The oft-repeated observation of India startups, that they are thriving even in a slowing economy, is dated news. The reasons are an interplay of multiple factors, according to Hari Krishnan, a fund manager at Astrarc Ventures.

Krishnan told KrASIA in an interview that one of the key reasons is the time factor. He says, “Startups and private equity have a phase lag effect compared to public markets. If public markets are going down, the private market will reflect that sentiment only after a year.” He also added that the investment numbers across all funding rounds are rather cyclical.

This sentiment is corroborated in a report by Chennai-based Venture Intelligence shared with KrASIA. Venture Intelligence is a research agency that tracks startup investments based on transactions, valuations, and financials of private companies.

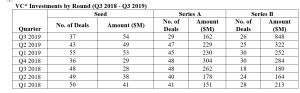

The VC investments report from Q3 2018 to Q3 2019, shows a pattern of highs and lows as can be seen in the chart below:

In the Indian venture capital investment scene, Q3 2019 has performed the best at USD 1.22 billion in Series D round.

Krishnan believes that the trend of investments gravitating towards late stage rounds speaks to local investors’ conservative attitude.

“Series C & D fund round firms get larger funding amounts as a lot of investors are taking a conservative approach nowadays and invest with large cheques only in late stage startups that have proven themselves in the past,” said Krishnan.

He added that “Series A & B fund round startups get about 4-5 million dollars ticket size per deal and they would have to do 300 deals to raise one billion dollars which is not possible. While the volume of deals in Series A is high, the valuation of the deals in Series C is higher.”

That said, he also thinks that in coming quarters early stage startups are also expected to shine, on the ground that “a good breed of entrepreneurs are coming onto the scene and investors are strongly expected to support seed stage startups.”

When it comes to the startups raising the bulk of the funding in the third quarter of this year, Udaan, Ola Electric, and Rebel Foods are the top three winners.

Business-to-business marketplace Udaan raised USD 586 million from Altimeter Capital, Hillhouse Capital and DST Global; Ola Electric, the ride-hailing firm’s electric vehicle arm, raised USD250 million led by SoftBank Group; and Rebel Foods, known for its Faasos rolls and Behrouz Biryani, raised USD130 million led by hedge fund Coatue Management.

Krishnan expects that in Q4 FY 19, turbulence is expected in the startup investment ecosystem as SoftBank might move cautiously due to the WeWork IPO debacle. For India the trend he forecasts in Q4 2019 would be, “Many high performing startups from India are gunning to go global, like Ola, Paytm and Zomato. As they are twinning in the domestic and overseas market a lot of growth and valuation is expected.”

Another trend that India will see is bigger startups buying their smaller counterparts. This is expected as there are nearly 20 unicorns in India with the notable being Ola, Paytm, Swiggy, Udaan, Zomato, Policy Bazaar, and Rivigo.

Indian startups are bucking the trend of a macroeconomic slowdown in India, China and the US which shows the confidence of the investors. More action is expected in the last quarter of 2019 since Oyo, Swiggy, Zomato, Dream11, Lenskart, and other large firms are negotiating fundraises as reported by local paper Mint.