Subscribe to our newsletter to read this first thing on Friday morning. This is the preview of what you will receive in your inbox.

A recent report by Hurun India, which tracks unicorn companies globally, said the country—after averaging three unicorns each month so far in 2021—nearly doubled the number of its unicorns to 51 by the end of August. It further added that there are 32 gazelles—USD 500 million-plus companies—and 54 cheetahs—USD 200 million-plus firms—that will turn into unicorns in the next two and four years, respectively.

One of the key factors that are catapulting local startups into unicorns is global liquidity. Since the beginning of this year, Indian internet startups have raised over USD 20.2 billion in funding across 576 deals, surpassing USD 13 billion raised across 878 deals in 2019.

While more and more startups are entering the elite USD 1 billion-plus club, older unicorns are targeting public markets to level up their game. For this week’s big read, Chiratae Ventures’s Karthik Prabhakar shared a historical look at India’s all previous IPO booms that have happened in the country and what this new emerging wave means for retail investors

The Big Read

India’s IPO boom and the road ahead

What Happened

This year, India is witnessing an increasing number of high-profile internet startups going public. Food delivery giant Zomato listed its shares on the public markets earlier in July and saw its market cap hitting USD 13 billion. Other big wig companies like digital payments firms Paytm and MobiKwik, omnichannel beauty product retailer Nykaa, online travel booking firm ixigo, and digital insurance marketplace PolicyBazaar, among others, have already filed with the Indian market regulator to get listed.

Although it is still early to call it an IPO boom, with the way things are, it may very well turn into the third wave of the IPO boom.

Looking back, the first wave of the IPO boom was set off with liberalization in 1993. Data shows that there were over 2,000 IPOs between 1993 and 1994, which set the stage for the future. The second wave of IPOs came with the onset of the golden period of 2005–07. India witnessed over 100 IPOs in 2007, just before the onset of the global financial crisis. However, it has had a patchy track record since then.

In comparison, a mature market like the US averages over 100 IPOs each year and over 400 IPOs each year in boom times. Despite being a country with a GDP of USD 2.8 trillion, buoyant equity capital markets largely driven by foreign institutional investors’ (FIIs) participation, and a favorable regulatory environment, the retail participation in equity capital markets is abysmally low in India—less than 3% of Indian households have exposure to equities (directly or indirectly).

However, the silver lining is that a low-interest-rate environment, coupled with increased liquidity in the hands of investors, is driving a lot more retail participation in recent quarters.

What Does It Mean

There were 55 million demat accounts by the end of FY 2021 compared to 5.8 million in 2007—a 10x increase in the number of demat accounts and potentially a more than 10x increase in the number of retail investors actively participating in the stock market (in 2007, only half of the demat account holders actively participated).

If recent IPOs are anything to go by, retail investor participation is scaling up significantly. The lure of the stellar listing gains has been attracting many first-time investors.

However, amidst all the frenzy and rosy outlook, there may be a danger of overexposure—retail participation can soon turn into a herd mentality, leading to unsustained growth of the markets (without fundamentals).

As a growing economy, India offers tremendous opportunities for entrepreneurs to build global companies. The country has a super active early-stage VC ecosystem that enables entrepreneurs to take that risk in the early stages, and a buoyant private equity market that enables strong early-stage businesses to access growth capital. As these companies scale up, it is only natural to see a lot more IPOs in the future.

The Weekly Buzz

1. Union Square Ventures made its first bet in India on EV infrastructure startup REVOS. Together with Indian early-stage VC Prime Venture Partners, the New York-headquartered investment firm has written a USD 4 million Series A check for Bengaluru-based REVOS. The four-year-old startup—which provides a smart platform to track, monitor, and control connected two- and three-wheeler EV vehicles and is building a peer-to-peer charging network for EVs—will use the fresh funds to deploy one million chargers in 500 cities across India and other emerging markets over the next three years.

2. In one of the biggest buyout deals in the Indian fintech space, South African internet giant Naspers’ global investment arm Prosus Ventures has acquired Indian payment gateway firm BillDesk for USD 4.7 billion. The acquisition will be carried through PayU, Prosus’ global fintech business, which has a presence across 20 countries, and provides merchants with online payment solutions for domestic and cross-border transactions, along with credit solutions. The handshake between the two payment gateway giants will solidify PayU’s position in India and make it one of the largest online payment providers locally and globally by total payment volume.

3. SoftBank-backed Indian mobility giant Ola is eying an initial public offering by early 2022. The Bengaluru-headquartered mobility firm is aiming to raise at least USD 1.5–2 billion by listing its shares on bourses at a valuation of USD 12–14 billion, a report by local media Economic Times (ET) said, citing sources. Another report by Bloomberg said Ola is eyeing a USD 1 billion IPO, seeking a valuation of USD 8 billion. Ola—which plans to file for IPO with the market regulator Securities and Exchange Board of India over the next two months—has joined a list of high-profile internet companies like e-commerce major Flipkart and hospitality unicorn Oyo that are likely to go public next year.

4. Indian D2C brands are thriving as VCs invest half a billion dollars since last year. Between January 2020 and August 2021, VC firms have backed about 146 D2C brands, investing almost USD 500 million, said a report by local media Economic Times, citing data from Tracxn. That is almost what the D2C brands raised in total in the previous five years, the report added. It also said on average there were two such investments per week since late March 2020, which was when the COVID-19 pandemic first hit the country. There are currently over 600 D2C brands operating in India. Some of the D2C companies that have gained consumers’ attention include beauty and personal care firms MamaEarth, Wow Skin Science, and Sugar Cosmetics, electronics appliance retailer BoAt, coffee brands Sleepy Owl and Rage Coffee, and home furnishing provider Wakefit.

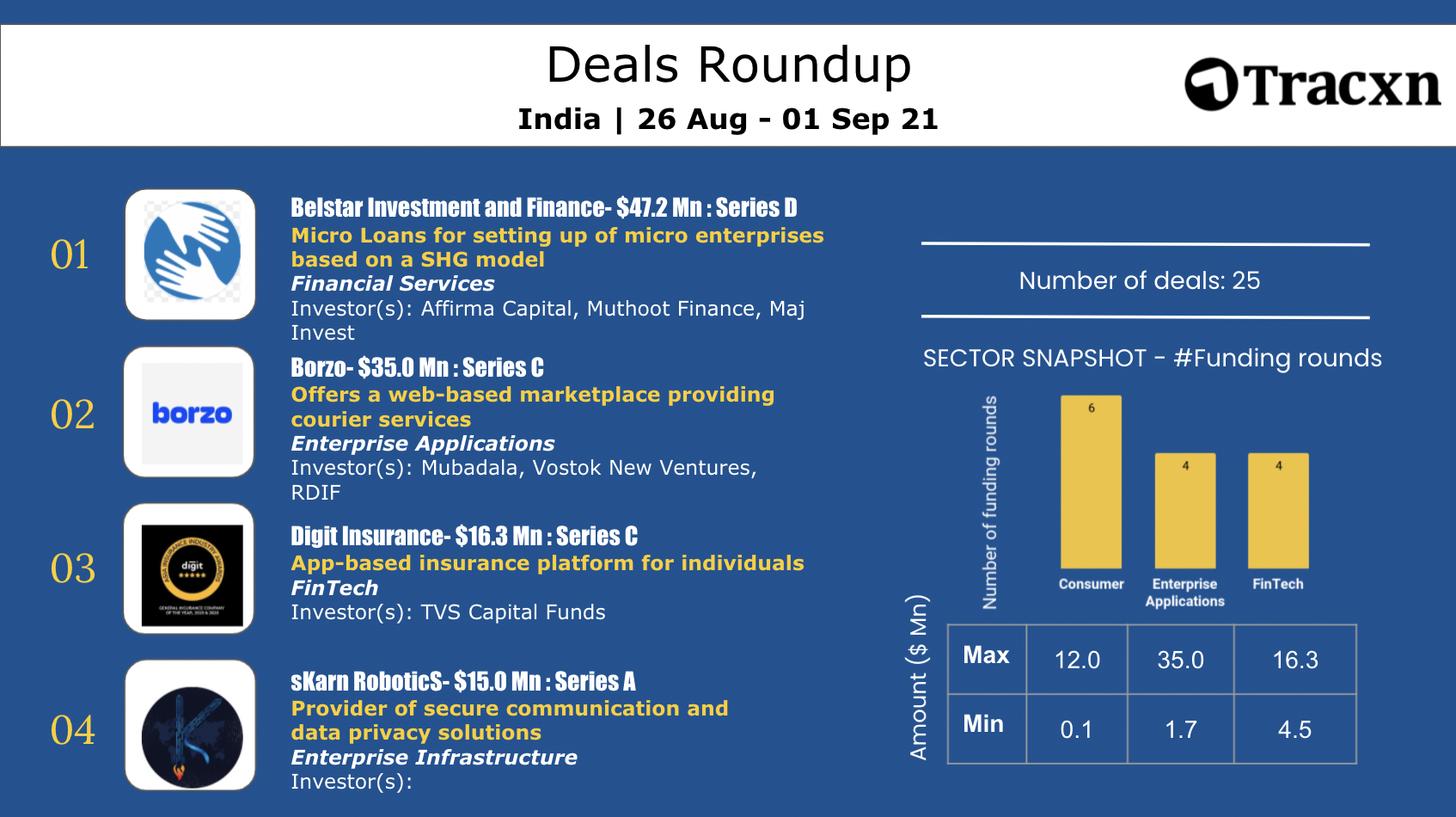

Top Deals This Week

In partnership with Tracxn

What We Are Reading

Has India tech’s golden decade arrived

The article chronicles how the Indian technology sector evolved over the last 60 years—beginning from the establishment of the country’s premier engineering colleges, Indian Institute of Technology (IITs), in the 1960s to the emergence of IT giants like TCS, Infosys, and Wipro in the 1980s, all the way to the dot com boom and bust in early 2000s, then to finally the rise of internet startup since 2010. The author argues, quite convincingly, why the last decade can be considered as the golden decade for the technology market in the world’s second-most populous country.

Upcoming Event

Pharmaceuticals Export Promotion Council of India—set up by the Ministry of Commerce, Government of India—is organizing “India Oceania Connect–Virtual Pharma BSM” during 14–17 September, 2021 to connect Indian exporters with stakeholders of the pharma industry in the Oceania region. Indian companies will be showcasing their products and services to countries like New Zealand, Australia, Papua New Guinea, and Fiji & Tonga.

Find out more about the event or sign up.

The Spoiler

Tune in next week to find out why Ankur Capital, co-founded by two women VCs, started making bets on startups developing deep tech solutions in areas like agritech, healthtech, and fintech back in 2014—when these sectors were largely ignored by mainstream VCs—and where it has led them.