Subscribe to our newsletter to read this first thing on Friday morning. This is the preview of what you will receive in your inbox.

Two months after COVID-19 hit India in March 2020, Prime Minister Narendra Modi delivered a speech that underlined the vision for a self-sufficient or atmanirbhar India.

“All our demands during the crisis were met locally. Now, it is time to be ‘vocal about local’ products and help them become global,” he said. At the time, the country was still under a national lockdown. His idea was to recognize the importance of local products and services as well as local manufacturing and supply chains while cutting down reliance on other countries.

Since then, many Indian startups have come forward to build up local equivalents to global platforms for regional users. The list includes Twitter-like microblogging app Koo, Clubhouse alternative Fireside, and short video app Moj, among others. To foster the innovation, the country announced Startup India Seed Fund earlier this year, with a corpus of INR 9.45 billion (USD 128 million) to back 3,600 startups over the next four years. It is yet to be seen how the government funding will help these startups, but it seems to be beneficial for companies if they have a government connect.

For this week’s big read we looked at how a local video conferencing platform Vconsole—which had won a government-organized contest in 2019—was able to beat global market leader Zoom in landing one of the most significant clients in the country—the central government.

The Big Read

India’s Vconsol is growing to become the local answer to Zoom

What Happened

In April 2020, India partially banned Zoom, forbidding its use at the Union Government level and replacing it with local alternative Vconsol.

Vconsol was created by Techgentsia, a startup from Kerala that had won prize money of INR 1 crore ( USD 135,000 ) in August 2019 in a contest organized by the Ministry of Electronics and IT. After the contest, Techgentsia cloned a dedicated instance of Vconsol and rebranded it as BharatVC, exclusively for India’s Union Government.

However, it was not until Zoom was debarred from being used in central government departments did the ministries reluctantly start to adopt the local software.

Techgentsia’s contract with the government is for three years, during which the firm will get an additional INR 10 lakh (USD 13,546) annually towards the maintenance of the project. Vconsol has been used by the Indian government agencies on various occasions including Prime Minister Modi’s video conferencing with the country’s Olympic contestants and their family members.

Techgentsia has also designed a hybrid court for a couple of southern states in India. Government institutions like Comptroller and Auditor General’s office, Atomic Research Centre, and Indian Plasma Research Institute too have migrated to Vconsol.

National Informatics Center (NIC), under India’s Ministry of Electronics and IT, which provides the infrastructure to run BharatVC, plans to increase its server capacity by 10 times to cater to all government departments.

Although central ministries have deployed Vconsole, the provincial governments have not accepted Vconsol yet. Two months ago, Techgentsia decided to open Vconsol to the public at a cost. It charges a subscription fee of INR 13,200 (USD 178) per year. On the other hand, Zoom offers a free basic plan.

What Does It Mean

There Even after the ban, India continues to be Zoom’s second-largest market after the US in terms of users. The company saw a 67x rise in free user signups and 4x growth in paid clients that have ten (or more) employees during the pandemic, according to Abe Smith, head of Zoom’s international business.

Zoom’s growth was confirmed by Eric S. Yuan, founder and CEO of Zoom, in a chat with Rajan Anandan, president of TiE Delhi-NCR and MD, Sequoia Capital, during India Internet Day 2020 in August last year. Yuan said that his favorite usage of Zoom in India is telemedicine. He also mentioned that many of Zoom’s employees are of Indian origin, including its mentor and investor, Subrah S. Iyer, COO Aparna Bawa, president of product and engineering Velchamy Sankarlingam, and chief information officer Sunil Madan.

Zoom was not discouraged nor deterred by India’s partial ban, after which the company announced that its private users in India can buy their preferred plans and add-ons with local currency. “India remains a key focus market for Zoom, and we will continue striving to grow as an Indian company,” said Sameer Padmakumar Raje, India Head for Zoom. The US-based giant had been relying on telecom operators like Airtel to sell its product. It also has plans to open a technology center in Bengaluru.

The ban on Zoom in central government departments was a blessing for Vconsol. The turnover of Techgentsia, which was USD 1 million, has grown to USD 5 million, said Joy Sebastian, founder and CEO of Techgentsia. “We have enough revenue from selling our products. We never looked for venture capital. We will only accept funding if it is in line with our goals and if it helps in value addition,” Sebastian told KrASIA.

While Zoom is still on a tear in India, Sebastian is also determined to compete in Zoom’s home turf, the US. Techgentsia has set up its US operations in New Jersey to cater to its clients like Kypura, GoDaddy, and Zendesk. According to Sebastian, it has a million users across multiple continents.

The Weekly Buzz

1. Indian edtech decacorn Byju’s is close to raising a USD 400–600 million pre-IPO funding round that will value the company at USD 21 billion. Last month, the Bengaluru-headquartered company began discussions with investment banks including Morgan Stanley, Citigroup, and JPMorgan Chase & Co to list its shares. According to a report by Bloomberg, Byju’s may file for IPO by mid–2022, aiming for a valuation between USD 40–50 billion. Earlier, the company was looking at a timeline of 12 to 24 months, which means it has hastened its plans and joined a long list of high-profile companies like hospitality chain Oyo, e-commerce major Flipkart, and ride-hailing giant Ola that are looking to go public next year.

2. Byju’s has acquired GradeUp to strengthen its presence in test prep. This is the edtech decacorn’s eighth acquisition this year, and second in the exam prep space overall. Earlier this April, Byju’s bought the country’s leading brick-and-mortar coaching chain, Aakash Educational Services, for almost USD 1 billion. Founded in 2015, Gradeup offers test prep courses across sectors like teaching, banks, railways, defense, central and state governments, and GATE, among others, through a combination of live classes, study material, practice tests, and assessments. To date, it has had over 25 million students prepare for various exams through its platform.

3. Former Tiger Global fund manager Lee Fixel’s Addition has invested USD 76 million in Tiger-backed logistics startup Delhivery. This is Addition’s second investment in the country, which comes a year after Fixel made his first bet in India on online news aggregator Inshorts’ location-based social networking platform Public. Notably, Fixel had invested in both—Delhivery and Inshorts—back in 2015 for Tiger Global. New York-headquartered Addition has backed almost five dozen startups since its inception in July 2020, but its pace of investments in India has been snail-like.

4. PhonePe-backed digital mapping company MapMyIndia has filed for IPO. This makes it the fourth profitable internet company to target public markets this year after travel broker ixigo, lifestyle retailer Nykaa, and used car marketplace CarTrade.The company’s offer comprises an offer for sale (OFS) of up to 7.5 million equity shares by existing stakeholders. This means MapMyIndia’s IPO is going to be an entirely secondary share sale and is primarily aimed at giving its backers a partial exit. Notably, Walmart-owned Indian digital payments firm PhonePe, the largest shareholder in MapMyIndia with a 36.1% stake, will not be offloading its shares.

Q&A Of The Week

6 thoughts on deep tech solutions by Ankur Capital’s co-founders

Eight years ago, two women formed a team and decided they would invest in Indian startups. One was Rema Subramanian, a finance professional with three decades of experience; the other was Ritu Verma, a physicist who previously worked for multinationals firms. At the time, internet usage and smartphone adoption was becoming more common in the country, and global VCs were beginning to cut checks for the nascent local startup ecosystem—particularly for e-commerce companies.

Instead of following suit, Subramanian and Verma realized there was “white space” in areas like agritech and health tech that presented promising opportunities. In 2014, they founded early-stage VC firm Ankur Capital with an INR 500 million fund (roughly equivalent to USD 7.9 million at the time) to primarily invest in startups building deep tech solutions in these segments.

Since then, the Mumbai-based VC firm has backed 20 startups including CropIn, which digitizes farms and does high-level analytics using satellite data to make predictions, StringBio, an alternative protein company that uses waste gas (methane) to make proteins for animals and humans, and Niramai, a breast cancer detection company.

We spoke to the co-founders and managing partners of Ankur Capital to know more about their journey, how their investment thesis has evolved, and the challenges of being women in the male-dominated Indian VC industry.

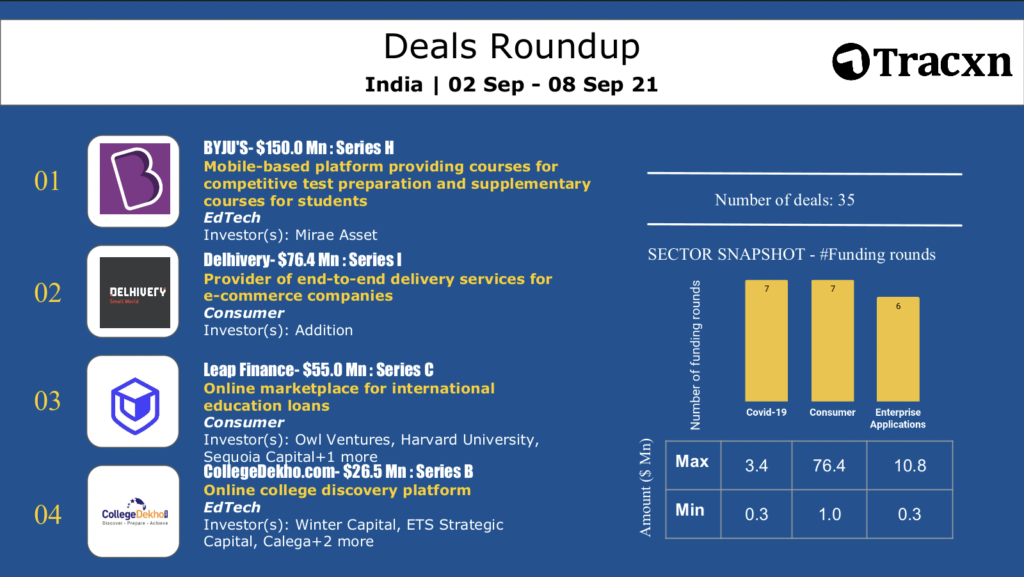

Top Deals This Week

What We Are Reading

Shifting Dynamics of Venture Funding

In this article, Murali Krishna Gunturu, principal at Inflexor Ventures, talks about the changing VC landscape—the shift in the balance of power from investors to having a better balance of power between investors and founders. Traditionally, investors had the upper hand in the fundraising process. However, intense competition for deals and a high supply of dry gunpowder has tilted the scales in favor of founders. He notes that VCs are now accepting of more generous terms, both monetary and otherwise.

The Spoiler

India’s Vconsol is growing to become the local answer to ZoomTune in next week to find how Indian SaaS startups successfully stole the thunder of their consumer-oriented contemporaries to garner attention from the VC community.