A few days after Vietnam loosened its social distancing restrictions in some cities and provinces on April 15, Prime Minister Nguyen Xuan Phuc attended the launch of a remote medical examination and treatment platform by the contact tracing app Bluezone. The new digital tools are expected to assist Vietnam’s COVID-19 fight and, beyond that, hasten the digital transformation of the country’s healthcare sector.

Vietnam has a growing population of tech-savvy consumers, and winning their trust is no easy feat. It has taken deep-pocketed Grab several years to educate consumers about the benefits of using a ride-hailing app. Locals still mostly prefer to pay cash on delivery for online orders because they don’t trust online payment systems.

For healthcare services, mistrust in digital platforms is no doubt even higher. There is a constant worry: Am I being cheated by doctors who don’t have the right qualifications?

COVID-19 might have shifted that mindset a little, according to some industry insiders. It started with the government’s relative success in using digital tools to raise public awareness about the pandemic.

Coronavirus electropop song goes global

Last month, Vietnam’s coronavirus public awareness pop song went viral after it was featured on the popular American TV show Last Week Tonight with John Oliver. The host found the song “incredible,” with an catchy melody and informative lyrics that demonstrate the correct techniques to wash one’s hands.

Vietnam’s containment and prevention of COVID-19 has been relatively successful, with zero recorded deaths and 268 confirmed cases as of April 22. This is the consequence of the creative use of digital tools on various channels to reach the country’s population and encourage a collective effort to maintain health standards.

NCOVI, an app developed by the Ministry of Health, surpassed Facebook as the most downloaded one on Vietnam’s Apple App Store last month. And Zalo, a homegrown messaging app with more than 50 million users, is where health authorities disseminate warnings and orders, not WhatsApp or Facebook Messenger. Viettel, the country’s main telecom provider, has added the #hayonha (#stayathome) hashtag to the notifications area of every phone under its coverage.

Dolly Hoang, manager at the Asia-focused consulting firm YCP Solidance, which recently published a report titled “A Look Forward: How Digitalization is Transforming Vietnam’s Healthcare System,” notes that COVID-19 has created an environment where the country’s consumers are shifting components of healthcare and their consumption of health-related information to various digital platforms. Some are using online consultations with doctors for the first time to avoid heightened risks at public hospitals, or because private healthcare facilities are closed.

Surging demand for online care

Healthcare startups now see an opportunity for broader acceptance among the general population.

Founded in 2014, Jio Health operates out of Ho Chi Minh City, Vietnam’s largest metropolitan area. The startup, which raised USD 5 million in Series A funding from Monk’s Hill Ventures last September, provides on-demand access to healthcare services through its app and website, alongside its own integrated clinic, lab, and pharmacy.

Years ago, founder and CEO Raghu Rai saw an early opportunity to form his company in Vietnam, where there was a growing middle class, a healthcare system that lacked digital infrastructure, and overcrowded public hospitals where doctors sometimes spent just a few minutes with each patient.

Jio Health has about 150 specialists across 14 types of care. The company believes it can meet about 80% of healthcare needs for most patients through a combination of online and offline services. This can range from video consultation, chats with licensed physicians, to home delivery of medication, and home visits by doctors.

Rai says that Jio Health has seen demand double for its online products. It is strengthening safety precautions for its core home-based medical services. “When this pandemic ends, people here are going to be much more conscious about alternatives to traditional facilities and digital healthcare might be a little bit more top of mind,” he said.

Changing habits

Nguyen Thanh Phan, CEO of Doctor Anywhere, understands that the habit of Vietnamese consumers—when it comes to healthcare—is not going to change overnight. “Most people, when they feel unwell, what they usually do is visit the nearest pharmacy and consult the pharmacist there, because it’s still quite difficult to access a doctor here,” says Phan. “We want to change that.”

Doctor Anywhere, which recently made headlines for its USD 27 million Series B funding, has a regional footprint across Southeast Asia. Founded in 2016, the company provides access to locally licensed doctors and medication deliveries. In Vietnam, Doctor Anywhere boasts a network of 100 private hospitals and clinics and about 80 pharmacies.

Phan says that the demand for online consultations on Doctor Anywhere has risen fivefold since the outbreak of COVID-19. Although these consultations are currently provided for free, the startup is focusing resources to shape good online experiences, so that customers will still use their platform to book medical appointments when normalcy returns.

In for the long run

Huynh Phuoc Tho, co-founder of medtech startup eDoctor, doesn’t want to make short-term moves just because of COVID-19. The company recently secured funding from CyberAgent Capital, Genesia Ventures, Bon Angels, and Nextrans. It was eDoctor’s first institutional funding round since 2014, when it began operating a healthcare advice hotline in partnership with Viettel.

At the time, the hotline was always overloaded, Tho recalls. In 2017, eDoctor finally launched a mobile app and has since then been competing with similar startups in areas such as online consultations and lab testing.

Tho says that even if people are more willing to try out online healthcare, customers still demand a smooth transition to offline services when they are needed. “Our goal is to help patients, doctors, and other partners within the ecosystem to become more efficient in delivering data-driven medical services,” Tho explains. “That means offering technological solutions to ensure that medical data is used safely and securely for long-term medical monitoring and assessment.”

What’s next?

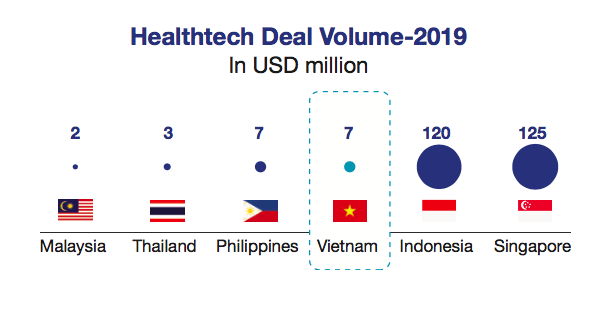

Despite growing optimism, health tech startups in Vietnam are still at a very early stage of development. YCP Solidance’s report shows that Vietnamese startups only recorded USD 7 million in investments in 2019, which is a modest sum compared to the hundreds of millions of dollars flowing into the payments or e-commerce sectors. The health tech deal volume in Vietnam is also much lower than in Singapore and Indonesia.

Hoang from YCP Solidance remarks that healthcare in the country is dominated and driven by the public sector. Overcapacity and understaffing are major problems plaguing public hospitals. Meanwhile, startups are looking to fill a gap with their home-care and telemedicine services, while also improving communications between doctors and patients.

However, according to Hoang, it will take some time for the sector to gain momentum, from wooing investors to winning consumers’ trust. “Health tech companies are playing in their own playground,” she said. “For the development in the long-term, it might require long-term collaboration and partnerships with other players in the ecosystem.”