In early July, barely a week after online education behemoth Byju’s raised an undisclosed sum of money from American venture capital firm Bond, reportedly at a valuation of USD 10.5 billion, Aniruddha Malpani, founder of angel investment firm Malpani Ventures, posted on LinkedIn a video of a Byju’s manager verbally harassing and name-calling a sales executive for not meeting the targets.

Openly calling out Byju’s for its toxic work culture, he criticized how the company pressurizes its employees to ramp up sales numbers so that it can attract more venture capital.

“Rather than trying to raise more money, shouldn’t they take better care of their employees?” asked Malpani in his post. “Or I guess if you do not care about how you treat your employees and your customers, it is easier to raise more money because you can earn more?”

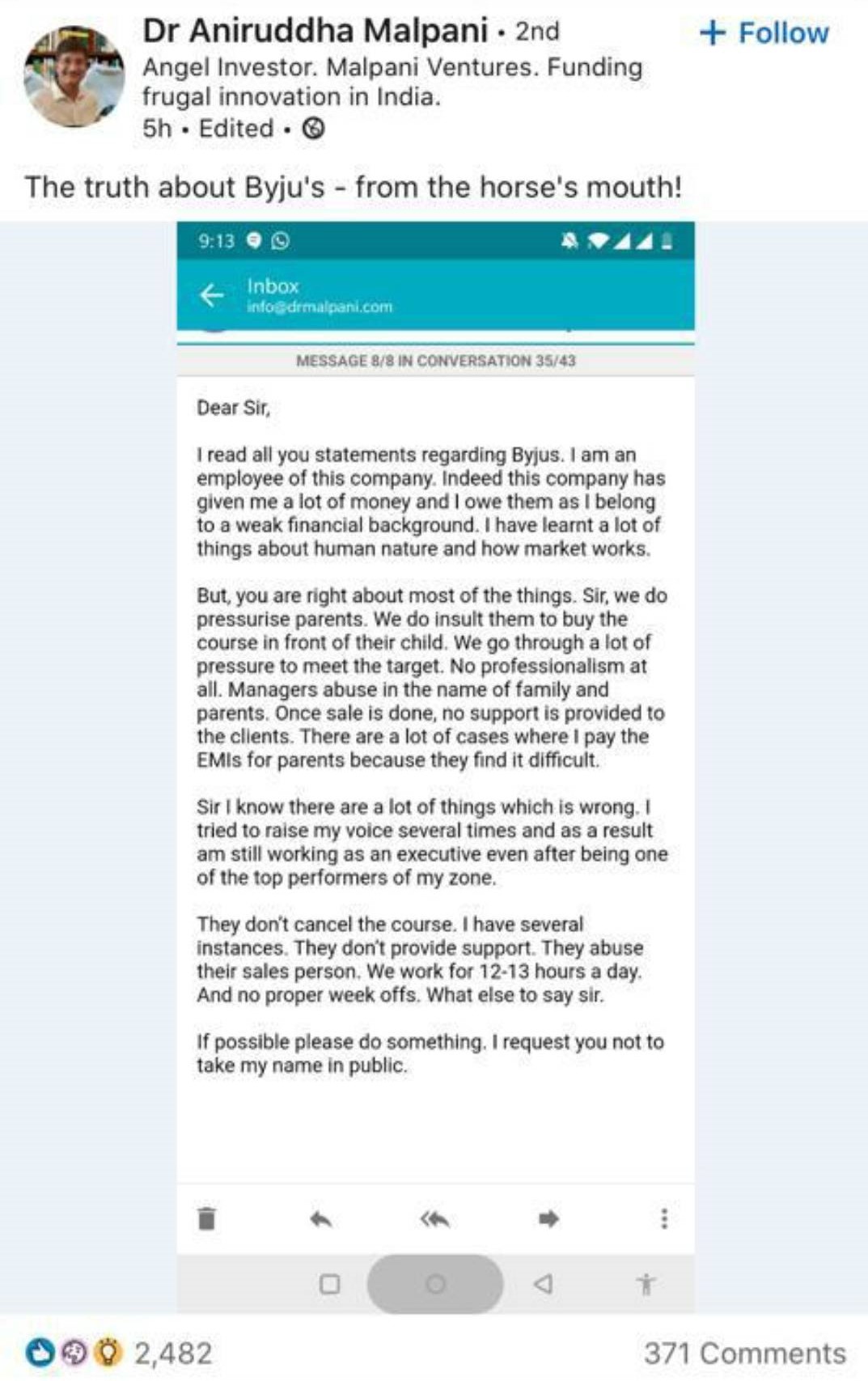

Malpani also shared a snapshot of a mail from a Byju’s employee, which was full of confessions.

“We do pressurize parents. We do insult them to buy the course in front of their child,” the employee wrote. “We go through a lot of pressure to meet the target. Managers abuse in the name of family and parents.”

“Once the sale is done, no support is provided to the clients. They do not cancel the course,” he alleged.

Although the employee admitted that Byju’s does pay a lot of money.

Over the next few days, Malpani continued his commentary on Byju’s alleging that the company mis-sells its app by “blaming and shaming parents.” He also said Bjyu’s lock parents “into multi-year subscriptions by offering discounts for payments made using EMIs through a third-party financer,” and once they sign these contracts, they are stuck, unable to cancel.

Within a week, LinkedIn, where he claimed to have over 180,000 followers, took down that video calling it defamatory. Later that month, the Microsoft-owned professional networking platform permanently deleted his account after Byju’s reported some of his posts for making inaccurate claims.

It is to be noted that the said video had been circulated online a couple of months before Malpani brought it to the attention of a wider audience, and Byju’s made a clarification in May that it had fired the manager in question as per its “zero-tolerance policy.” Byju’s also denied pushing Linkedin to delete Malpani’s account, adding that the doctor-cum-investor had been writing about Byju’s for a long time.

Despite the claims that were made by Malpani, and supported by many of his followers across social media, Byju’s has remained unfettered and is scouting for additional funding of USD 400 million from DST Global. It already has good enough numbers to show its existing and future investors. According to the company, for the period of April and May–when India was under the nationwide lockdown to prevent the spread of COVID-19–it made a combined revenue of USD 99 million (INR 710 crores). Moreover, it added more than 20 million new users in the past four months.

Industry experts believe if these allegations are not resolved, they can mar the company’s image, and lower the consumer confidence in the brand.

Deja Vu

This is not the first time the company has faced criticism for being sale-centric, pressurizing employees to meet sales targets, and luring customers to buy the course by making false promises.

For instance, it has been alleged before that Byju’s locks customers in a yearly or multi-year contract and makes them unable to cancel the subscription. Byju’s offers discounts to customers if they buy a course on EMI by taking out loans from its third-party lender partners. After the contract is signed, if a customer wants to cancel the subscription, she allegedly can’t and is forced to pay EMIs unless she wants loan collectors to harass her.

To be sure, the company has a 15-day refund policy. The problem arises when sales executives, or business development associates (BDA) as Byju’s calls them, make false promises of ‘cancel anytime’ or do not upfront mention its refund policy.

As far as these BDAs are concerned, they reportedly had a weekly target of making sales worth USD 2,671 (INR 200, 000) a year back. And if they don’t, they were allegedly shamed in front of their team members.

Read this: The making of Byju’s–the world’s most valuable edtech startup

Malpani in one of his blog posts, citing a new Byju’s recruit, said the company hires BDAs offering an attractive package of INR 1 million (USD 13,330) per annum. But the catch is they have to sell products worth USD 8,010 (INR 600,000) in a month to become a permanent employee or a BDA. And till the time they reach that target, they are paid just INR 25,000 (USD 334).

Industry insiders believe, due to these aggressive targets, sales executives, either new or experienced, try to close deals with customers by hook or crook.

“It is not that the top management, aka founder, is not aware of what’s happening at the ground level in large companies like Byju’s,” Vivek Gupta, co-founder of online test preparation platform Exam Tyaari, who was with Unacademy earlier, told KrASIA.

“It is they who are running the show, so they know each and everything,” he said.

When KrASIA reached out to Byju’s for its views on these allegations, it said it won’t be able to comment on the story.

Byju’s has fielded such situations before and that is why despite all these claims of mismanagement, it looks confident to raise new rounds of funding and has had no problem in attracting new investors.

The valuation game

According to Gupta, valuations in the edtech space generally range between 8x-12x of the revenue. For instance, if a company is making USD 100 million in revenue, its valuation will be somewhere around USD 800 million to USD 1.2 billion.

In other words, achieving its targeted revenue is critical for Byju’s to maintain its valuation. More importantly, it has to deliver on promises that it has made to its investors, which includes high-profile names such as Sequoia Capital, Tiger Global, General Atlantic, Naspers, Tencent, and Chan-Zuckerberg Foundation, among others.

To ensure it delivers on its targeted sales, Byju’s has an army of salespeople. According to the company, it has a team of 4,000 people at present, and the critics allege that a significant portion of them are sales executives.

Gupta said Byju’s also onboards college students as interns for two to three months on a revenue-sharing basis to make sales.

“With this kind of organization, if they do not get the desired traction, the company can not sustain the valuation they have currently. So there is pressure on everyone,” Anil Joshi, managing partner at Mumbai-based early-stage VC Unicorn India Ventures told KrASIA.

“Certainly, there is a pressure to deliver, because money is raised with a promise, and investors keep monitoring the deliverables every week,” he said. “And that is when probably founders or promoters get carried away because they need to deliver.”

According to him, startups have a lot of flexibility initially, but as an organization grows, it needs to follow processes.

“In the transition from hands-on-approach to a professional process-driven-approach, sometimes slippages like mismanagement, no control on things, decisions being taken without approval, happen, which can result in a disaster,” said Joshi.

However, he believes it would be wrong to blame investors for creating a situation, where pressure leads to toxic work culture and mismanagement in a company. These things, he said, usually happen when founders are unable to deliver on the promises they made at the time of investment.

“Companies like Byju’s have a lot of room to grow as they operate in a nascent market, thus investors’ expectations from founders are high,” he said. “And if they are not able to deliver, there is where the things fall.”

Malpani has a different outlook on the situation though.

“The reason Byju’s work culture is so toxic (and is getting worse) is because it flows from top-down,” Malpani said in one of his LinkedIn posts. “The investors (who own the majority of business) care only about chasing numbers, targets, and revenues, and hold the founders responsible for achieving this.”

The Achilles’ heel

Apart from meeting the expectation of its current backers, Byju’s also has to continuously ramp up its numbers to attract fresh funding to execute its expansion plans in India and abroad. The company posted a net profit of USD 2.6 million (INR 20 crore) for the financial year ended March 2019. Although, many industry veterans feel it remains to be seen whether the company can achieve a sustainable revenue model without splurging VC money and remain profitable.

“Byju’s idea is to first increase the volumes and then figure out the right approach. They can then hire a better team to make a better company,” Gupta said.

Read this: Indian entrepreneurs set up a total of 61 unicorns globally

The only hope is that they reach that point before a majority of customers shun them. But for that to happen, Byju’s will need to appease its employees and customers alike.

“Sometimes when you scale so fast, this is the kind of outcome that happens where the customer gets forgotten or the customer journey gets warped, which is what is happening right now,” said an investor who backs consumer startups, declining to be named. “With such a backlash coming from the consumers, they cannot ignore them. It will come back and bite them.”

“The fact is that they have so much capital and have to show returns on that. But if they do not do something to improve the situation, at some point they won’t have an option,” he said. “Because your reputation is at stake, and if this continues, the customers will move and the growth won’t sustain.”

According to Joshi, things may turn bad for Byju’s if there is mismanagement and they do not “stay true to their content” and the services they provide.

“These are growth pangs, they will keep coming across all these issues,” he said. “Only thing is, they need to ensure good governance, ethical practices, and keep on improvising on their shortcomings. Otherwise, it will start impacting the health of their company.”