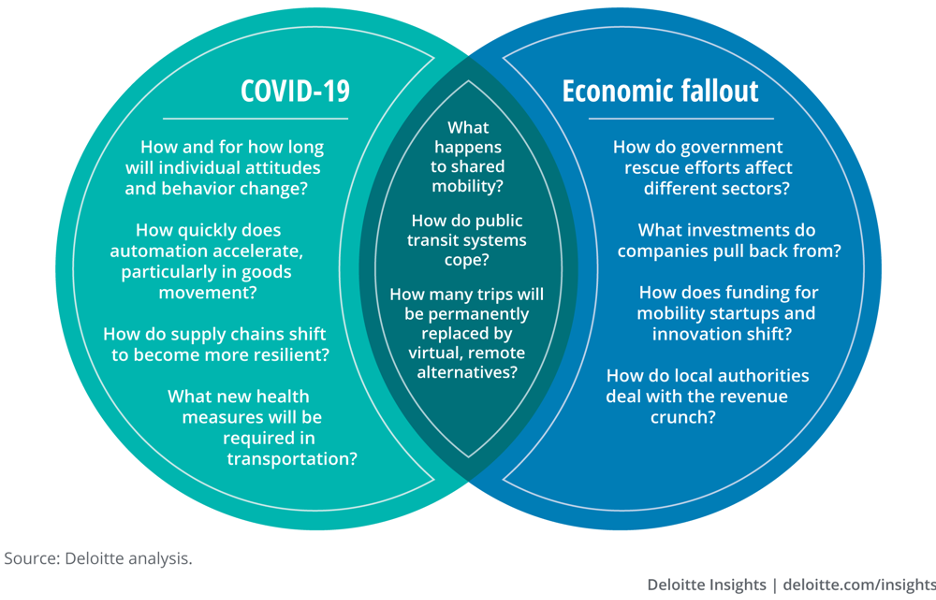

COVID-19 and the corresponding economic fallout pose fundamental questions across the mobility spectrum. As the situation persists, government, investors, business, and startup leaders in Southeast Asia need to act quickly to adapt to and prepare for an untested new normal. Prolonged hesitation would be detrimental to the economic development in the region, which had been enjoying rapid progress and momentum in digitization prior to the pandemic.

One just has to think about the breadth and scope of services provided by the two ride-hailing super app giants in the region, Grab and Gojek, to understand how new adoption of technology in consumer finance, retail, logistics and more has grown in the past few years in tandem with the advances in the mobility sector. These startups—and so many more that exist in the wider mobility ecosystem—are not just the harbinger of the future for the region, they are also an important provider of livelihoods in the region’s evolving economy.

Scenario thinking is relevant in clarifying the choices before us and drawing out the implications of the actions required to help prepare for mobility post-COVID-19. To this end, we considered four possible futures of mobility over the next three to five years, driven by the longevity and severity of the pandemic and the degree of cooperation between and within governments and modeled their implications for mobility in Southeast Asia.

Four Possible Futures of Mobility

We invite you to explore these scenarios and trends in greater depth in the full article, The futures of mobility after COVID-19.

A passing storm: Acute but brief public health and economic crises accentuate some enduring shifts in mobility trends, including increased reliance on e-commerce and home delivery and greater emphasis on sanitation and safety. Despite a temporary pullback, most providers and governments return to their status quo ante roles. “Typical” business cycle downturn dynamics play out, with consolidation taking place across the board, from small mobility startups to larger incumbents.

Good company: Public goods, including transportation, are increasingly provisioned by the private sector. Mobility businesses, especially the largest tech-based providers, step in where government-provisioned services struggle to keep up, offering seamless transportation for their customers. Seeing mobility data’s utility in managing the pandemic, individuals are increasingly open to sharing information with the private sector; mobility technology advances quickly.

Sunrise in the east: The East Asian model’s perceived success extends from managing the pandemic to mobility. China, Singapore, Japan, and others become the leading hubs for mobility innovation and R&D, overshadowing Silicon Valley and Tel Aviv. The physical and digital value chains for electric vehicles, autonomous vehicles, and other technologies consolidate in the East, to the detriment of European and North American businesses. Active mobility management to address systemwide challenges around congestion and air quality becomes the norm, enabled by robust government data collection and analytics.

Lone wolves: National, regional, and local governments accrue greater authority as they lead efforts to combat the coronavirus. Cities force data sharing and actively regulate mobility via top-down monitoring and control (for example, pricing), first as a way to control COVID-19 and then as a way to meet other, systemwide goals. Data privacy and cybersecurity give way to increased government oversight.

In the midst of the uncertainty, there are some clear trends we expect will take hold and persist, irrespective of which of the modeled scenarios does eventually play out. In Southeast Asia specifically, where many different countries and market conditions exist, these scenarios may also relate to one country more than another:

From commute to telecommute. Telework, telemedicine, and e-learning are likely to become permanent fixtures for some portion of the population, especially where broadband capacity and speeds are present, reducing the need to access mobility or changing the nature of mobility requirements. The magnitude of this change depends on the persistence and severity of the pandemic, and the scope of government response.

In the Philippines, for instance, officials have confirmed that schools will not reopen until a vaccine is found, which is a much more drastic action compared to its neighbours which have already reopened schools, albeit in phases. The further impact for a country like the Philippines is that demand for e-learning will drive improvements in technology infrastructure, not necessarily the other way around. Where these trends take hold and become mainstream, actual commuting—or the movement of people—may permanently reduce.

New order for retail. Commuter trips may be getting substituted with digitization, but the transportation of goods is likely to remain or increase in volume. In fact, the perceived health risks of venturing into crowded stores coupled with stay-at-home orders are accelerating the ongoing shift toward online retail and home delivery. We will likely see increased attention to, and innovation around, supply chain optimization, long-haul trucking, and last-mile freight movement, with the potential for expanded testing and deployment of automated delivery via robots and drones, as well as remote operation and autonomous drive for long-haul trucking.

Organizations should explore ways to capitalize on e-commerce and home delivery. Online retail and last-mile fulfillments were already growing rapidly pre-coronavirus, and the pandemic will surely accelerate this trend. The confidence in this sector can be seen in the funding rounds that have been successfully carried out by logistics and warehouse players such as Ninja Van, Shipper, and Waresix, despite the economic downturn we are experiencing.

Above and beyond safe driving. As roads become busy again, a “safe” trip will likely also mean one that is sanitary and hygienic. Every organization needs to undertake a comprehensive assessment of its end-to-end operations and interactions with customers through the lens of health and sanitation. In China, the pandemic has hastened the deployment of autonomously driven robotaxis that can avoid exposure between drivers and passengers. Evolution of this nature may not be possible in Southeast Asia yet, given the poorer road and digital infrastructure and the lower level of regulatory and consumer adoption readiness.

Where technology shifts cannot serve, operations have to be tweaked and a decentralized innovation approach has to be applied. For ride-hailing players, the decentralization of both customers and suppliers of the service would mean that safety measures require an even higher level of centralized coordination and monitoring—we have seen this in the form of new health protocols and an upgrade of the customer apps with health information features, for example.

Can we expect a new normal soon?

Mobility, already a highly dynamic space, looks set to be even more fluid over the coming months. Few across the ecosystem will survive unscathed. Some players will exit, new entrants may rise, and partnerships will be forged. New consumer preferences, new use cases, and new business models are likely to emerge.

Now is the time to take stock of current ecosystem partners and assess what new collaborations might be needed. Mobility players should develop a robust and active market, competitor, and ecosystem sensing capability to inform the effort. Public-private engagement and cooperation will likely feature prominently in any mobility future, as it already has for the telehealth sector in Indonesia, for instance. Actively building those relationships now could pay dividends.

Above all, as in any crisis situation, calm leadership is paramount. For organizations to be successful in this environment, leaders should explore the scenarios, model the impact, and stay alert to the technology changes that might drive the business. The new normal may not yet appear stable, but with the right tools for scenario planning, businesses can have an increasing grasp of the unknown and better navigate into the future.

Richard Mackender leads Deloitte Southeast Asia (SEA) Innovation, a cross-function, cross-country unit dedicated to driving innovation as a long-term value creator across Deloitte’s Southeast Asia operations.

Andrey Berdichevskiy leads the global Future of Mobility Solution Centre for Deloitte in Singapore, with the mission of “igniting collaborative shifts in mobility for good”. It focuses on offerings in mobility ecosystem engineering, mobility solution development and mobility venture connect.