Read China Venture Roundup for key monthly takeaways about China’s tech venture and investment landscape. KrASIA keeps you updated on China’s most active investors, promising startups and the hottest verticals of the moment – bringing you closer to one of Asia’s most developed tech ecosystems.

This new series will be published weekly – sign up here to get notified!

Overall Venture Performance

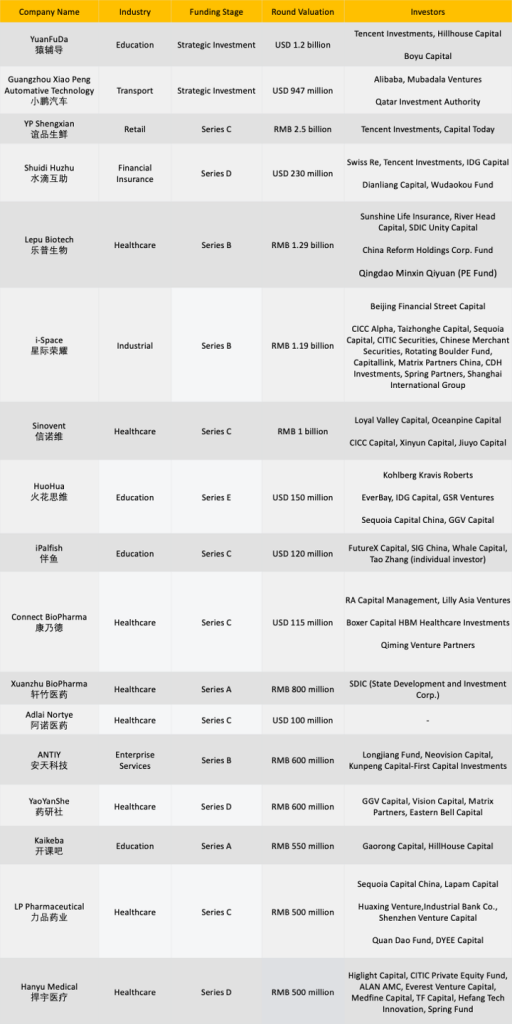

According to reports from China’s mainstream technology and innovation media outlets, there were 172 investment institutions that actively invested in 12 different verticals; including but not limited to HealthTech, Enterprise Services, Tech Hardware and Entertainment. The total amount of invested capital is reported as RMB 43.82 billion.

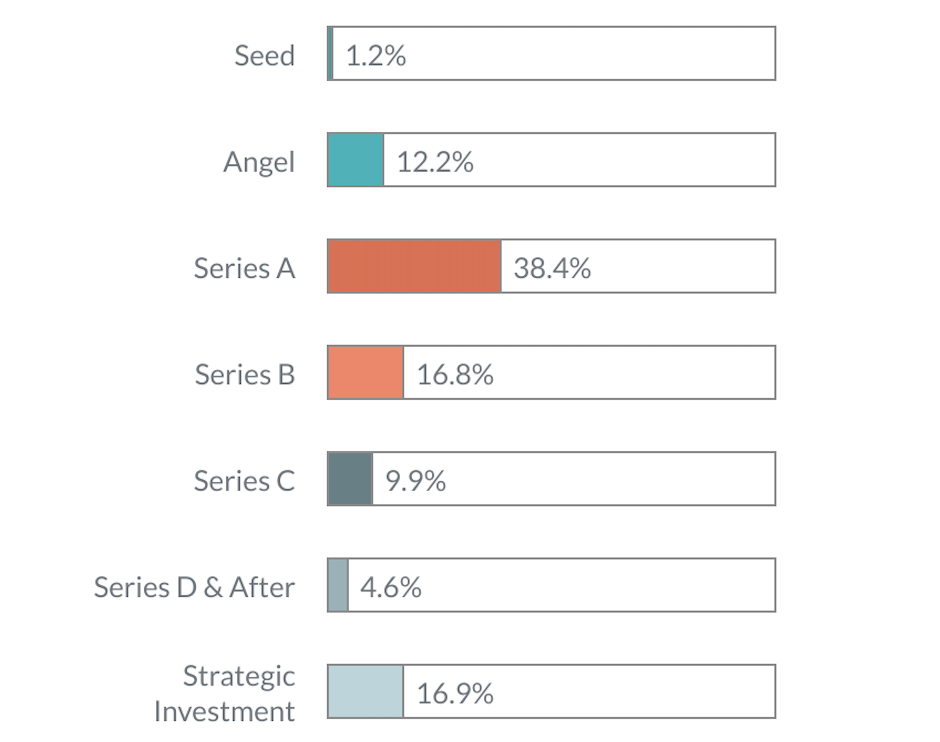

As the pandemic shows improvement, the market is showing signs of recovery including the frequency of larger investments. With the uptick, 17 startups received more than RM 500 million in funding this past August. The single, largest investment made was the USD 1.2 billion strategic investment into EdTech unicorn YuanFuDa (猿辅导), rounding its total valuation to almost USD 13 billion.

Leading Industries

Out of the 172 investments made, the hot spots in August were Healthcare (43 investments), Enterprise Services (42), and Tech hardware (29). Entertainment and Consumer-tech followed closely, and Education also had a good showing with the single big ticket investment.

Subdividing the field of HealthTech, bio-med R&D saw 19 deals closed and digital health saw 10. To name a couple that were outstanding –

Lepu Biotech – raised RMB 1.291 billion for series B

Lepu Biotech, founded in 2018, focuses on the development of its tumour treatments platform. Targeting tumour immunotherapy, the company has developed its platform around PD-1 and PD-L1 drugs, and core combination drugs (oncolytic virus and ADC). Moreover, Lepu is building an open-industry platform for target discovery, patent drug development, development and production.

Startup Highlight:

With high efficacy in treating cancer, PD-1 drugs has encouraged the growth of anti-cancer drug market. Sales volume of these drugs, alongside the drug’s efficacy in treating different types of tumours, has grown exponentially since 2019. The price, however, of the PD-1 drug is far higher than that of conventional anti-cancer drugs with its unit price at RMB 7200. Administered bi-weekly, the annual cost comes close to RMB 200,000.

Despite this, its high price has not suppressed the market’s appetite. After making its entrance into the market, its total sales amounted to RMB 775 million just before January this year. Ultimately demonstrating that the commercial prospects of new anti-tumour drugs is undeniable.

Shukun Technology – raised RMB 200 million of strategic investment from Qiming Venture Partners

Shukun Technology is an AI-driven medtech company, focused on developing diagnostic systems for cardiovascular diseases. Their core technologies include, but are not limited to, AI 3D reconstruction imaging, hemodynamic analysis, surgical planning and navigation, and intelligent disease management. They have also developed and launched their exclusive cardiovascular AI imaging platform.

Startup Highlight:

Shukun is famous in the industry for its original “digital heart” technology. It’s subsequent products “digital brain” and “digital chest” were likened to be the “polaroid” of the CTA (Computed Tomography Angiography). With their technology, complete image processing, AI-assisted coronary artery, chest, and brain diagnoses, intelligent printing of medical scans, output text and chart structured reports can automatically generate.

Shukun’s technology has entered the stage of clinical use in many top hospitals in China, such as Peking Union Medical College Hospital, Beijing Friendship Hospital, Beijing Anzhen Hospital, Fuwai Hospital, Shanghai Ruijin Hospital, the First Affiliated Hospital of Sun Yat Sen University, Shenzhen Hospital of Peking University, Xijing Hospital, and has received much praise.

Notable Early Stage Startups

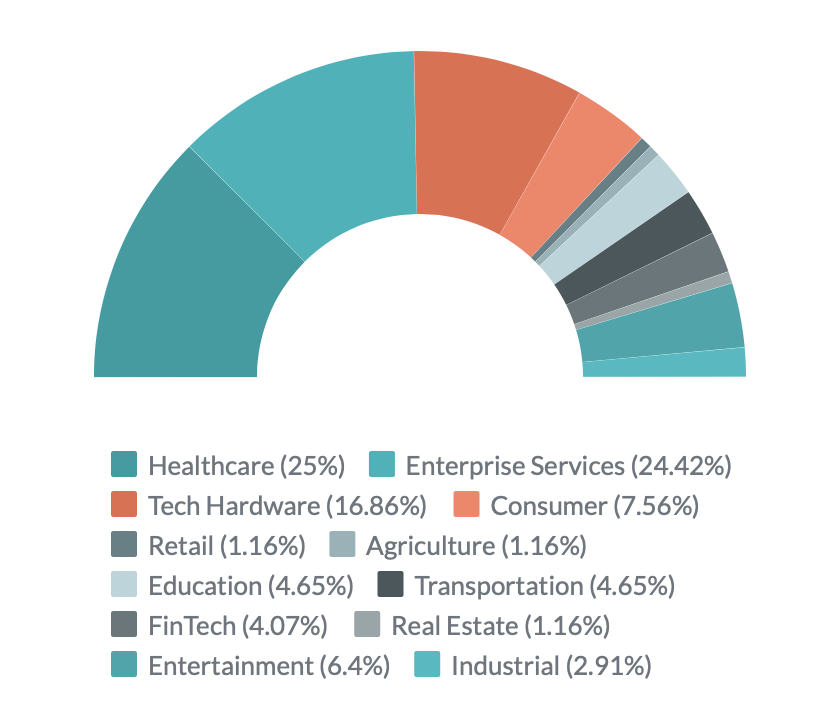

Many investment institutions had cast their attention to series B and pre-series B startups this August. Seed, Angel and series A saw the most number of successful rounds, with 66 investments made. A few of these early stage startups had won the favour of many well-known investment institutions, signalling potential new market trends.

Yuanbao Tech: Closed series A, led by Hillhouse Capital Group

Yuanbao Tech is a Cyber Security company. With their independent intellectual property rights quantitative risk assessment model and platform, they provide customers with an active risk management solution of “service + insurance”.

It provides developed models of cyber security insurance products and accompanying technical services to insurance and reinsurance companies. Concurrently, it offers “cyber health management services” such as active risk monitoring and ‘early warning’ systems to insured companies . Ultimately improving the overall risk management for enterprises through cyber security insurance.

Startup Highlight:

Developing cyber security models is complex and difficult. Yuanbao Tech solves the pain point of guaranteeing secure networks and its price by directly providing customers with a quantitive assessment of their cyber security risk .

Moreover, they are able to reduce the probability of cyber security accidents and potential business losses with their line of active risk management solutions.

Holomatic; closed A+ round with investments from VStar Capital, Chaos Investment, IDG Capital, NavInfo Co. Ltd.

Founded in 2017, Holomatic develops autonomous-driving solutions for highway and smart parking scenarios, with mass production as it’s ultimate goal. This round of financing will be used to expand the R&D team and to strengthen the core technical advantages of its autonomous driving solutions. The team will continue to improve its highway auto-driving system HoloPilot and its intelligent parking system HoloParking, optimizing it to meet their large-scale production plan.

Startup Highlight:

HoloPilot’s software and hardware construction is completed, the integration of key multi-sensor systems, and the development of intelligent decision-making control modules. It has also successfully built systems for automatic driving on the expressway, including automatic car following and lane keeping, traffic congestion guidance, active lane changing and overtaking, going up and down ramps, road navigation and other functions.

It supports the maximum speed of 120km/h, and can adapt to various climatic and road. HoloPilot’s performance in large-scale road testing has demonstrated it to be consistently stable and reliable.

Starfield FoodTech; series A closed at USD 10 million, led by Sky9 Capital.

China’s leading brand of plant-based protein, Starfield, uses plant proteins as raw materials and molecular sensory technology to extract “meat” molecules from plants. This round of financing will be used for product development, supply chain improvement, brand promotion and team operations.

Startup Highlight:

To date, Starfield is the leading plant-based alternative protein company in China, having received the most public funding amongst its peers. Additionally it is the only alternative protein company with independent R&D and production capabilities in China. It currently has five production lines with an annual output of 20,000 tons.

As a product, Starfield also presents it own unique advantage. Despite many similar plant-based meat brands in the market, there is no technological innovation behind these ‘meats’. They often use artificial flavouring and additives, which run counter to the principle of plant-based meat being a healthier option. Starfield’s product flavours are derived from flavour precursor compounds, from natural plants without adding any artificial flavouring. Thus making it tastier, healthier to meet the discerning taste of customers’.

Most Active Investment Institutions

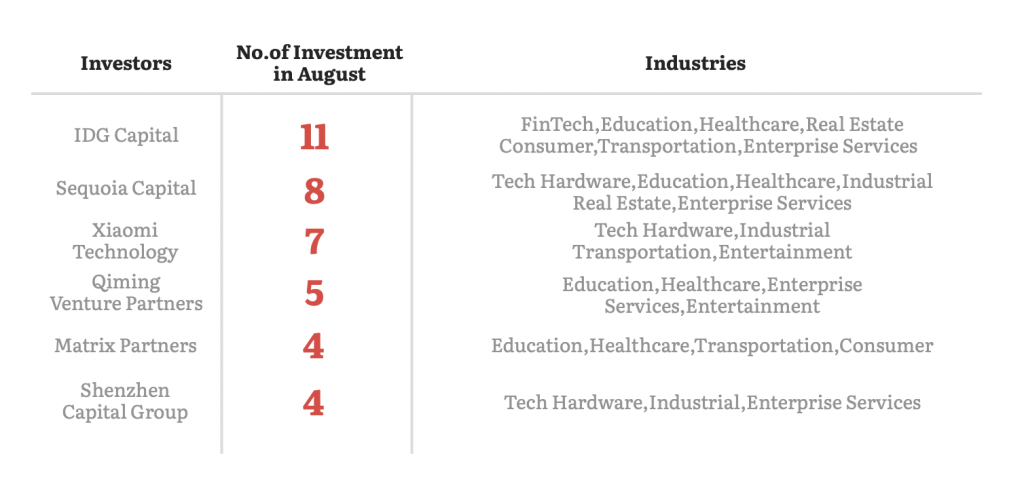

IDG Capital was August’s most active investor, taking part in 11 different deals. The new additions to their portfolio remain diversified covering financial insurance, education, health care, travel, real estate, consumer tech, enterprise services, and range from early stage series A startups to pre-IPO.

Sequoia Capital, Xiaomi Corporation, Qiming Venture Partners, Matrix Partners, Shenzhen Venture Capital have each made more than 4 investments this month, most of which focus on post-series B mature startups.

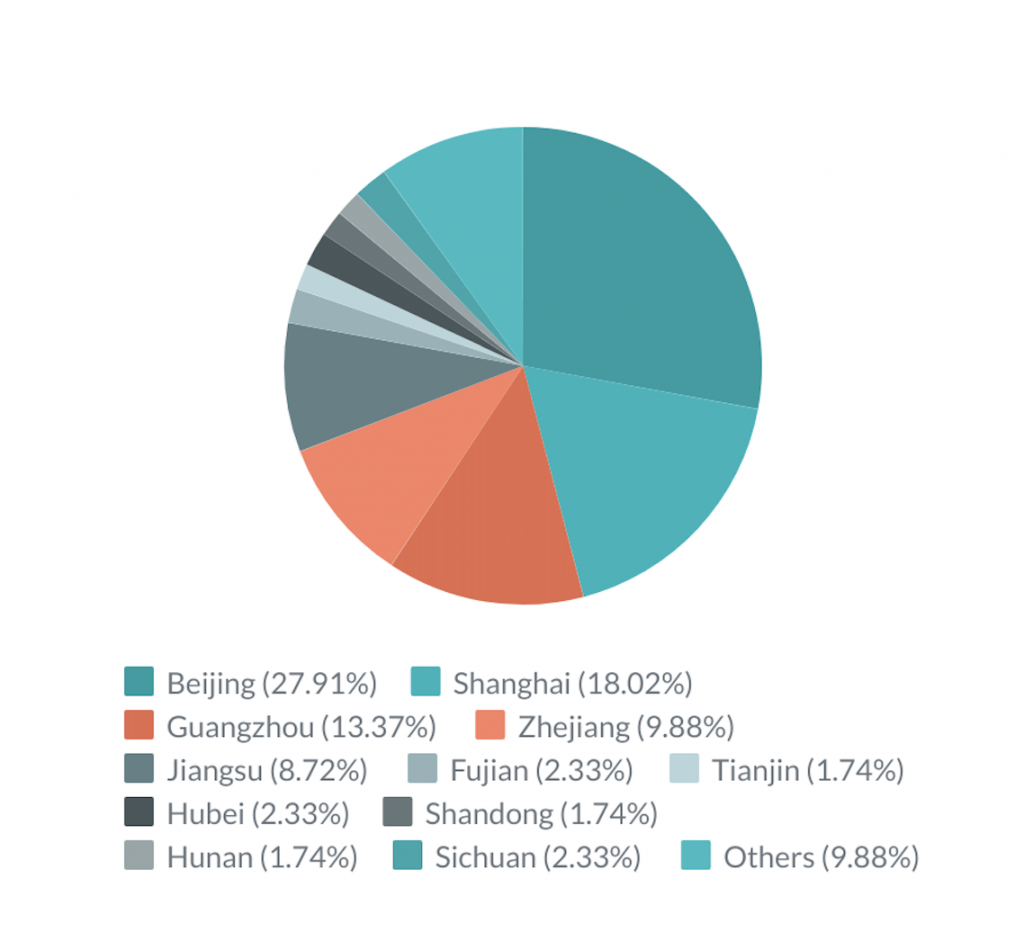

Beijing, Shanghai and Shenzhen remain the centre of action, stimulating neighbouring cities

In August, Beijing was at the heart of much fund-raising activity, with a total of 48 deals closed in the city. China’s northern region accounted for 59.3% of the month’s investment activity, totalling 102 deals, with Jiangsu and Zhejiang seeing quite a bit of activity.