Subscribe to our newsletter to read this first thing on Friday morning. This is the preview of what you will receive in your inbox.

Back in March 2021, when I used to order groceries through Dunzo, a Bengaluru-based hyperlocal service known for making faster deliveries than many bigger e-grocers, I would sit back and wait for 30–45 minutes for items to get delivered. Despite its efficient service, I could never use it to order a missing ingredient while cooking. As India suffered the second wave of COVID-19 pandemic beginning in April, I traveled back to my hometown Lucknow and spent over six months there. Dunzo doesn’t have a presence in the city, only e-grocers Bigbasket and Grofers, which would take their own sweet time—two to three days—to complete orders.

Coming back to Bangalore in November, I Dunzo-ed my daily essentials, and voila, the items were delivered within ten minutes, to my surprise. Now in retrospect, I shouldn’t be that surprised, after knowing how much money hyperlocal service players, including Dunzo, were investing in quick commerce—delivering goods within 10–30 minutes—to woo millions of consumers who have shifted to buying groceries and home essentials online since last year.

Quick commerce is indeed one of the segments that emerged and shined in India in 2021. And for this week’s big read, we looked at how food delivery giant Swiggy, which is one of the top hyperlocal players, is gearing up to grab a bigger chunk of the quick commerce market, at a time when competition is heating up.

The Big Read

Food delivery giant Swiggy recently announced it would invest USD 700 million in express grocery delivery service Instamart. The move is set to intensify competition in the fast-moving quick commerce space in India.

Quick commerce has been on the rise in the South Asian nation since late last year on the back of the wide adoption of internet-based services and millions of urban millennials’ willingness to pay a premium for convenience.

The Bengaluru-headquartered company launched Instamart in Bengaluru and Gurugram in August 2020 to deliver high-demand grocery and household goods to customers within 45 minutes. With the continuous capital infusion, the company is planning to bring down the delivery time to 15 minutes to match rivals—Zomato-backed Grofers, Google-backed Dunzo, and new entrant Zepto, all of which now promise to deliver goods within 20 minutes.

Swiggy isn’t the only one taking its quick commerce play up by a notch. E-grocery firm Grofers, which raised over USD 100 million from Zomato in June 2021, aims to have 350 dark stores or delivery-only retail outlets by the end of 2021, a significant buildout from November’s 200, in order to make deliveries within 10 minutes. Meanwhile, Dunzo is in process of setting up 300 micro-fulfillment centers to ensure delivery in under 19 minutes.

Aside from these established players, there is a new kid on the block. Quick commerce startup Zepto, which was founded earlier this year and promises 10-minute deliveries, recently raised USD 60 million in its first round of funding at a post-money valuation of USD 225 million. Reportedly, it is looking to raise another USD 250 million at a valuation of USD 1 billion.

The Weekly Buzz

1. SoftBank and Tiger Global-backed Delhivery has bought US-based Transition Robotics ahead of IPO for an undisclosed amount. This is the logistics firm’s third acquisition in 2021. Delhivery will get all registered IPs of Transition, which has over ten years of experience in unmanned aerial systems, popularly known as drones, from hardware and software design to testing, validation, and manufacturing. The move is expected to strengthen Delhivery’s capabilities in aerial photography, remote sensing, inspection, and surveys.

2. SoftBank-backed Snapdeal to venture into offline retail ahead of IPO. The company will open over two dozen brick-and-mortar stores next year, beginning with the first one in January. Snapdeal is venturing offline at a time when companies like eyewear firm Lenskart and beauty and fashion startup Nykaa have set a track record of turning profitable over the last two years after adopting an omnichannel approach. With an upcoming USD 250 million IPO, it has become imperative for the 11-year-old e-retailer to pave a clear-cut path to profitability.

3 . Investments in Indian SaaS firms rose 165% to USD 4.5 billion in 2021, compared to USD 1.7 billion last year, according to a recent report by Bain & Co. The steep increase in funding was primarily driven by a spike in USD 50 million-plus deals this year. The rising capital inflow in the segment over the last two years has given birth to a string of SaaS unicorns. India now has 13 billion-dollar SaaS firms compared to just one in 2018, of which five entered the elite unicorn club this year.

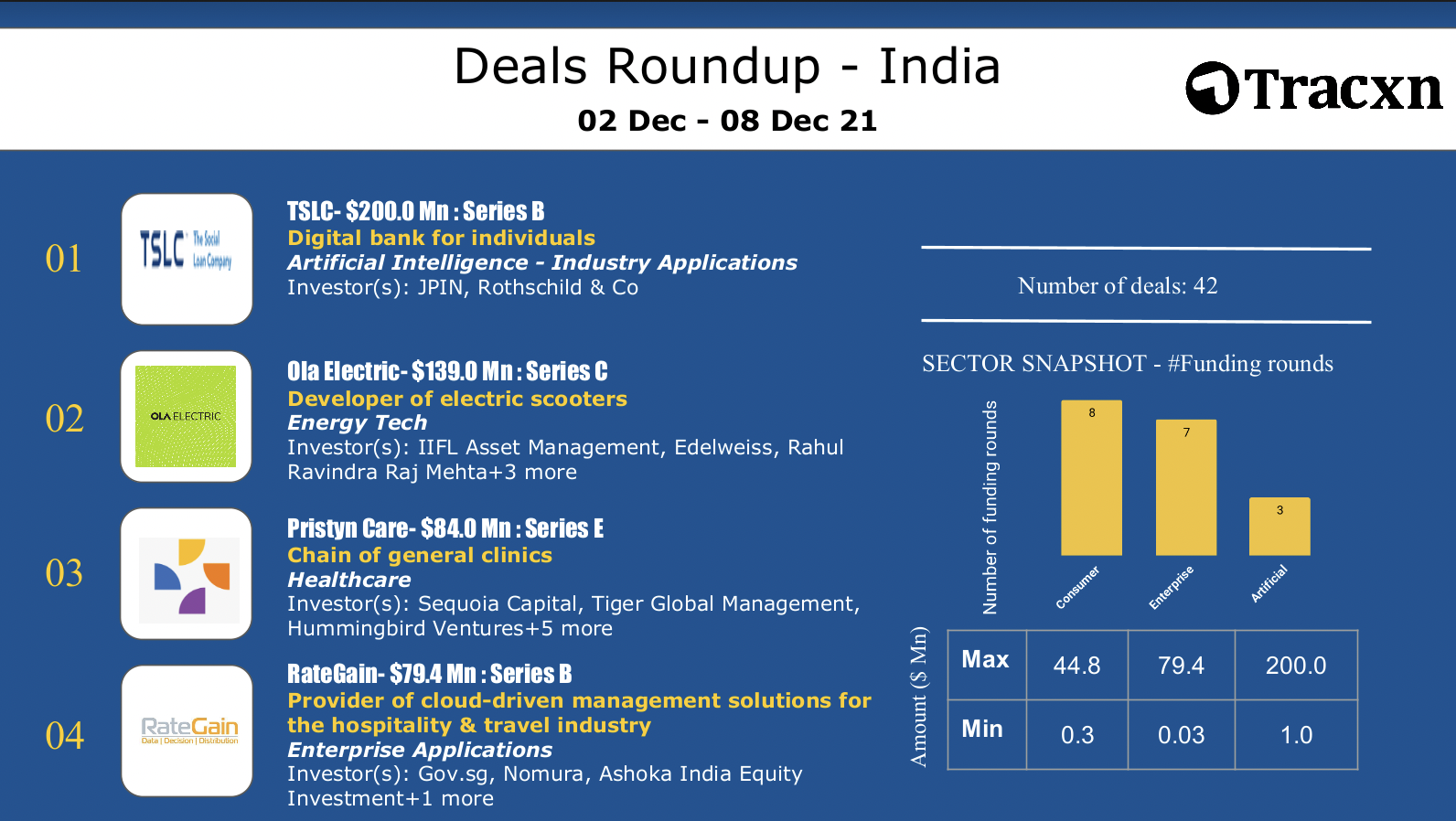

Top Deals This Week