This article is adapted from an entry published by 36Kr Chuhai.

The verdict is in: Entrepreneurs believe that we are in the golden age for direct-to-consumer (D2C) brands.

In recent years, many new brands have emerged to challenge established and well-known global labels. The new players have innovative products and services that facilitate an improved customer experience. For many investors, a bet on a sharp consumer brand is a safe venture.

With outstanding players like Bubble Mart and Perfect Diary as guideposts, consumer brands are among the most popular investment targets for venture capital (VC) investors in China and beyond. In fact, some Chinese VCs see this arena as a “battlefield.”

Competition among emerging D2C brands is increasingly fierce, and the market is becoming cramped. Brands need to build a solid image by delivering engaging messages to stand out from the crowd.

We spoke to founders of seven brands from China, Japan, and Indonesia, who shared their insights on the trends and challenges in this business segment.

Wang Wen, chief marketing officer of pet lifestyle brand Vetreska:

Vetreska sets out to be a leading player in the pet-focused lifestyle segment.

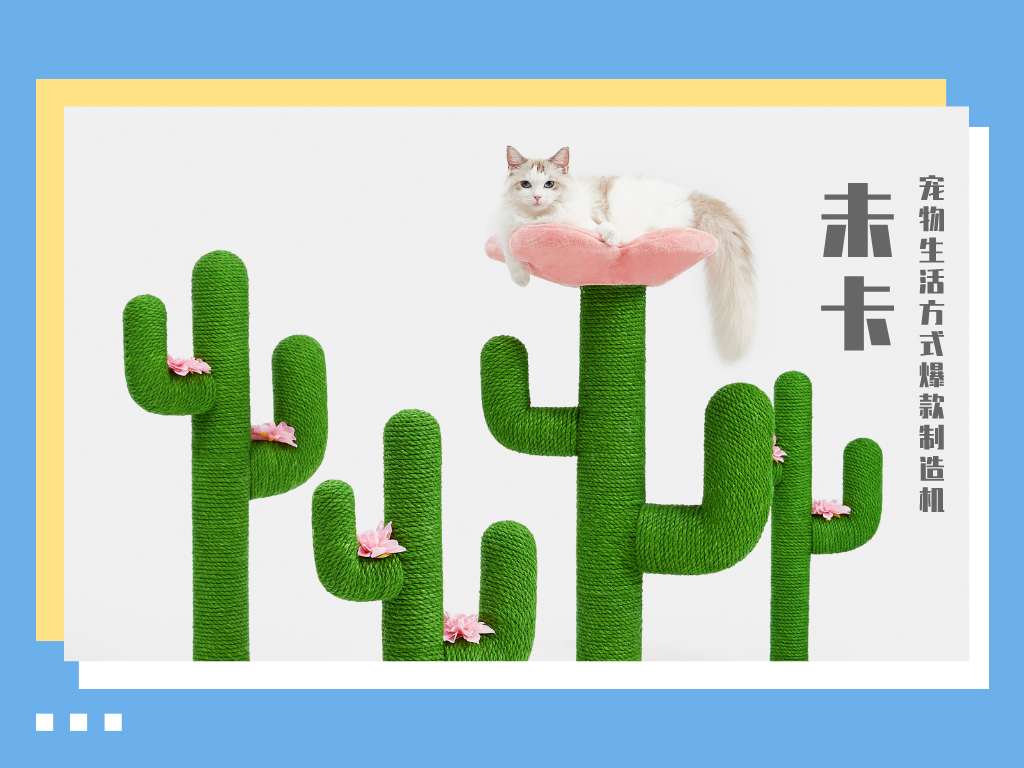

In 2015, Vetreska’s founders brought home unique pet products that they purchased in the United States. Their haul included beverages, ice cream, and ketchup for cats and dogs. These products attracted the attention of fellow pet owners in China, so we realized that there is a potential market for quirky pet products. At least one product from Vetreska goes viral every year—cat grass, our cactus-shaped scratcher, and a watermelon-shaped cat litter box. We will also sell cat food that is imported from New Zealand this year. Offline distributors and agent channels account for 90% of Vetreska’s sales.

Nowadays, many brands lack differentiation. Therefore, consumer brands need to leave a mark quickly by building their own identity. When we are in the process of designing a product, we already know whether the product will go viral. Plagiarism is a major problem for us. One month after we release the image of a new item, there would be cheap and poorly made counterfeits, so we are making more efforts to protect our intellectual property.

Although most [lifestyle] trends originate from the United States, and they are still ahead of the curve, China could also become a trendsetter in the coming years. Many trends related to our diets will also be carried over to what we feed our pets. The concept of an organic, natural, and healthy diet is becoming more popular in pet food nowadays.

We’ve expanded to overseas markets including the United States, Canada, Japan, and South Korea. One interesting observation is that the same cultural symbols are interpreted differently in different places. For instance, while the cactus is seen merely as an Instagrammable object in China, it represents the actual desert in the US. We also adjust our strategy for the Japanese market as customers prefer products that have local cultural characteristics. This strategy is similar to Burberry, whose Blue Label is only available in Japan.

Yin Kuo, founder of oral care brand Canban:

I started Canban in 2018. The life cycle of oral care products is long and the innovation level is low. Meanwhile, the annual compound growth rate of sales of oral fast-moving consumer goods (FMCG) products is very high, so we think there is room for new brands. Our products include toothpaste, mouthwash, oral spray, and teeth whitening strips.

A brand delivers value to consumers through its products. Consumer goods companies rely on content to boost traffic, giving consumers a way to understand your product and value proposition. When a customer naturally associates your brand with a specific type of product, it means your brand has a competitive edge.

While there were not many opportunities for new consumer brands ten years ago, I believe that today is the golden age for new D2C brands. China’s cultural self-confidence is thriving, and young people love local products more than ever before. There have been major improvements in the quality and aesthetic design in local products. In addition, the supply chains for local goods have been strengthened. There are also more online platforms to give brands new exposure opportunities.

In the future, Canban plans to expand into Southeast Asia and the Middle East. In 2019, Lisa, a member of the South Korean girl band BlackPink, said on Instagram that she liked our products. Soon after, there were agents from China and abroad reaching out to us, hoping to sell Canban’s products.

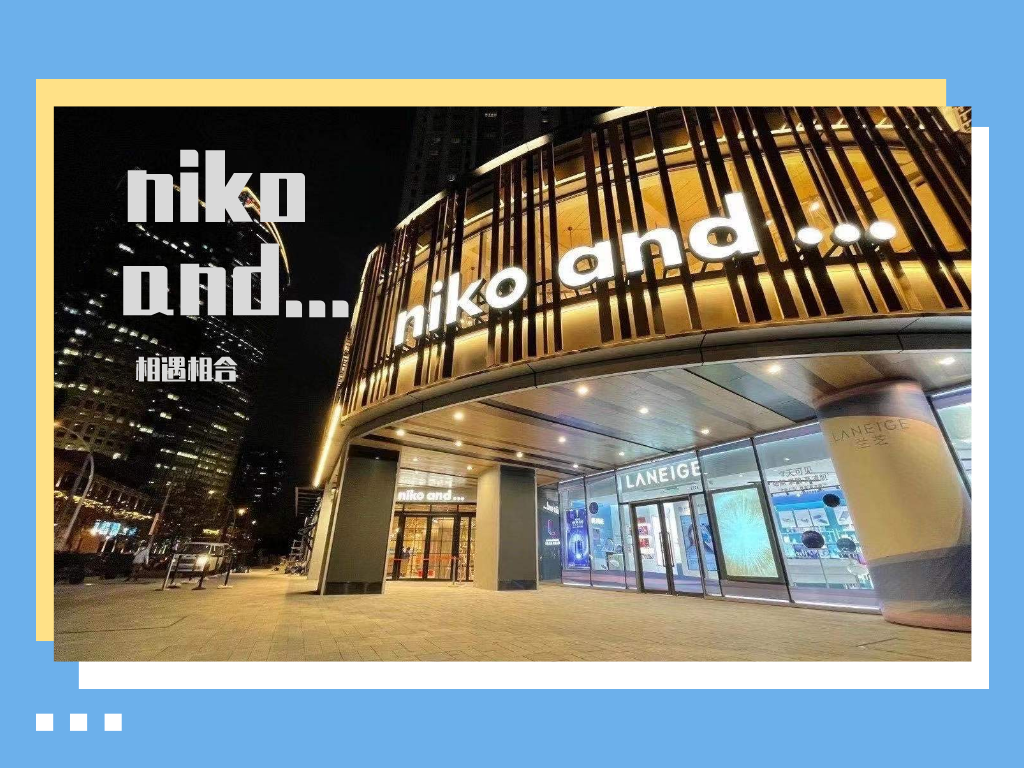

Takayuki Ozawa, head of China market, Niko and…:

Niko and… is a fashion and lifestyle brand that is built around nine key words—clothing, food, living, traveling, knowledge, health, music, travel, and Tokyo. Niko and… has what we call the “style editorial brand” concept, where we “edit” the store constantly, just like how a magazine may have a different theme for each issue. This idea comes from our understanding of fashion and lifestyle. We don’t think “lifestyle” can be defined. It must be fresh and constantly evolve. Therefore, Niko and… is a brand that is not limited to any specific style. Our in-store product selection changes every 45 days, so customers can always “mix and match” and even discover new styles.

Niko and… opened its first store in 2017 in Fukuoka. It then gradually expanded all over Japan. We also crossed into Hong Kong, Taipei, and Shanghai. We started with women’s clothing before tapping into categories and products such as menswear, coffee, food, and more. Our China operation has its own product development department, and about 30% of the products in China are different from those in Japan. Our position is low-price, multi-lifestyle products. Our customers are urban men ad women who are 20–40 years old. Each customer spends about RMB 300 (USD 46) per order.

The biggest challenge we face is in creating and maintaining our “style editorial brand.” To give customers fresh experiences, the brand needs robust product development capabilities, shop furnishing designs, supply chain management, and personnel management. It feels like we reopen the store every month. On the good side, our sell-through rate is currently at 95%.

I’ve been living in China for five years. We have done live streaming with Li Jiaqi and Viya. The sales volume is very high, but at the same time the overall impact on the brand image needs to be considered. Our parent company, Adastria group, has more than 30 brands and over 1,400 stores in Japan. It has a history of more than 60 years. From a men’s clothing store in Mito, the firm has grown into a multi-brand apparel and lifestyle group. Adastria’s e-commerce company .st is one of the largest apparel e-commerce companies in Japan, with more than 10 million users.

The rise of Japanese consumer brands is closely related to the development of Japan’s overall economy. After the financial bubble burst, Japanese consumers began to pay more attention to affordable products and no longer blindly chase after high-end brands. Japan’s lifestyle market is increasingly populated with low- and medium-priced brands. In addition, web-based commerce provides more choices. Consumers do not buy something just because everyone else is after it, they buy what they like.

Howard Wei, director of new retail marketing and partner, Meishang:

Founded in 2018, Meishang has three brands: Colorkey, Super Face, and Lab101. In 2019, we launched the popular Colorkey lip gloss, which was the bestselling product in its category on Tmall. In 2020, our Singles’ Day sales exceeded RMB 160 million (USD 24.6 million), making us one of the three domestic cosmetics brands to surpass the RMB 100 million sales mark within three years of being on Tmall. Our products are also in department stores and physical stores. Brick-and-mortar retailers need to adapt to new product rhythms too, or else they will lose out on business.

If a product goes viral on the internet, that is because its category carries potential. Let’s look at lip gloss as an example: it’s a relatively new category and there weren’t a lot of choices for consumers in the mid-tier price range. We utilize top supply chains for breakthroughs in color rendering, color retention, and the skin feel of our lip gloss. At the same time, we have done well on social media platforms like Douyin and Xiaohongshu. Compared to the brands built or favored by internet celebrities, we are slower, because good products take time to polish. But we move faster than conventional brands.

I used to be a cosmetics importer. In the last two years, brands in China have taken their products to the level where they can now export them. Upgraded supply chain capabilities and the utilization of web-based channels to get the word out have bulked up exports. We began to expand overseas at the end of last year, and will start selling through e-commerce marketplaces such as Shopee, Lazada, and Amazon. Then, we will collaborate with distributors, and the third step is to launch independent websites. We’ll expand to Southeast Asia, Japan, and South Korea, then tap into the Middle East.

Wang Kai, marketing director of Dreame:

Dreame was founded in 2015. At the end of 2017, Dreame joined the Xiaomi ecosystem for smart household cleaning appliances. Our products include vacuum cleaners, hair dryers, and floor-cleaning robots.

We are a company with a geek gene. Dreame invests around 12% of revenue every year in product development. We hope to gain more international recognition in the field of technology and design. Dreame has continuously achieved technological breakthroughs. For example, our vacuum cleaner is the first to reach a speed of 150,000 rpm, maximizing suction power. We have our own factories, so we have great control of our supply chain.

Dreame has expanded to more than 80 markets overseas. The main ones are in Europe, the United States, Japan, South Korea, and Southeast Asia. We have formed collaborations with many e-commerce platforms, including AliExpress, Amazon, and eBay. For users in different countries and regions, we customize our products according to local preferences. For example, residences in China usually have one floor, while European households have two storeys, so that requires customizations in the map feature.

In the past two years, our goal in promoting the brand has been to cultivate awareness of our innovative core technology and shape a home appliance brand that is loved by consumers around the world. We will obtain more exposure opportunities through large-scale showcases, cross-border brand cooperation, online advertising, and key opinion leader (KOL) marketing.

Because of the COVID-19 pandemic, smart hardware like health monitors and cleaning appliances have been explosively popular. Meanwhile, the demand for smart home and office hardware is increasing overseas. Therefore, the smart home product category is also one of the most sought-after verticals in major industry events such as CES 2021.

Andrew John, co-founder of Indonesian eyewear brand Saturdays:

When I was in the US ten years ago, I went to school with the founders of Warby Parker, a pioneer D2C eyewear brand that removed the middlemen in the transaction process to serve consumers directly. When I moved to Southeast Asia, I thought it would be a great thing to bring that concept here, but on a local level.

There’s also a personal reason. [Co-founder] Rama Suparta and I have been wearing glasses for a long time. Glasses are an expensive purchase, but it’s a boring experience, so we wanted to change that with Saturdays. We chose this name because it evokes a sense of fun, happiness, and freedom. We have eight stores and offer a “home try-on program” in five cities in Indonesia.

There are several different problems we solve. First is the pricing. The eyewear industry is controlled globally by a single player, Luxottica, which has a huge portfolio of brands. This keeps prices high for customers. There are a few large, traditional optical players in Indonesia that mainly distribute brands from this company, leaving customers with few options. Therefore, we design and produce great quality products at a fraction of the price, and sell them directly to customers through online and offline stores.

Secondly, eyewear is not one size fits all, so our products are designed to match the facial features of customers within Indonesia and Southeast Asia. A pair of eyeglasses from an established optical company can easily cost more than USD 250, while our price starts at USD 90, including prescription lenses.

Social media is certainly helpful for communicating our brand’s message, as social media penetration in Indonesia is at 62% of the total population (or 170 million users). We also find our lifestyle stores, which are equipped with their own cafes, are a good marketing channel.

Rama Suparta, co-founder of Saturdays:

The epidemic has brought great challenges to the retail industry. As a young brand, we launched the “try at home” option to allow customers to choose up to ten pairs of glasses on the website or app, and we provide home try-on services. Our opticians follow a strict set of regulations to ensure the safety of customers and themselves.

Marshall Tegar Utoyo, co-founder and CEO of Indonesian furniture brand Fabelio:

Fabelio is a digital-first furniture brand that focuses on Indonesia’s rising middle class and affluent consumers in urban areas. The core issue we want to address is that it was very hard, expensive, and time-consuming to buy trendy furniture for a home. E-commerce platforms are geared towards search categories (like phones and electronics, where you can compare items based on functions), and not browser-based categories like furniture.

Indonesia has been known for furniture manufacturing for years, especially items made from solid wood. I think the recent decade has brought innovation to factories so they can now process engineered woods better. In Indonesia, Jepara city in Central Java is the most famous for its solid wood furniture, and the city of Cirebon in West Java province is known for its rattan products. Meanwhile, factories that work with engineered wood are in bigger industrial cities around the country, like Jakarta, Medan in North Sumatra, and Surabaya in East Java.

So far, we have served more than 85,000 consumers and sold over 200,000 items. Our dedicated category managers and designers decide which products to put on the shelves. The company has just expanded its business from Jakarta to the entire island of Java. In order to make buying furniture and decorations easier, we also set up an offline showroom to facilitate in-person experiences. In the past five years, e-commerce platforms and brands like ours have invested millions of dollars in advertising. People are familiar with online shopping, but for products like furniture, brands still need an offline presence to build trust and strengthen their brand awareness.

The most difficult part of building our brand is getting customer service to keep up with the demand, which is something that we are constantly trying to improve. We use a data-driven approach. For example, we set up small showrooms (less than 300 sq m) near residential areas, but limit the number of displayed products because our customers already browse through the catalogue online. Business-wise, this allows us to have one of the highest sales per square foot in the retail industry, as well as strong same-store sales growth.

Regardless of the category, consumers will always pursue the most convenient way to shop. D2C brands now pay a lot of attention to the shopping experience and convenient interactions with users. We also see increasing interest from investors in D2C startups because these brands usually have solid gross margins. I think there will be more startups entering this segment through the pandemic.