Today, we are excited to announce that Yellow, a leading micro-mobility platform based in Brazil, has raised $63 million in series A led by GGV Capital. Yellow launched Brazil’s first dockless bike-sharing service in Sao Paulo in August 2018. It has also begun piloting e-scooters and developing e-bikes to provide a comprehensive micro-mobility solution to users in Brazil and beyond. Additionally, Yellow offers digital payments through its Yellow Pay platform. We are thrilled about the partnership and wanted to share our thoughts on why we made the investment.

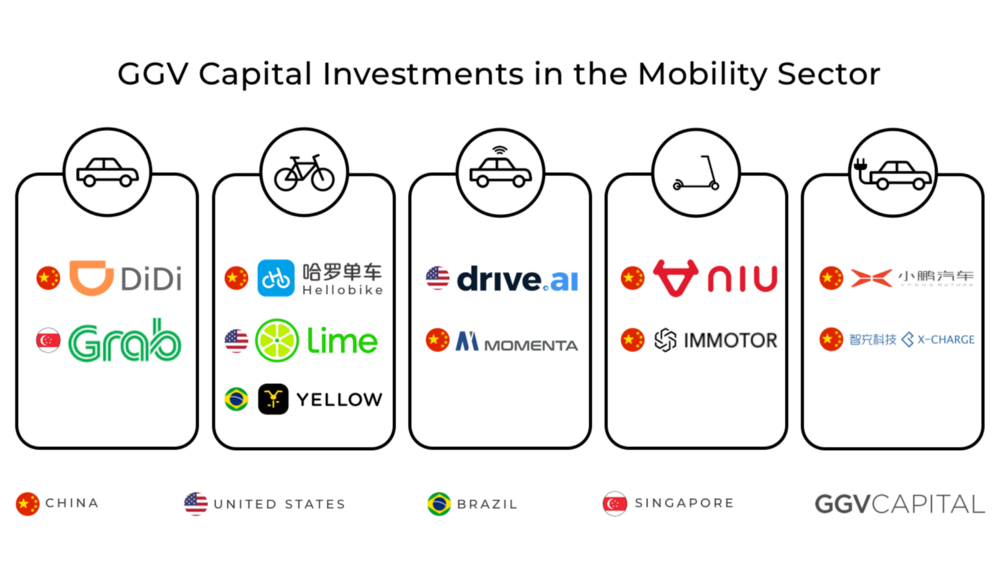

First, Yellow fits with one of GGV’s longstanding investment themes: making our cities more efficient and easier to navigate. GGV has already made many investments in the mobility sector, as can be seen in the graphic below.

Our lessons from these past investments? Megacities across the world–whether it’s Beijing, Jakarta, or Sao Paulo–are experiencing the same trends: rapid urbanization, worsening pollution, and overburdened public transportation. With a population of 12 million, Sao Paulo is well known for its bottleneck traffic jams and is in fact the fourth-most congested city in the world. Micro-mobility solutions tailored to local conditions should take off quickly, thanks to pent-up demand for alternative ways of getting around.

Second, Yellow has a world-class team that is uniquely positioned to grow the company into a regional leader in the mobility sector. Founder and CEO Eduardo Musa, a seasoned operator and entrepreneur, is the former CEO of Caloi, a leading Brazilian bike manufacturer, which he successfully sold. His background in manufacturing is particularly relevant as Yellow will build its own factory for bikes and scooters in Latin America to enjoy reduced costs (free from import taxes) and increased efficiency from recycling used bikes. Yellow’s other co-founders, Ariel Lambrecht and Renato Freitas, were former co-founders of the Brazilian ride-hailing company 99, the first Latin American private unicorn when it was acquired by Didi Chuxing for over $1B this January. Having gone through exits in the past, these entrepreneurs know what it takes to build a company from start to finish, and the dos and don’ts of scaling startups.

Third, we are particularly excited about another vision of Yellow’s: financial inclusion. Given that the region has low credit card penetration, Yellow now offers convenient QR code-based digital payments through Yellow Pay, which allows users to transform cash into digital credit for Yellow’s services. Through a network of certified points of sale, such as convenience stores, newsstands, and bakeries, users buy Yellow Credits in cash by scanning a QR code, and can then apply these credits to Yellow rides. We have seen the power of QR code-based mobile payment in China, where the mobile payment market is 10 times larger than in the US and WeChat Pay now has a 97.3% penetration among users under 18 years old. Just like how Alibaba incubated Alipay and Grab incubated GrabPay, we believe Yellow Pay presents a great opportunity for financial inclusion in a region where a substantial proportion of the population remains unbanked. Just how big an opportunity is online payment? PayPal’s market cap is three times that of Ebay, and Ant Financial is worth more than Goldman Sachs. This is why we believe Yellow’s combination of mobility and payment solutions holds enormous potential.

Our decade-long experience of investing in China has taught us that when a new economy disrupts an old economy — as mobile Internet vastly enhances the efficiency of offline activities — the power it unleashes is boundless. We look forward to partnering with our friends at Yellow, our co-investors monashees, Base10 Partners, Grishin Robotics, and Class 5, as well as other promising global entrepreneurs, to write the next chapter of digital economy in emerging markets across the world.

This piece originally appears on Hans Tung’s Medium, written by Hans Tung, Robin Li, and Zara Zhang.

Hans Tung is a Managing Partner at GGV Capital. He has been ranked by Forbes Midas List as one of the world’s top venture capitalists six times from 2013 to 2018, most recently ranking number 20 in the world. He has invested in 11 unicorns, including Xiaomi, Wish, Bytedance (a.k.a. Toutiao), Slack, Airbnb, OfferUp, Peloton, Coinbase, Xiaohongshu, Meili, and SmartMi. Read his blog at hans.vc and listen to his 996 Podcast on tech in China.

Robin Li is a Vice President at GGV Capital, and Zara Zhang is an investment analyst at GGV Capital.