Airfares notably surge whenever festive periods—such as the Lunar New Year—draw near, reflecting the heightened enthusiasm for holiday travel. According to data from Trip.com, summer bookings increased by 170% year-on-year during this year’s Lunar New Year period, with the average airfare over 15% higher compared to 2023.

However, what remains largely unknown to the public is the presence of a significant market behind aircraft dismantling, which can be more lucrative than running aircraft operations.

Aircraft, as durable assets, are subject to various factors such as rising fuel prices, diminishing performance levels, and escalating maintenance costs, all of which may lead to operational expenses exceeding generated revenue. Consequently, aircraft are often retired and disassembled before they reach the end of their service lifespan.

Over the past two decades, with the rapid expansion of China’s aviation sector, a wave of aging aircraft has reached retirement age as the fleet continues to grow. Data from the International Air Transport Association (IATA) indicates that the global average retirement age for commercial aircraft is 25 years. Freight aircraft have a slightly higher ceiling at approximately 32 years, while the average retirement age for aircraft in China stands at 17 years.

In 2022, the average age of China’s aviation transport fleet was around eight years, with aircraft under ten years of age constituting 78% of the fleet.

With the challenge of fleet aging for China looming over the next decade, a green transformation of aircraft dismantling and recycling is taking shape domestically.

Aircraft dismantling and recycling involve the disassembly of aircraft using specialized equipment and techniques, followed by the restoration, refurbishment, remanufacturing, and inspection of components such as engines, landing gears, and avionics. These certified components are then channeled into both domestic and international second-hand aircraft material markets for sale or lease.

Mentis Aviation Group (MAG), established in 2021, is an aviation company that specializes in aircraft dismantling and component maintenance services, as well as sales, aircraft leasing, and other aviation services.

Dismantling an aircraft is not merely about procurement, dismantling, and resale. According to MAG investor Wu Qian, to maximize asset returns, a professional team is needed to accurately assess the potential value of assets and provide tailored solutions such as leaseback and dismantling, or leaseback and passenger-to-cargo conversion, based on various potential scenarios.

Using the Airbus A320 model as an example, a brand new A320 has a catalog price of approximately USD 130 million, but its retirement price is at best a seven-figure USD sum. Through aircraft dismantling, at least 1,000 reusable components can be obtained from an A320, which can be used to generate income that far exceeds its market price.

The challenge of aircraft dismantling is not in the technology

As the world’s largest single-country aviation market, China’s aircraft dismantling business is still in its infancy. One factor is the relatively short development history of the domestic aviation industry, resulting in limited retired aircraft assets and by extension, a modest volume of dismantling business, thereby hampering the formation of an industrial agglomeration.

The scale of China’s aviation maintenance and remanufacturing industry was about RMB 200 billion (USD 27.6 billion) in 2022, accounting for roughly 30% of the global market share. However, over 90% of retired aircraft are exported to other countries for storage, dismantling, and remanufacturing, with less than 10% being dismantled and reused in China, indicating significant room for domestic development.

Currently, there are three common types of aircraft dismantling companies:

- Subsidiaries of airlines or maintenance, repair, and overhaul (MRO) companies engaged in civil aircraft maintenance.

- Entities engaged in the buying, selling, and leasing of used aircraft materials.

- Companies focused on aircraft storage and dismantling as their main business.

In the face of significant market demand, domestic companies have begun to take action, including MAG, which specializes in the sale and leasing of high-quality aircraft components.

Composed of an international team of experts, MAG has participated in over 400 aviation asset management transactions worldwide, generating a total value exceeding USD 5 billion.

MAG provides various services including dismantling and recycling, cross-border asset transactions, leading, and other technical services to maximize the value of aviation assets. The company’s dismantling department is based at HefeI Xinqiao International Airport, where it serves primarily commercial aircraft.

Chen Lin, aircraft dismantling manager at MAG, told 36Kr that the prevailing perception of aircraft dismantling as a highly technical operation is somewhat misguided. In comparison to aircraft maintenance, dismantling operations are relatively straightforward and cost-effective.

However, due to the unique nature of aviation, it cannot be simply grouped together with other maintenance categories. Enterprises aspiring to engage in aircraft dismantling need to apply for a license qualification, with requirements imposed on various aspects such as the facility, tools, personnel, and technology, necessitating significant upfront investment in fixed assets. This poses a challenge for small- and medium-sized startups.

MAG’s specialty lies in evaluating aircraft asset values, acquiring them at fair prices, and selling dismantled components for profit.

The MAG team predicts the value of listed retired aircraft, inspects aircraft equipment lists, and generates dismantling income forecasts based on the corresponding aircraft models and available assets. Subsequently, when an asset enters the retirement stage, MAG participates in bidding by providing a comprehensive and flexible trading plan. Should a bid be accepted, MAG will purchase the assets either independently or in cooperation with professional asset owners, subsequently entrusting them to third-party organizations for dismantling.

During the dismantling process, most original components often cannot be directly reused. Instead, they are recertified, repaired, or overhauled using MAG’s component MRO facilities, or by tapping into the capabilities of its network of maintenance suppliers and original equipment manufacturers (OEMs).

Afterward, these components will be sent to global inventory centers, with related information distributed to global buyers to facilitate sales and leasing arrangements.

Since 2022, the MAG team has cooperated with KP Aviation, an aftermarket materials and services provider, purchasing six engines and a Boeing B737-800 unit. MAG also collaborates with various other overseas partners to participate in the global sale of aviation assets.

Expansion of the used aviation materials market

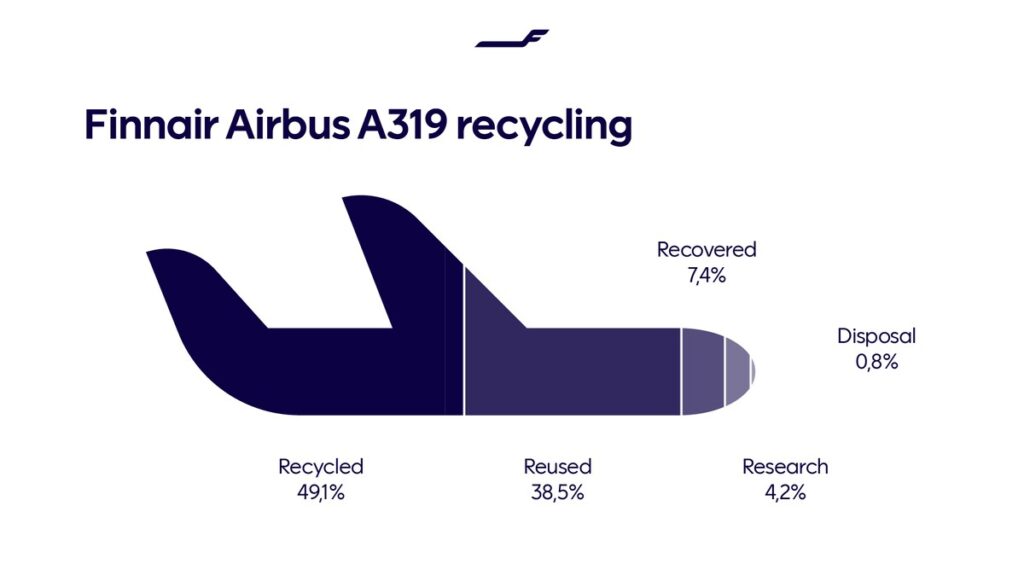

In July 2021, Finnair completed the dismantling of a 21-year-old Airbus A319, with a recovery rate of 99.2%.

Generally, over 90% of aircraft components are dismantled and recovered, with high-value components including engines, landing gears, and avionics, among others.

Public data shows that engines account for around 70% of sales in the aircraft aftermarket parts market, with average prices fetching about 80% of the value of the initial aircraft. Industry insiders told 36Kr that engines have consistently been among the first assets sold in asset packages.

The sale of used aviation materials has certain prerequisites. For example, when MAG purchases retired aircraft, it concurrently searches for suitable component buyers and conducts transactions. Therefore, when selling engines, they may be delivered to buyers as soon as they have been dismantled.

The resurgence in air travel demand following the pandemic has had dual effects. On one hand, it has propelled the need for aircraft maintenance and the pace of asset retirement, thereby increasing the volume of dismantling operations. Conversely, the OEM supply chain has been adversely affected by material shortages and stagnant labor productivity.

Due to reduced engine production and supply chain constraints, OEM manufacturers Airbus and Boeing have been storing assembled aircraft bodies without matching engines. Additionally, the absence of other essential components has led Airbus and other OEMs to revise down their production targets.

In light of this, demand for used aircraft components has surged substantially.

Compared to OEM parts, used components can reduce costs by 30–50% and meet excess demand that manufacturers are unable to satisfy. The global used aviation materials market size was estimated at USD 6 billion in 2022, and expected to grow to about USD 9.7 billion by 2030. International aviation consulting firms and the Aircraft Fleet Recycling Association (AFRA) also anticipate that, with technological advancements and gradual market maturation, the annual market growth rate could reach 5.5%.

MAG investors said that, due to the impact of the pandemic, the stagnant aerospace manufacturing industry in Europe and the US will need 3–5 years to resume production rhythms and capacities.

In addition, aircraft dismantling and recycling can also drive the development of adjacent industries such as component maintenance and logistics transportation, thereby extending the average aircraft lifecycle.

The global aircraft dismantling service market has exceeded USD 97 million in value and is expected to grow at a compound annual growth rate (CAGR) of 6–7%, reaching around USD 180 million by 2027. The US accounts for over 80% of the total, based on the number of participating companies and business volume. Several industry bigwigs, including Boeing, Airbus, and others, have also ventured into the aircraft dismantling field.

With the continuous expansion of domestic demand, it is foreseeable that aircraft dismantling will continue to undergo rapid growth in China, positioning the next decade as a golden period for the industry with promising prospects that lie ahead.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Huang Nan for 36Kr.