GridCare raises USD 13.5 million to ease power strain in AI data centers

GridCare, a US-based startup optimizing energy access for data centers, has raised USD 13.5 million in an oversubscribed seed round led by Xora, a deep tech fund backed by Temasek. Other backers include Aina Climate AI Ventures, Sherpalo Ventures, Breakthrough Energy Discovery, and several unnamed investors.

The company focuses on resolving power bottlenecks in artificial intelligence infrastructure by identifying underutilized grid capacity. According to GridCare, its platform can slash the time-to-power for data centers from five to seven years down to as little as six to twelve months—a boost that enables hyperscalers to roll out compute clusters faster.

By partnering with utility providers, GridCare offers tools to enhance grid utilization and revenue, while helping AI developers avoid costly delays. The fresh capital will go toward technology development, expanding utility partnerships, and broadening the company’s geographic footprint as AI-driven electricity demand accelerates.

Airwallex raises USD 300 million at USD 6.2 billion valuation

Airwallex, a global business financial platform, has secured USD 300 million in a Series F funding round at a USD 6.2 billion valuation. The raise includes USD 150 million in secondary share sales. Participants in the round include Square Peg, DST Global, Lone Pine Capital, Blackbird, Airtree, Salesforce Ventures, Visa Ventures, and multiple Australian pension funds.

Reportedly serving over 150,000 customers, Airwallex provides cross-border payments, multi-currency accounts, foreign exchange, spend management, and embedded financial APIs. The company expects to exceed USD 1 billion in annualized revenue by the end of 2025.

With the new funding, Airwallex aims to expand into Latin America, the Middle East, Japan, and Korea, while continuing to develop its products and scale its proprietary payments infrastructure.

Antler invests in early-stage Malaysian and Vietnamese startups

Singapore-based venture capital firm Antler has invested USD 110,000 each into Malaysian startups LocalPasar and FilePillar as part of its Southeast Asia accelerator program, per e27. The firm also backed Vietnam-linked aquaculture startup Sinhke with an undisclosed pre-seed amount.

- LocalPasar operates a digital agriculture intelligence platform to modernize Southeast Asia’s wholesale produce market. The platform offers real-time pricing, demand forecasts, and transparent sourcing, aiming to improve farmers’ earnings and reduce procurement costs for restaurants. The funds will go toward regional expansion and product development.

- FilePillar offers a tax automation tool tailored for accounting firms managing multiple clients. Built with AI, the platform streamlines compliance workflows and audit preparation. With new capital, FilePillar plans to expand its team, scale its offering, and enhance AI-driven features.

- Sinhke is developing a system that uses computer vision and proprietary hardware to assess shrimp larvae health. The startup claims its real-time diagnostic platform can double survival rates and save farmers up to USD 1.5 billion annually. The funding will be used to scale hardware deployment, refine analytics, and expand into Thailand and Indonesia.

Kind Kones closes Series A extension to fuel regional growth

Kind Kones, a Singapore-based plant-based ice cream brand, has completed a Series A extension round led by female-focused investor network Epic Angels, alongside other F&B-savvy angel investors.

The Singapore-based company plans to use the funds to expand across Southeast Asia and Dubai through franchised and owned outlets. The capital will also support operations and R&D, as Kind Kones positions itself to capture a larger share of the plant-based frozen dessert market.

Every Half raises USD 3 million to grow Vietnamese coffee chain

Every Half Coffee Roasters, a Vietnamese specialty coffee chain, has raised USD 3 million in a pre-Series A round led by Openspace Ventures and DSG Consumer Partners, according to The Saigon Times. Both are returning investors.

Launched in 2021, the company runs 14 outlets in Ho Chi Minh City and is vertically integrated from bean sourcing to retail. It sources coffee from regions including Dien Bien, Lam Dong, and Dak Lak, with a focus on fermentation research and craft brewing.

The funds will be used to expand store count, strengthen supply operations, and test exports to North America through e-commerce. Every Half also plans to explore new store formats across urban Vietnam.

ANGIN supports sustainable startups Collabit and Arconesia in Indonesia

ANGIN, an Indonesian angel investment network and impact platform, has issued soft loans of under USD 100,000 each to Collabit and Arconesia through the WiraUsaha initiative, conducted in collaboration with Koalisi Ekonomi Membumi (KEM).

- Collabit, based in Bitung, transforms fish byproducts into collagen and agricultural peptides, aligning with circular economy principles in the marine sector.

- Arconesia, operating in Bengkulu, enables fruit intercropping during oil palm replanting cycles, which boosts farmer incomes and reduces deforestation. It also provides smallholders with financing, training, and market access.

SeaTown backs AddVita with SGD 115 million to build health distribution network

AddVita, a healthcare and life sciences distribution platform based in Singapore, has secured a commitment of up to SGD 115 million (USD 89 million) from SeaTown Holdings International.

The investment will support a buy-and-build strategy targeting distributors of medical, lab, and pharmaceutical products across Asia. AddVita aims to improve healthcare delivery by consolidating supply chains and leveraging operational synergies.

Kite Magnetics lands AUD 3.6 million to commercialize electric motors

Kite Magnetics, an Australia-based deep tech startup, has secured AUD 3.6 million (USD 2.3 million) in a seed plus round led by SQM Lithium Ventures. Other participants include Investible, Boson Ventures, Breakthrough Victoria, and Monash University.

Kite is commercializing Aeroperm, a nanocrystalline alloy developed at Monash University over three decades. The company claims the material enables motors that are up to 25% more efficient and 50% lighter, targeting electric aviation, EVs, and industrial use cases.

The funding will go toward scaling production, securing supply deals, and preparing for market launch.

Toyota invests USD 250 million in Joby Aviation to scale eVTOL aircraft

Joby Aviation, an aviation company, has received USD 250 million from Toyota Motor Corporation to support certification and manufacturing of its electric vertical takeoff and landing (eVTOL) aircraft.

The partnership, which began in 2018, now includes both capital and strategic guidance from Toyota. Joby, which has logged over 30,000 miles in test flights, is preparing to begin commercial operations in 2025. The funding will help scale production at its California pilot facility.

Neuralink raises USD 600 million, doubles valuation to USD 9 billion

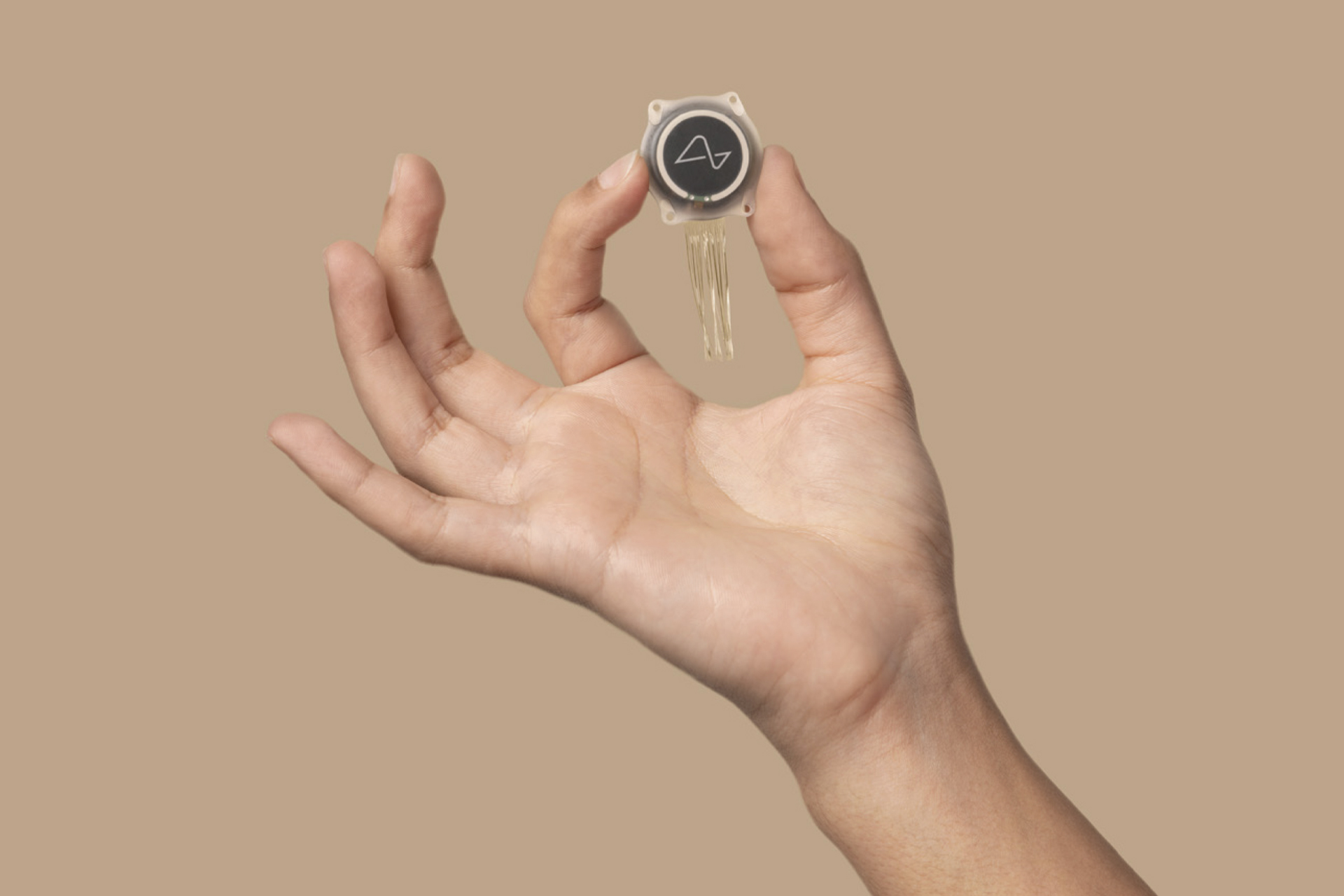

Neuralink has raised USD 600 million at a pre-money valuation of USD 9 billion, more than doubling its worth from 2023, according to Semafor citing Pitchbook data.

The final amount exceeded its earlier target of USD 500 million and follows the implantation of its brain-computer interface in three patients, including one individual with motor neuron disease who reportedly used the device to communicate.

This marks Neuralink’s largest funding round to date.

Recent deals completed in China:

- Transcend Semiconductor (T-Semi), a chipmaker, has raised nearly RMB 100 million (USD 14 million) across its two angel funding rounds. The rounds drew backing from Hua Capital, AAC Technologies’ investment arm, Xunfei Ventures, and Guoyuan Innovation Investment. T-Semi was founded in 2023 and focuses on mid- to high-end automotive communication chips. —36Kr

- Polly Polymer, an advanced materials company specializing in 3D printing, has raised more than RMB 200 million (USD 28 million) in a Series B funding round. The round was co-led by LADIC and Zhilai Investment, with participation from multiple investors. Existing backers GSR United Capital, Vitalbridge, and Zhongxin Innovation Capital also upped their stakes. The company will use the funds to advance its 3D printing technology, expand manufacturing facilities, and explore AI-driven applications. —36Kr

- Joyin, a smart robotics company, has secured over RMB 100 million (USD 14 million) in its angel extension round. Jinqiu Fund led the round, with existing investors Matrix Partners, Vitalbridge, and Monolith doubling down. Lighthouse Capital also participated and served as the financial advisor. —36Kr

- Sinspace, a developer of electric servo systems for aerospace applications, has closed a pre-Series A funding round worth an eight-figure RMB sum. Langcheng Capital and Cowin Capital took part, with Renchen Capital acting as the financial advisor. The funds will support R&D, team expansion, and lab infrastructure. —36Kr

- NuraNavX, a brain science company, has raised an eight-figure RMB sum in angel funding from K2 Venture Partners. The funds will be used to promote its AI-based connectome mapping product and enhance R&D efforts. NuraNavX’s technology visualizes brain network functions and connectivity to aid in diagnosing and treating neurological conditions. —36Kr

- Zhonghai Energy Storage Technology, an energy storage systems company, has raised over RMB 100 million in a pre-Series A++ funding round. Ant Group led the round, with Equilibrium Investment and Beijing Changping SME Innovation Venture Development Fund participating. The company specializes in iron-chromium flow battery technology and aims to expand production capacity and R&D. —36Kr

- Sigma Squares Tech, a computer vision company, has raised nearly RMB 100 million in a Series B+ funding round from a state-backed fund in Beijing. The funding will support new application development and industry deployments. This follows a previous nine-figure RMB round raised in October 2024, backed by Cowin Capital, Oriza Hua, Alwin Capital, and other investors. Sigma Squares serves clients across eyecare, high-end medical devices, and pharmaceuticals. —36Kr

CrediLinq, Ringkas, Firsty, and more made recent headlines:

- CrediLinq, a fintech startup based in Singapore, raised an undisclosed amount in a Series A funding round co-led by OMVC and MS&AD Ventures. Other investors participated, including Citi Ventures, 500 Global, 1982 Ventures, Big Sky Capital, the Rustem Family Office, and Epic Angels.

- Ringkas, a mortgage tech startup, landed USD 5.1 million in a pre-Series A funding round from Flourish Ventures, Kadan Capital, and other investors.

- Firsty, a Singapore-based startup aiming to offer free mobile data globally, raised SGD 7.5 million (USD 5.8 million) in a funding round co-led by Speedinvest and Dutch Founders Fund, with participation from executives at KPN, Uber, Booking.com, and Adyen.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].