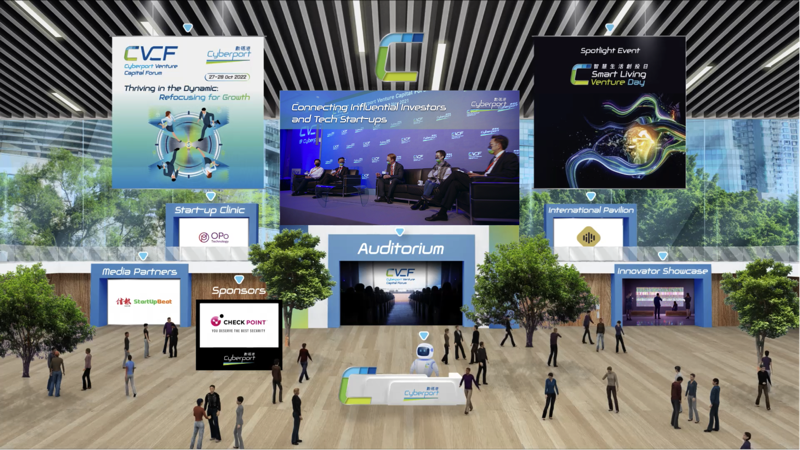

Cyberport’s premier annual venture capital event, the Cyberport Venture Capital Forum was successfully concluded on October 28, 2022. The forum was held in a hybrid format, gathering over 100 international venture capital experts, investors, venture companies, and the Cyberport start-up community for two consecutive days. The forum, together with the Smart Living Venture Day, the Startup Workshop, and the Startup Clinic, attracted around 2,500 participants and about 110,000 page views on the online platform. It also facilitated over 300 one-on-one meetings between investors and start-ups.

In addition, the 5th Anniversary Celebration of Cyberport Investors Network (CIN) was held on the first day and announced Hendrick Sin, Co-Founder, Executive Director and Vice Chairman of CMGE Technology Group Limited as the new Chairperson of Cyberport Investors Network Steering Group.

In the morning’s opening session, Professor Sun Dong, Secretary for Innovation, Technology and Industry of the Hong Kong Special Administrative Region (HKSAR) Government, delivered the opening remarks. Simon Chan, Chairman of Cyberport, delivered the welcome speech afterwards, together with Peter Yan, Chief Executive Officer of Cyberport, Cindy Chow, former Chairperson of CIN Steering Group and Hendrick Sin, the new Chairperson of CIN Steering Group, who co-hosted the opening ceremony and officially kicked off the event.

“As announced by the Chief Executive in his Policy Address last Wednesday, we are promulgating the Hong Kong Innovation and Technology Development Blueprint which is going to lay out the future directions and major strategies for the I&T development in Hong Kong from the top-level perspective,” said Professor Sun Dong, Secretary for Innovation, Technology and Industry of the HKSAR Government in his opening speech. “The Government will also establish the Office for Attracting Strategic Enterprises to be led by the Financial Secretary for attracting strategic enterprises around the world. We will be working closely with this Office to attract top-notch I&T enterprises and talents to Hong Kong to strengthen the local I&T ecosystem and to power up the development of tech industry of Hong Kong. I trust that you share my excitement for the future of Hong Kong’s I&T landscape.”

“Technological innovation was one of the key focuses at the recent 20th Party Congress. The Central Government emphasizes science and technology as our primary productive force and innovation as our primary driver of growth. In Hong Kong, the latest Policy Address laid out forward-looking and targeted measures to boost I&T advancement, expand the tech talent pipeline, and attract new enterprises which are representative and with high potential to set foot in Hong Kong. With these new blueprints in place, we are encouraged by the promising outlook for I&T entrepreneurship,” said Simon Chan, Chairman of Cyberport, in his welcome speech. “Cyberport is fully committed to accelerating start-up growth by enhancing the critical capability of fundraising for entrepreneurs. As a tech investor, Cyberport strategically leverages Cyberport Macro Fund (CMF) and Cyberport Investors Network (CIN) to drive investment from the local and global arenas, empowering the expansion of startups to the Mainland and overseas.”

A positive fundraising outlook for Cyberport’s startups

Despite the sluggish performance of the global venture capital market due to market uncertainties, the fundraising of Cyberport community companies has performed well over the past year. From October 2021 to September 2022, the Cyberport community companies have raised more than HK$15.5 billion, a significant increase of 176% compared to the same period last year, with a cumulative fund of HK$34.4 billion. Cyberport has been promoting and facilitating investment matching and supporting startup fundraising through the Cyberport Macro Fund (CMF), with satisfactory performance during the same period. From October 2021 to September 2022, Cyberport injected capital through the CMF into three Cyberport start-ups, including GRWTH (EdTech), Wada Bento (FoodTech) and AVALON StreiTech (HealthTech). Since its establishment in 2016, CMF has approved a total of 25 projects, attracted co-investment of HKD 1.55 billion (USD 197.5 million), and raised a total of more than HKD 1.725 billion (USD 219.8 million), with an investment ratio of 1:9.

CIN’s 5th anniversary and accumulated investments of over HKD 1.7 billion

The Cyberport Investors Network (CIN) has been helping the Cyberport startup community to raise funds, in addition to providing investment insights and experience to promote the growth and development of start-ups. From October 2021 to September 2022, the CIN facilitated investments of around HKD 580 million (USD 73.8 million), with a year-on-year growth of around HKD 80 million (USD 10 million). Since its establishment five years ago, CIN has maintained more than 150 corporate members, including venture capital funds, private equity funds, angel funds, family offices, corporate venture capital, and more than 25 Greater Bay Area (GBA) investment members.

The CIN has facilitated investments of over HKD 1.7 billion (USD 216.5 million) in total, supporting 67 projects in the process. Cyberport is thankful for the excellent leadership of Cindy Chow, the Executive Director of Alibaba Hong Kong Entrepreneurs Fund, over the past two years, and announced at the forum that Hendrick Sin, Co-Founder, Executive Director and the Vice Chairman of CMGE Technology Group Limited will be the new Chairperson of Cyberport Investors Network Steering Group.

“My three years in this position have been very rewarding. Although tech investment has witnessed many ups and downs in recent years, I am proud to share that above all CIN has largely come out on top. We have further bolstered our partnership with the Cyberport Macro Fund to facilitate deal flow and provide more targeted matching,” said Cindy Chow, former Chairperson of Cyberport Investors Networking Steering Group. “The macro-environment will remain challenging in the near term, and start-up fundraising will remain difficult. Nevertheless, CIN will continue to support the Cyberport ecosystem by bringing in more international investors. Meanwhile, we will carry on engaging with our members based on their sector interests and stage appetite to help them identify the right investment opportunities, thereby enhancing Cyberport start-ups’ fundraising and deal-making capabilities.”

On CIN’s future, Hendrick Sin, the new Chairperson of Cyberport Investors Network Steering Group said, “It is indeed an honor and a pleasure for me to take up the baton and carry on the vital mission of CIN. We’ll step up CIN’s strategic collaboration with members and strengthen the link between industry organizations and Cyberport start-ups. We’ll also organize more activities to help start-ups improve their fundraising and deal-making skills. We’ll amplify our impact by continuing to expand and diversify CIN’s membership, and align investors more closely with Hong Kong’s current and upcoming I&T needs. This includes engaging more investors from the GBA and across the world to review investment opportunities from the Cyberport community.”

Analysis of I&T and investment hot topics

This year’s event focused on revealing the new drivers of the market. There were three key panel discussions, with guests including Rebecca Fannin, founder of Silicon Dragon, an internationally renowned venture capital platform, and representatives from Quest Ventures, Hony Capital, among others. The discussions featured the current macroeconomic trends and regional political landscape. Duncan Chiu, HKSAR Legislative Council Member (Technology and Innovation), together with industry leaders such as Cindy Chow, Executive Director of Alibaba Hong Kong Entrepreneurs Fund, reviewed Hong Kong’s I&T ecosystem. Hendrick Sin, Co-Founder, Executive Director and the Vice Chairman of CMGE Technology Group Limited, and many other experts gave their insights on the investment potential of the GBA.

There were many sessions to explore a number of I&T hot aspects including Green Finance, HealthTech and MediTech, the metaverse, BioTech, CleanTech, ConstructionTech and Artificial Intelligence (AI). Dr. Kai-Fu Lee, Chairman and CEO of Sinovation Ventures, and the President of Sinovation Ventures Artificial Intelligence Institute, shared his predictions on how our world will be reshaped by AI. Dr. Finian Tan, Founder & Chairman of Vickers Venture Partners, analyzed the latest developments in emerging technologies such as CleanTech, BioTech, and other energy sectors.

In case you missed any of the sessions by our 100+ speakers, the CVCF virtual platform will open until 16 November. All keynote speeches and panel discussions are available on demand. The platform also features the 100+ Innovator Showcases and power pitches from promising startups in Hong Kong and beyond. To register for a free Virtual Pass, visit this website.

For more details on the CVCF 2022 program schedule and full speaker line-up, please visit here.