacturing company, has raised AUD 10.5 million (USD 6.9 million) in an extension to its seed funding round, led by Australian venture capital firm Main Sequence. Breakthrough Victoria, Virescent Ventures, Investible, and Voyagers Climate-Tech Fund also participated in this round.

The capital will support the commercialization of Xefco’s water-free textile finishing and dyeing solution, Ausora. By eliminating the use of water and cutting energy consumption, Xefco aims to create a greener supply chain for the fashion industry.

Xefco’s first product, XReflex, which improves the thermal efficiency of insulated clothing, has already been adopted by fashion brands Zara and The North Face.

Thrixen raises USD 7 million from new investors

Thrixen, a Singapore-based medtech startup, has raised USD 7 million in an oversubscribed funding round jointly led by new investors 22Health Ventures and John Ballantyne (Aldevron).

The funds will be used to enhance Thrixen’s diagnostic technology platform, which can be used to perform multiple diagnostic tests at the point of care. Additionally, 22Health will also provide Thrixen access to its ecosystem of US healthcare providers.

Salmon bags USD 25 million in Series A1 round

Salmon, a Manila-based financial services company, has bagged USD 25 million in a Series A1 funding round led by the International Finance Corporation (IFC), with participation from Northstar Group and other investors. The IFC contributed USD 7 million of the total investment amount.

The funds will enable Salmon to develop new credit products and lifestyle banking offerings, with plans to launch them in the second half of 2024. Salmon aims to provide affordable and accessible banking services to the growing bankable population in the Philippines.

Singapore state investor Temasek invests in US-based Blaize

Singapore state-owned investor Temasek has invested in Blaize, a US-based provider of artificial intelligence-powered edge computing solutions.

This investment was made as part of Blaize’s latest USD 106 million funding round, which also saw participation from Bess Ventures, Franklin Templeton, Denso, Mercedes-Benz, as well as new investors Rizvi Traverse, Ava Investors, and BurTech.

Recent deals completed in China:

- PaXini Technology, a company specializing in haptic technology for robotics applications, has secured a nine-figure RMB sum after completing consecutive Series A and A1 funding rounds. ENN Group led the Series A round, while BAIC Capital, Nanshan SEI Investment, and Infotech Ventures participated in the Series A1 round. The funds will be allocated toward technology advancement, product development, and market expansion. —36Kr

- Churui Intelligent Technology, a Wuhu-based integrator of hardware and software for energy storage applications, has secured an eight-figure RMB sum of Series B financing from Anhui State-owned Capital Operation Holding Group. It will utilize the funds to construct dedicated production lines for major clients, conduct product R&D, and run market promotions. —36Kr

- Liuxing Technology, a Shenzhen-based provider of software and information technology solutions, has completed its pre-Series A funding round. The amount of investment remains undisclosed, with Detao Capital and ZhenFund as the investors. —36Kr

- Poly Material Technology, a Hangzhou-based technology company specializing in the R&D of carbon-based new materials, has snagged an eight-figure RMB sum following the completion of a Series B+ funding round. The company intends to use the funds for technology R&D and to supplement working capital. It last raised funds in December 2023, when it received close to RMB 200 million (USD 27.6 million) in a Series B round led by Hefei Industry Investment, with the support of various investors. —36Kr

- Phomera, a Zhuhai-based technology enterprise specializing in the R&D and industrialization of flexible mechanical metamaterials, has banked close to RMB 100 million (USD 13.8 million) in a Series A funding round led by Yijing Capital, with participation from existing investor BASF Venture Capital. The company plans to use the proceeds for capacity building, market expansion, production enhancement, and talent acquisition. —36Kr

- Gimay, a company that harnesses artificial intelligence and other technologies to offer a range of beauty-related analytics and intelligence solutions, has announced the completion of its angel round of financing. The round was led by Goldport Capital, with Haining Juanhu Dream Fund participating. —36Kr

- Atom Intelligence, a big data solutions provider, has received nearly USD 100 million from Azuremount WH. CVCapital acted as the exclusive financial advisor for this investment. —36Kr

- Volant Aerotech, a Shanghai-based developer of electric vertical takeoff and landing (eVTOL) aircraft, has banked nearly RMB 100 million in a Series A+ funding round led by Hua Qiang Capital, with support from Jadex Capital. The newly raised capital will be used to propel the development and testing of its eVTOL aircraft, accelerate product manufacturing, and explore opportunities in the commercial aircraft market. —36Kr

Latest deals in India:

- NSEIT, the digital technology business of the National Stock Exchange of India (NSE), has been acquired by Bahrain-based investment firm Investcorp for INR 10 billion (USD 119.7 million). —Inc42

- PharmEasy, an online drug dispenser under API Holdings, has raised INR 18 billion (USD 215.5 million) from the Manipal Education and Medical Group (MEMG) and existing investors. However, the capital was notably raised based on a valuation 90% lower than the firm’s peak worth. —Entrackr

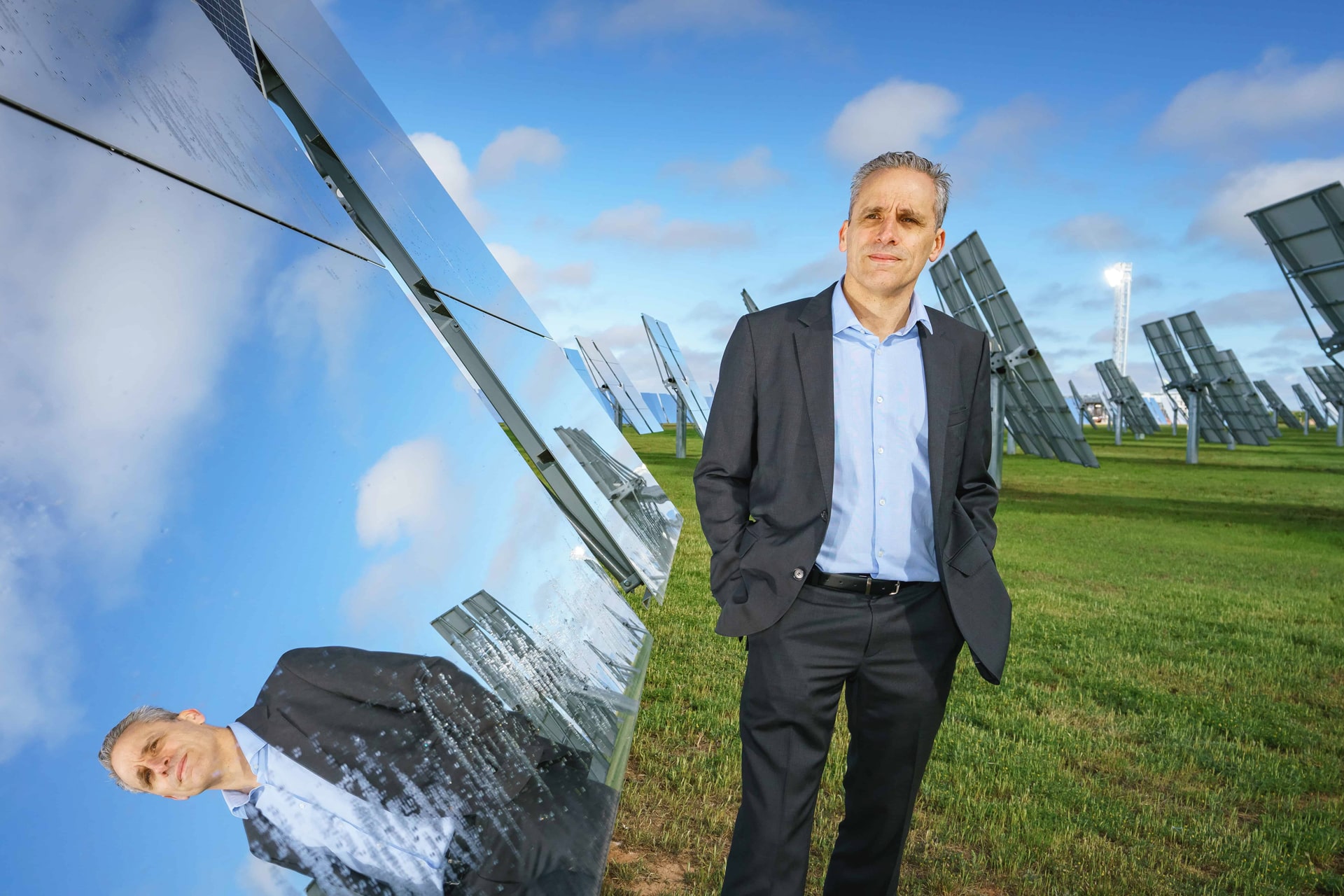

RayGen Resources, Uncharted, Decarbonization Partners, and more led yesterday’s headlines:

- RayGen Resources, an Australian solar and storage technology company, secured close to USD 33 million in a Series D funding round led by SLB, with participation from Breakthrough Victoria.

- Uncharted, a GameFi company, secured USD 1.7 million in a funding round led by Shima Capital, with participation from The Spartan Group, Double Peak Group, Devmons, and 32-Bit Ventures. Uncharted’s angel investors also include the three founders of Immutable, as well as Justin Waldron (Zynga) and Aleksander Larson (Ronin).

- Decarbonization Partners, a joint venture between Temasek and BlackRock, closed its fund after securing USD 1.4 billion in commitments from over 30 institutional investors, in addition to commitments from both partners. Investors include Allstate, BBVA, Kirkbi, Mizuho Bank, MUFG Bank, and TotalEnergies, among others.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].