In 2013, Rob Rhinehart, a Silicon Valley computer programmer, got fed up with eating fast food for meals. While preparing a healthy lunch requires too much effort, he decided to program the way humans eat. By decoding all the nutrition the human body needs on a daily basis and putting them into one drinkable beverage, Soylent was born.

The meal replacement solution spun controversy for its orthodoxy, but still managed to attract great attention from venture capital funds (VCs) and gain popularity among busy and affluent urban workforce who value convenience as much as a healthy diet. The company received USD 50 million in its Series B round from investors including Google Ventures in 2017, and its products are available in more than 4,000 Walmart in the US.

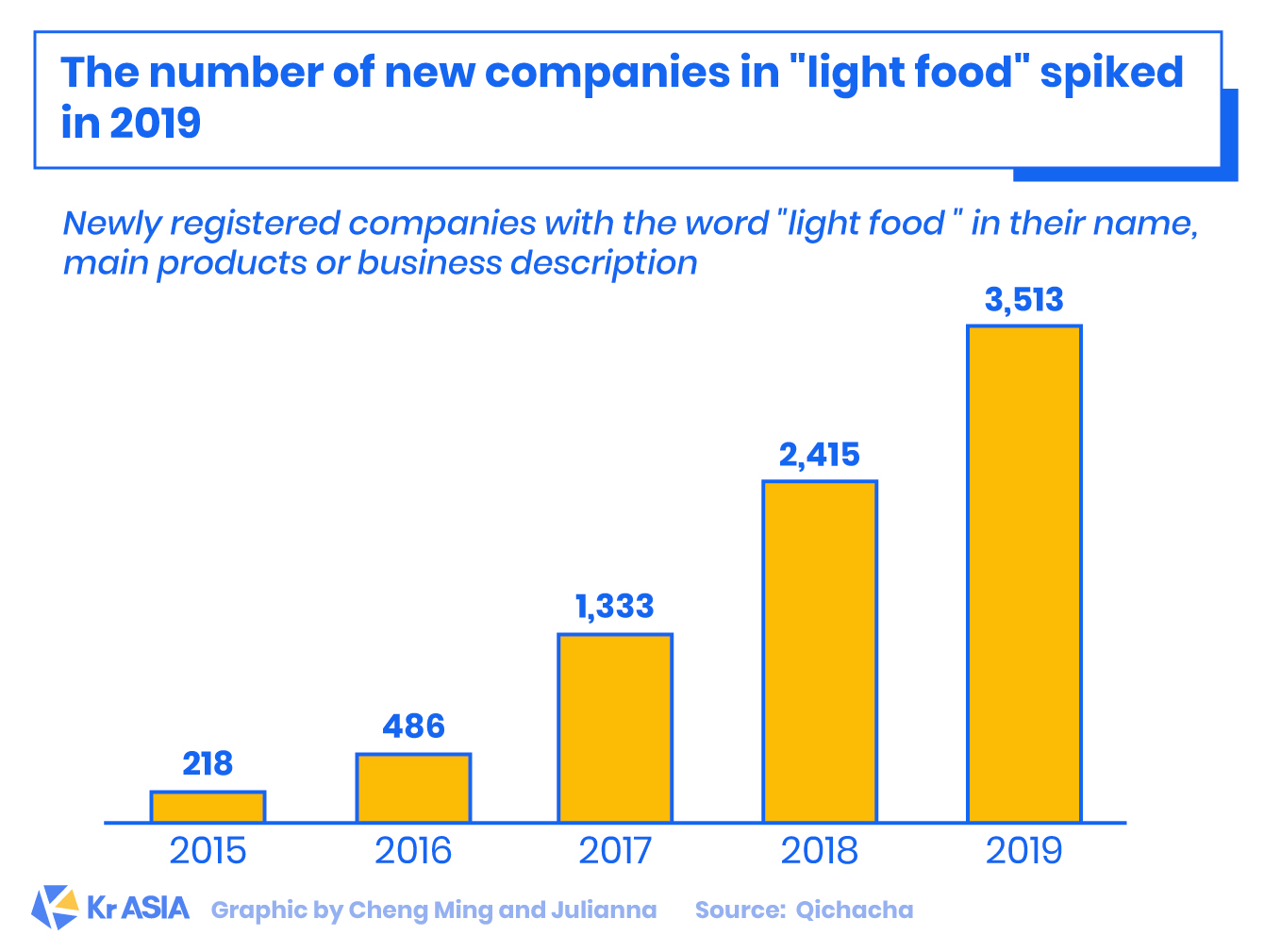

Inspired by the success of Soylent, the number of meal replacement products also mushroomed in China over the last two years, and they come in a motley group of forms. From liquid lunch that tastes like milk tea, to chicken breast in a snack package, these “foods” that break human nutrition down to its most basic essentials are taking over social media channels like a storm. Startups hope the meal replacement products would be able to tap into China’s growing demand for a more convenient, healthier life.

An infant market

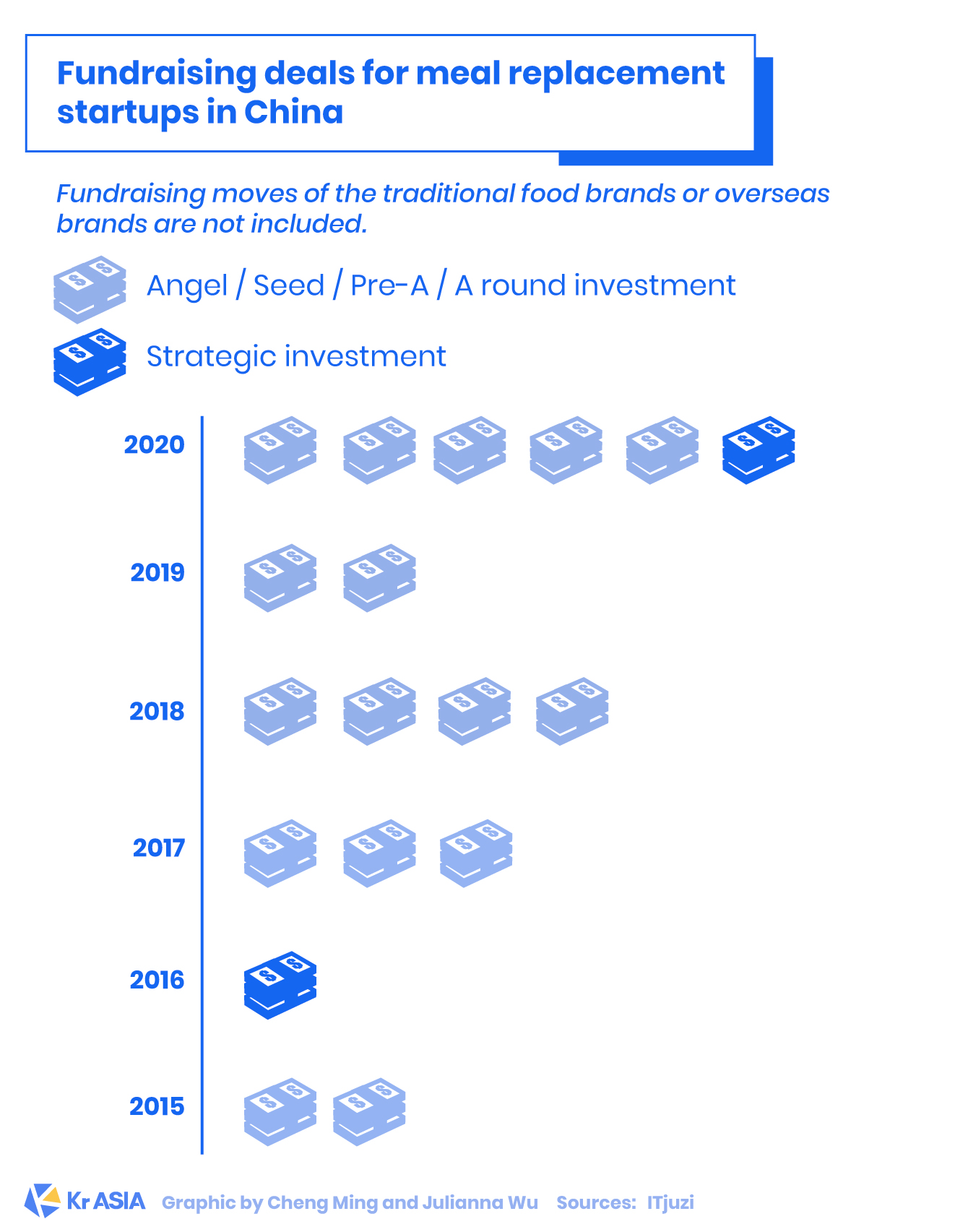

Although most of the players in the meal replacement sector have only entered the business in the last five years, consumers and VCs have already demonstrated a strong interest in the potential of meal replacements.

In 2015, Chinese computer programmer Shao Wei followed the suit of Rhinehart to set up Ruffood, hoping to bring the Soylent phenomenon to the country, his meal replacement brand closed two rounds of fundraising within one year, with an angel round bagging as much as RMB 10 million (USD 1.45 million).

Another startup in the space, Beijing-based health management firm Yeshou Shenghuo bagged USD 1.45 million in its angel round in 2019, benefitting from the fan base the brand accumulated as a health blogger on WeChat, the country’s biggest chatting app.

In addition to daily necessities like masks, medicine, and fast food, the COVID-19 pandemic has alerted people to the importance of a healthy lifestyle, stimulating the sales of many meal replacement and diet products.

For instance, protein bar manufacture Ffit8, which launched in March as a crowdfunding project, became an immediate public sensation, selling more than RMB 10 million (USD 1.45 million) worth of products in total. The brand ended the 14-day campaign having generated 10,341% of its original crowdfunding goal, 36Kr reported.

Aside from these “internet” meal replacement startups who rely on e-commerce for sales, social media for promotion and contract-based factories for manufacturing, many traditional food and beverage companies in China are also eager to join the fray. The likes of Mengniu Dairy, snack and beverage maker Want Want, and instant noodle-maker Master Kong are releasing their own liquid meal replacements, diet snacks, energy bars, and other food substitutes.

According to the statistics of Euromonitor International, the market size of meal replacement products in the world was USD 66.2 billion in 2017, among which China accounted for around 12.5%. It is estimated that the Chinese market will reach USD 17 billion in 2022, double the size of 2017.

The end for food, the start of a healthier life?

There are five main types of meal replacement products: powder, biscuits, dairy products, oatmeal, and energy bars. In China, meal replacement powder is the most popular category, thanks to the widespread internet marketing campaign from some of the brands.

Wonderlab, founded in 2019, is all over China’s social media right now. The brand managed to generate a monthly sales of between USD 4.3 million and USD 7.2 million in 2020 for its six-flavor meal replacement powder box, for the flavor of which it cooperated with popular milk tea chain Heytea.

“I bought Wonderlab + Heytea meal replacement powder when I came across it on JD.com,” as Sida Wang, a Beijing-based video producer in her 20s, told KrASIA: “But before that, I’ve seen so many of their advertisements on WeChat already,” she added.

As a fan of Heytea, Wang felt attracted to the idea of “meal replacements that taste like milk tea”.

One week into her trial of the liquid dinner, Wang said she’s happier eating normal food, but meal replacement products are part of her weight-loss plan: “the calories in one of these bottles is at least lower than a normal meal.”

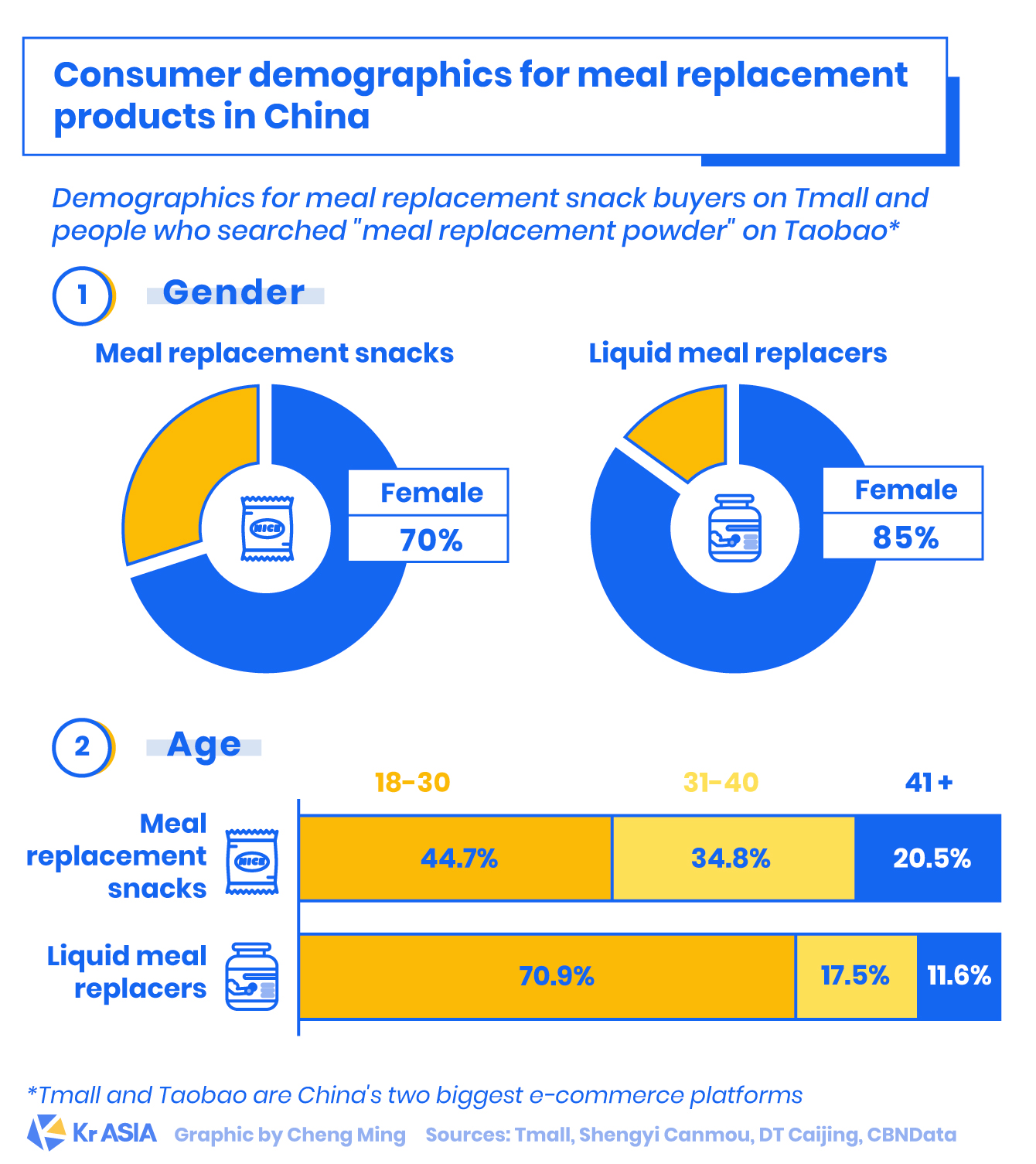

Different from Soylent, who targets “college students, gamers and young professionals”, basically people who’re too busy to cook, meal replacement products in China are most popular among the young females who aim for both convenience and a healthier lifestyle.

Not very full, not very healthy

Add water, shake and drink up…eating a powder-based meal can be as easy as that. For some brands like Smeal, customers don’t even need to “make” the meal and can simply open up a bottle and consume.

Moreover, according to Wonderlab’s advertisement on Taobao, which is one of the biggest e-commerce sites in China, a bottle of its products contains the combined nutrition of one cup of milk, one beef stake, 30 units of spinach, 11 vitamins, four minerals, and one amino acid.

It seems that these meal replacement products, although in different packages and different forms, have offered an option for the young elites to eat quickly, conveniently, and healthily. One can even lose weight just by “eating” these replacers.

However, taking meal replacement products without having a normal meal can lead to various health risks such as liver and kidney damage, as “many manufacturers would secretly add some pharmaceutical ingredients inside in order to pursue one-sided and quick effect,” said state-owned media Xinhua. Also, the long-term intake of low-energy diet meal replacements has an impact on the heart function, said the same Xinhua report.

For video producer Wang who often works overtime, meal replacement powder is an efficient meal option, but it can’t hold her hunger for long: “I usually eat it for dinner, but will be hungry again late in the night,” said the Beijing resident: “but if I have a bowl of noodles for dinner, late-night hunger won’t happen.”

According to the advertisement, one bottle of Wonderlab can make a person feel full for five hours.

“I think if I really wanna lose weight, exercise is the only way,” said Wang, as she made up her mind to go downstairs for a bowl of noodles at 5 pm before drinking a meal replacement powder shake for dinner.

In the VC and brands’ defense, though, meal replacement products aren’t just for losing weight, it’s a lifestyle.

Even if they don’t buy meal replacements for now, more and more millennials are opting for healthier lifestyles, such as cooking their own meals and doing exercises, which are essentially the same with these meal replacement products, Chen Momo, the vice president of Vision Plus Capital, told news outlet China Venture.

“In addition to the product itself, the service from the companies is equally important,” Chen told China Venture from the point of view of an investor: “Products and services that promote a healthy lifestyle are the foundation of engagement and repurchase for the customers.”