PDD Holdings, the company behind Temu and Pinduoduo, has usurped Alibaba Group as China’s most valuable e-commerce company based on market value. ByteDance’s overseas earnings now make up 20% of its total revenue for the first half of the year, with TikTok emerging as a formidable powerhouse. Under the leadership of Jiang Fan, international business has also become one of the few bright spots among Alibaba’s various businesses.

Yet, amidst this global wave, Meituan’s presence seems notably absent. Once standing as the third largest internet giant in China during its prime, Meituan has now slipped to the fifth position.

When will Meituan venture beyond the confines of the Chinese market? This question, lingering in the minds of many, is beginning to see some developments.

36Kr learned that Zhu Wenqian, Meituan’s head of overseas investments, made several visits to the Middle East from October last year to the middle of this year. According to various insiders, Zhu’s visits were not just about understanding local business policies but also focused on assessing the competitive landscape of the food delivery market in the region.

In May this year, Zhu, along with Wang Xing, CEO of Meituan, Wang Puzhong, president of Meituan’s home business group, and other core Meituan executives revisited the Middle East, holding meetings with members of the Saudi royal family, and several ministries. Sources told 36Kr that by mid-year, Meituan had begun recruitment for a human resource director to establish a Middle East team and considered making Riyadh its first pilot city. However, this initiative was later put on hold.

“Top-level opinions were divided,” an insider said. Presently, Meituan’s specific business plans and pilot city in the Middle East remain unfinalized. Nonetheless, the recent developments add fuel to speculations about Meituan’s global aspirations.

Meituan’s interest in the Middle East has to be analyzed within the broader context of 34 investment agreements signed between China and Saudi Arabia in December last year. Notable enterprises, including Huawei, Tencent, Alibaba, China Civil Engineering Construction Corporation, and CITIC Capital, inked agreements with various Saudi companies. Meituan’s visits to the Middle East coincided with this period.

To attract businesses, the Saudi government introduced regulations in 2021, with the goal of ceasing the awarding of government contracts to companies with regional headquarters based outside of Saudi Arabia by January 1, 2024. This partly explains Meituan’s consideration of operating in Riyadh.

Adding to that is the latest announcement of a 30-year corporate income tax exemption for companies relocating their regional headquarters to Riyadh. “This is about luring people and businesses away from other Middle Eastern countries, especially the UAE,” an investor familiar with the Middle East told 36Kr.

In recent years, Dubai, the largest city in the UAE, has been the preferred destination for Chinese companies going global in the Middle East due to its more developed infrastructure, higher per capita GDP, and business-friendly environment.

According to World Bank data, the UAE’s per capita GDP in 2022 was USD 54,000, ranking third among all Middle Eastern countries, after Qatar and Israel. Saudi Arabia’s per capita GDP in 2022 was USD 30,000. The corporate income tax rate in the UAE is 9%, one of the lowest globally. It is reported that internally, Meituan considered Dubai as the preferred pilot city for its Middle East expansion.

Taking the food delivery market in Dubai as an example, Meituan’s main competitors would be Talabat, Careem, and Deliveroo. Deliveroo is also one of Meituan’s major competitors in Hong Kong, colloquially referred to as China’s Uber Eats.

Talabat is backed by Delivery Hero, the parent company of Foodpanda. This German food delivery giant began its Middle East expansion as early as 2015 and has successively acquired local platforms Talabat and Carriage as well as Zomato’s UAE business. Delivery Hero has captured around 70% of the UAE’s food delivery market.

In 2022, Delivery Hero’s revenue reached EUR 8.57 billion (USD 9.4 billion), equivalent to 30% of Meituan’s revenue during the same period. However, it is also in a loss-making state, with a net loss of EUR 300 million (USD 438 million) in 2022.

However, compared to the domestic market, the average order value in the Middle East is higher, generally above RMB 200 (USD 28) as compared to Meituan’s Q3 food delivery average order value of RMB 48 (USD 6.7). Since the unit economic model of food delivery is highly correlated with the average order value, the Middle East may be a more suitable target market for the international expansion of Meituan’s food delivery business. The Middle East and North Africa (MENA) are also among the best-performing regions globally for Delivery Hero, accounting for one-third of its revenue.

One of the reasons for Meituan’s hesitation, according to an insider, is “concerns internally about whether the food delivery volume and growth rate in the Middle East are worth pursuing and whether it can be profitable in the short term, especially considering that food delivery is a business that is heavily offline, with strong execution and fulfillment requirements.”

According to Statista, the UAE’s food delivery market is expected to reach USD 3.79 billion by 2028, with a user base of 5.5 million. However, compared to the domestic Chinese market, the scale is not at the same level. In 2022, Meituan’s food delivery gross transaction value (GTV) was RMB 94 billion (USD 13.1 billion), and the number of users who transacted reached 678 million.

Earlier, there were rumors that Meituan was considering acquiring Southeast Asian food delivery brand Foodpanda, but eventually chose to abandon the idea. “The team carefully studied it, and it was difficult for Foodpanda’s Southeast Asian business to be profitable. The average order value was too low, and the growth rate of orders was slow,” a member of Meituan’s investment team told 36Kr.

Wang Xing has stated on multiple occasions that “in terms of expanding overseas, the company will maintain a cautious attitude.” However, he also believes that “globalization is an absolute necessity and a huge opportunity.” In the third quarter earnings call, Wang Xing emphasized again that the company does not rule out the possibility of seeking overseas growth.

Meituan’s global expansion in recent years has indeed been very cautious. Except for the early launch of its overseas accommodation business, other efforts are basically carried out through investment rather than direct participation.

In 2018 and 2019, Meituan invested twice in Gojek, an Indonesian ride-hailing platform. Gojek is one of the leading platforms in the Southeast Asian market, offering services such as ride-hailing, delivery (food, parcels, and groceries), as well as payments and financial services. Prior, Meituan has also participated in a USD 100 million financing project for Swiggy, an Indian food delivery platform. Meituan also recently announced a partnership with online travel agency Agoda to provide overseas hotel booking services for Chinese tourists.

Choosing companies with similar main businesses is the core logic of Meituan’s past overseas investment targets. However, compared to direct participation, its potential to have an impact is lower, limiting its ability to make a bigger splash in the market. This was largely the case until May this year, when Meituan launched KeeTa, its takeaway platform, in Hong Kong.

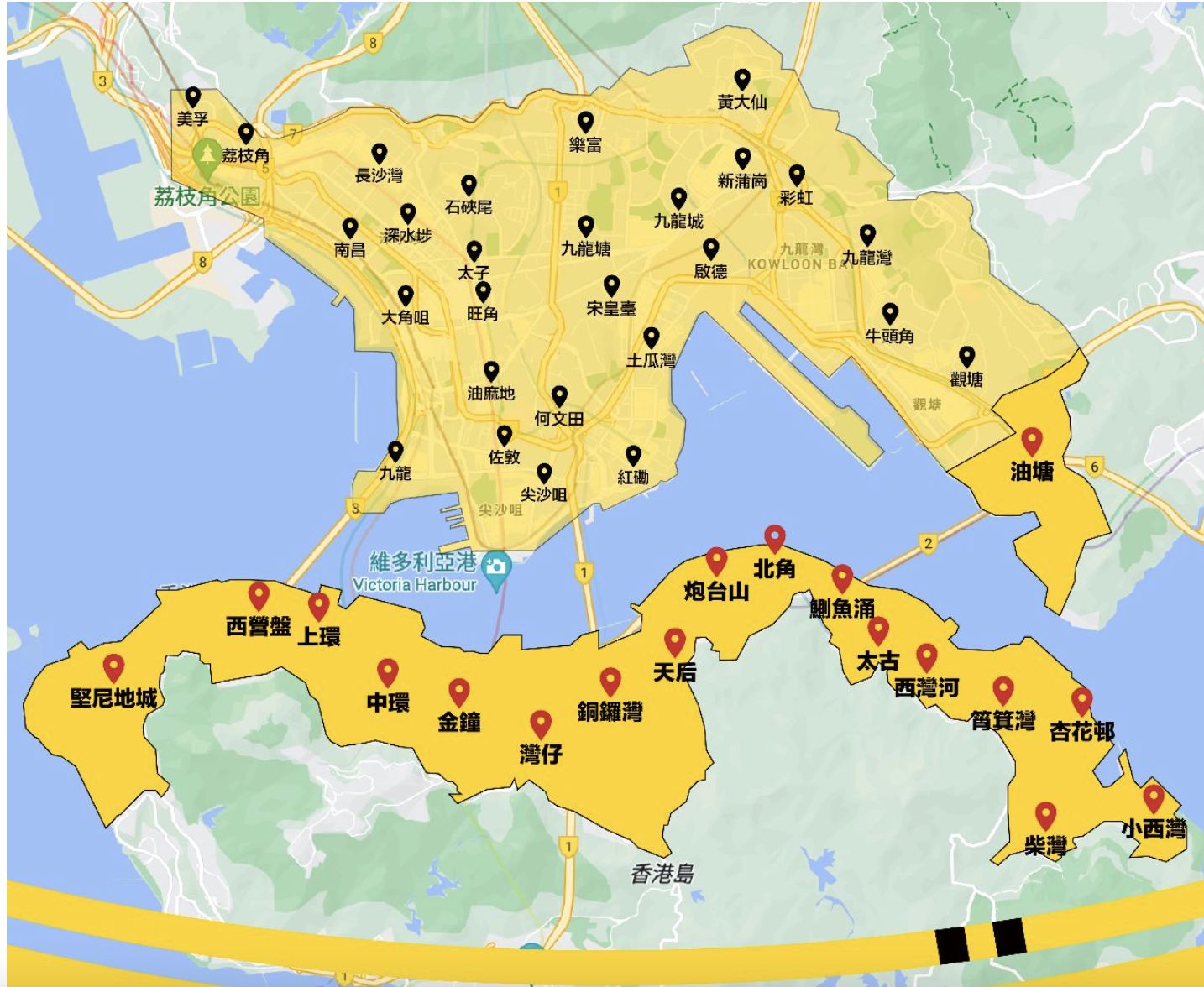

“This is the first step for Meituan to go international,” said Wang Xing, making clear that Hong Kong is suitable as the first launch location for Meituan’s overseas business because its culture and dining habits are similar to mainland China. As of September this year, KeeTa has covered the entire Kowloon area and expanded to Hong Kong Island, providing services in the Central and Western District, Wan Chai District, and Eastern District.

However, insiders said that Meituan did not allocate much resources to this business and did not hold high expectations. Due to high delivery fees, relatively slow delivery speeds, and the developed offline catering industry, Hong Kong users typically lack the willingness to purchase takeaway foods.

According to a report from Measurable AI, within a month of KeeTa’s launch in Hong Kong, it captured 20% market share in the Mongkok area before falling into a decline. A considerable gap also exists between KeeTa and local mainstream food delivery platforms Foodpanda and Deliveroo.

Nonetheless, this may be a choice that Meituan has to make.

Since the beginning of this year, Meituan’s stock price has fallen by more than 50%, performing much worse than the Hang Seng Technology Index during the same period. In addition to the impact brought by Douyin, the Chinese equivalent of TikTok, the main reasons for the price dip are the impact of the economic downturn on the potential growth rate of takeaway and the underperformance of Meituan Select, the retail arm of Meituan.

In Q3 this year, Meituan’s losses from new initiatives amounted to RMB 5 billion (USD 700 million), and investors are starting to feel impatient. Several investors have stated that Meituan’s new businesses are contributing negatively to the company’s overall valuation. In comparison, its competitor Duoduo Maicai is now almost at a breakeven point. This new force that Wang Xing had high hopes for is showing signs of fatigue in its fourth year.

The next source of growth is inevitably apparent: going global.

However, compared to e-commerce, the business model of food delivery is inherently not scalable enough, which means that Meituan needs extremely high operational efficiency to ensure profitability. The selection of a “landing city” is crucial, which may explain why Meituan has not taken action to expand yet.

More importantly, Meituan’s current cash flow is not abundant. The operating cash flow generated by Meituan’s operations in Q3 was RMB 11.2 billion (USD 1.56 billion), with cash and cash equivalents of RMB 25.1 billion (USD 3.51 billion). Facing fierce competition in the domestic market and needing to sustain low-price subsidies that stimulate the growth of takeaway orders, Meituan does not have unlimited funds available for its overseas business expansion.

But as Zhu Xiaohu, founding partner of GGV Capital, once said, “the ability to go global defines the ceiling for Chinese internet companies.” In this globalized landscape, retreating isn’t an option for Meituan.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Dong Jie for 36Kr.