Carro raises USD 60 million to boost Japanese car demand in Asia Pacific

Carro, an online automotive marketplace in the Asia Pacific, has raised USD 60 million in a round led by Cool Japan Fund, Japan’s sovereign wealth fund, with participation from new investors. The funding will be used to strengthen demand for Japanese vehicles across the company’s regional markets.

“Japanese automakers have always had a strong presence and historical dominance in Asia Pacific,” said Aaron Tan, Carro’s co-founder and CEO. “Japanese cars continue to be reliable and trustworthy with their advanced automotive technologies, including fuel cell innovations and superior safety features. We are confident we can increase the market share of Japanese plug-in hybrid electric vehicles in time to come.”

Founded in 2013, Carro reportedly operates in seven markets and transacts more than 100,000 new and used vehicles annually. It also offers financing, insurance, and after-sales services.

Dat Bike raises USD 22 million to expand electric motorbike production

Dat Bike, a Vietnamese electric motorbike manufacturer, has raised USD 22 million in a Series B round led by Japan-listed clutch manufacturer FCC and venture firm Rebright Partners, with participation from Jungle Ventures, Cathay Venture, and AiViet Venture.

The company will use the funds to expand manufacturing capacity, advance R&D for new models, and strengthen partnerships with ride-hailing platforms and financing providers. CEO Son Nguyen said the investment will help Dat Bike scale production and deliver affordable, high-performance electric motorbikes to more riders in Vietnam and Southeast Asia.

Founded in 2019, Dat Bike develops most components in-house, from chassis to software, allowing greater control over cost and quality. Its flagship Quantum S series competes directly with internal combustion motorbikes.

Terra Oleo emerges from stealth with USD 3.1 million to reinvent fats and oils

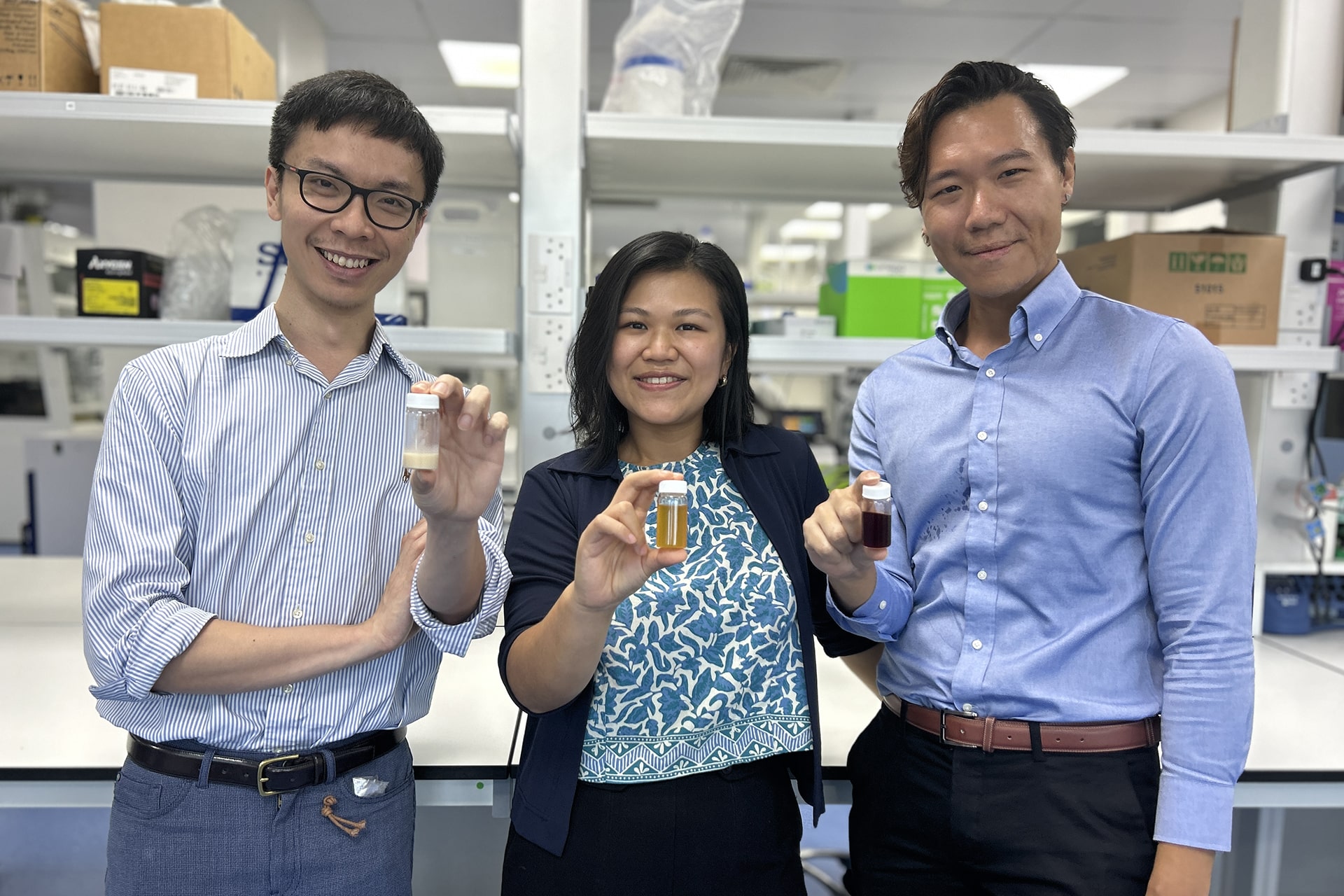

Terra Oleo, a Singapore-based biotech startup, has emerged from stealth with USD 3.1 million in seed funding and selection to Breakthrough Energy’s Fellows program. Backers include ADB Ventures, The Radical Fund, Elev8.vc, Better Bite Ventures, and an undisclosed palm oil industry investor.

The company uses microbial fermentation to produce sustainable alternatives to palm oil derivatives and cocoa butter for use in cosmetics, food, and pharmaceuticals. Its platform converts agro-industrial waste into tailored lipid profiles without the refining steps or byproducts of conventional processes.

This marks Terra Oleo’s first publicly disclosed funding. CEO Shen Ming Lee said the company is preparing to scale its lab technologies into market-ready products, with testing agreements underway with global consumer goods firms.

Atomionics secures USD 12.7 million to scale quantum sensors for mineral exploration

Atomionics, a Singapore-based startup developing quantum sensors for subsurface exploration and navigation, has raised USD 12.7 million in a pre-Series A round led by Paspalis, with participation from BHP Ventures, IQT, Wavemaker Partners, VU Venture Partners, SG Growth Capital, and others.

The funding will support scaling of Atomionics’ Gravio device, a portable quantum gravimetry sensor that maps subsurface terrain without drilling or radiation. The technology targets exploration of copper, lithium, and other critical minerals.

The company plans to expand operations in Australia with a new office and test deployments in the Northern Territory, while also establishing a US base to pursue applications in resource exploration and defense.

Bilight snags angel funding to advance flexible solar technology

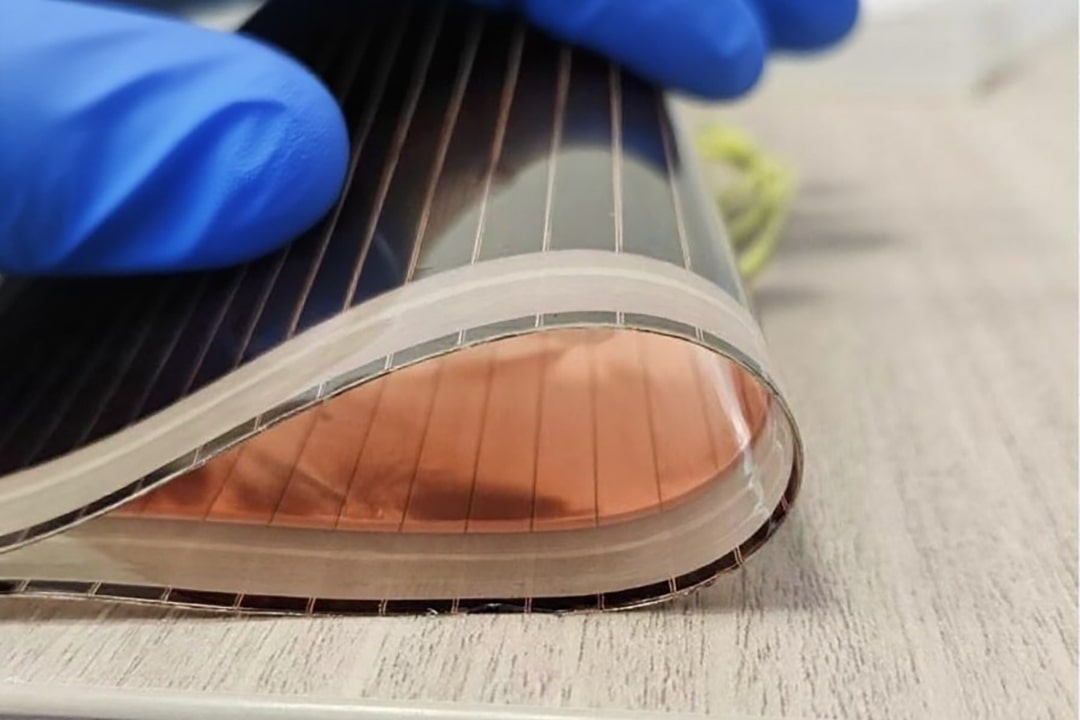

Bilight Innovation, a renewable energy startup, has closed an angel investment round with backing from Somar, a Japanese electronics and materials company.

Bilight specializes in developing flexible perovskite photovoltaics and its pilot facility has produced ultra-thin, lightweight solar devices with improved efficiency and low-light performance compared with silicon panels. Led by CEO CC Hsiao, the team holds more than 300 patents across display, materials, and solar technologies.

The company operates in the US, Germany, Japan, South Korea, and India, and has partnerships with e-paper and energy storage firms. Bilight aims to make clean solar energy more widely accessible by embedding photovoltaics into consumer and industrial products.

UltraGreen.ai secures anchor investment at USD 1.3 billion valuation

UltraGreen.ai, a health tech company, has raised USD 188 million in an anchor investment round co-led by 65 Equity Partners and Vitruvian Partners, with participation from August Global Partners. The deal values the Singapore-headquartered company at USD 1.3 billion.

UltraGreen develops fluorescence-guided surgical technologies and is the world’s largest provider of indocyanine green (ICG), used in more than 90% of fluorescence-guided surgeries globally. The new funding will support expansion of its artificial intelligence-powered surgical imaging platform and international growth.

Founder and CEO Ravi Sajwan said the partnership strengthens UltraGreen’s ability to integrate imaging agents, hardware, and AI tools to improve surgical precision and outcomes.

Seon raises USD 80 million to scale fraud prevention platform

Seon, a fraud prevention and anti-money laundering (AML) compliance platform, has closed an USD 80 million Series C round led by Sixth Street Growth, with participation from IVP, Creandum, Firebolt, and Hearst.

The company, with offices in Austin, London, Budapest, and Singapore, will use the funds to expand globally and accelerate AI-powered product development. Seon says it analyzes tens of millions of transactions daily for clients including Revolut, Plaid, Nubank, and Afterpay.

The funding will also support new partnerships with financial institutions and cloud providers.

BlockOffice acquires Activ8 to expand Web3 services

BlockOffice, a Malaysia-based professional services firm, has acquired Web3 marketing agency Activ8 (formerly Lydian Labs), the organizer of Malaysia Blockchain Week.

Activ8’s co-founders Noelle Lee and Ian Tan will continue to lead the rebranded firm, with most staff transitioning over. BlockOffice CEO Jay Lim said the deal strengthens the firm’s ability to offer marketing alongside financial and back-office services for Web3 clients.

Activ8 will remain the official organizer of Malaysia Blockchain Week, which drew more than 6,000 attendees in 2025. The 2026 edition is expected to expand with BlockOffice’s global network.

Saison Capital launches USD 50 million Onigiri blockchain fund

Saison Capital, the venture arm of Japan’s Credit Saison, has launched Onigiri Capital, a USD 50 million blockchain fund. It has secured USD 35 million to date and will invest in startups building real-world asset solutions in stablecoins, payments, tokenized assets, DeFi, and financial infrastructure.

The fund aims to connect blockchain founders with Asia’s institutional markets, leveraging Credit Saison’s network in Japan, Korea, Singapore, and Southeast Asia. It is co-managed by Saison Capital’s Qin En Looi and Hans de Back.

Looi said Asia is becoming a hub for tokenization innovation, while de Back emphasized bridging Silicon Valley startups with Asian institutional capital and regulatory frameworks.

Recent deals completed in China:

- Maimai Planet, an agritech company, has secured over RMB 100 million (USD 14 million) in a pre-Series A funding round. The round was jointly led by Qihong Yuyuan, Star Chain Capital, Spright, and Honglian Qiyuan, with participation from existing shareholders. The company will use the capital for R&D in AI-driven agriculture models and smart sensing equipment. —36Kr

- Kingwills, a high-performance materials company, has raised several hundred million RMB in a Series C round led by Oriza Hua, with continued support from industrial investors. The funds will support new product development, capacity expansion, and ecosystem building. —36Kr

- Suxin Technology, a polymer recycling platform, has closed pre-Series A and pre-Series A+ rounds consecutively, raising an eight-figure RMB sum. The pre-Series A was led by an industrial fund co-managed by Jinding Capital and Helead, with Innoangel Fund reinvesting, while the pre-Series A+ round was backed solely by Zip Capital. The funding will enable scaling of production lines for its enzymatic PET (polyethylene terephthalate) recycling technology. —36Kr

- Aixam, a medical robotics company, has raised an undisclosed sum in a pre-Series A+ round from Huaxi Yinfeng Investment, under Luzhou Laojiao Group. The company will channel the funds into product registration and development. Aixam’s valuation now exceeds RMB 250 million (USD 35 million). —36Kr

- Aerospace Servo, a precision servo systems developer, has secured tens of millions of RMB in a Series A+ round led by Landstone Capital, with participation from Junyuan Capital and existing investor Capital X. Proceeds will go toward team expansion, equipment upgrades, and working capital. —36Kr

- Danfit, an online fitness platform under Winning Tech, has raised an eight-figure RMB sum in a Series B round from Shanghai Youshi Fund and Shanghai Dongchao Investment. The funds will be used to accelerate its expansion in China, enhance its membership services, and explore overseas markets. —36Kr

Greenitio, Living Roots, LineWise, and more made recent headlines:

- Greenitio, a Singapore-based materials startup, raised USD 1.5 million in a seed funding round led by SGInnovate, with participation from Better Bite Ventures, Silverstrand Capital, and several angel investors from the chemicals and cosmetics industries.

- Living Roots, a Thailand-based agritech startup, raised a bridge round to expand the deployment of its platform. The round was led by Epic Angels, with participation from angel investors across Southeast Asia.

- LineWise, a Thai-founded startup building a troubleshooting platform for manufacturers, raised USD 1.1 million in pre-seed funding. Investors include Y Combinator, A2D Ventures, Exitfund, Remus Capital, SBXi Fund, and Team Ignite Ventures.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].