Indonesian online travel unicorn Traveloka is intensifying its bet on the financial service sector as it prepares an initial public offering.

Primarily known as the Southeast Asian country’s equivalent to Expedia, the US travel booking service, Traveloka has steadily become a burgeoning fintech player in recent years, and is now expanding its “buy now, pay later” services beyond its ecosystem.

With travel slowly recovering in some parts of the region, analysts say the pay-later service could boost the valuation of the unicorn—a private company valued at over USD 1 billion—when it conducts its IPO, now slated for next year.

Fintech “is definitely very important… Fintech is one of the three important [business] pillars,” Traveloka president Caesar Indra told Nikkei Asia in a recent interview. The other two pillars are travel and lifestyle services, including booking activities and food deliveries.

“We will continue to invest in the area and develop more products in the future, because the opportunity is quite big,” Indra added. Though he declined to share the amount of investment for the business, he said the company is “hoping this fintech [business] will become an important revenue driver.”

Buy now, pay later is essentially a digital credit service mostly for e-commerce, allowing consumers to purchase a product and pay at a later date, often in installments. It primarily targets the underbanked, a vast population in Indonesia boasting increasing purchasing power but deprived of services such as credit cards. The sector has seen accelerated growth with the biggest local tech players including GoPay, part of the country’s largest private tech company GoTo, and Ovo, the Indonesian digital payments arm of Singapore’s Grab, all joining the fray.

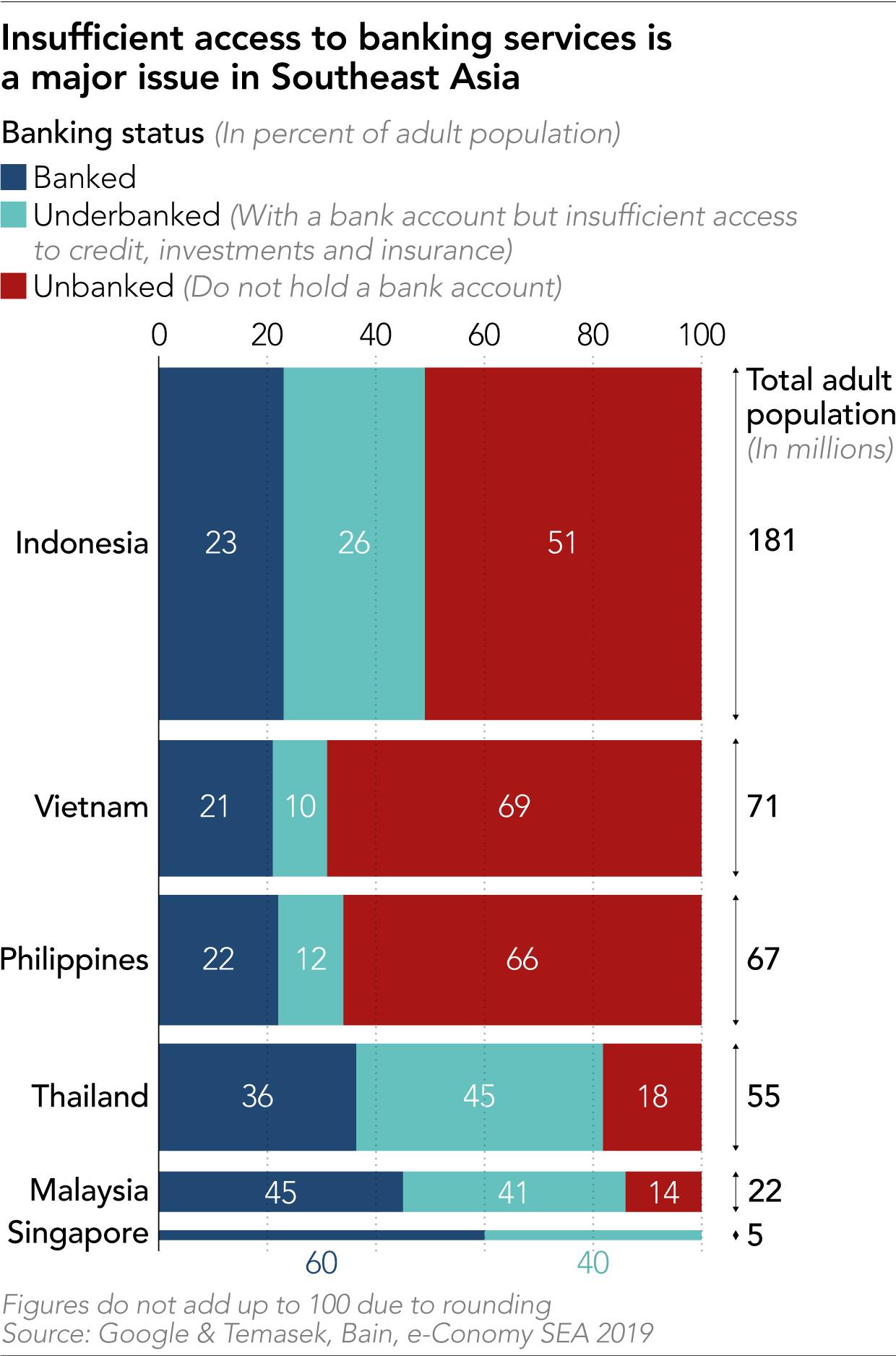

A 2019 report by Google, Temasek, Bain and e-Conomy SEA found that Indonesia’s underbanked totaled some 47 million people, or 26% of the adult population. The country is the world’s fourth-largest country with about 270 million people.

Traveloka was one of the first startups to offer buy now, pay later in Indonesia when it launched the service in 2018. While it was confined within the Traveloka ecosystem, the travel startup is now expanding the service outside its platform. The latest move came in September, when it partnered with state-owned lender Bank Negara Indonesia and launched PayLater Virtual Card Number, a pseudo-virtual credit card, allowing customers to use Traveloka PayLater on popular e-commerce websites like Tokopedia and Shopee.

Indra’s company also participated in a recent fundraising by Sirclo, an e-commerce enabler for micro, small and medium-sized enterprises, or MSMEs, and Indonesia’s equivalent to Shopify, with a view to introducing the PayLater option to MSMEs selling their goods online using Sirclo’s service.

“We want to extend [PayLater Virtual Number] to a bigger set of users,” Indra said. “During COVID, there is an acceleration of digital adoption. More transactions are done online, even food consumption, meals are order[ed] digitally… Those with virtual numbers transact 3 times more in value than [regular PayLater users] without virtual numbers,” he added. “We don’t know if this trend will continue but it is a promising trend.”

Traveloka having a pay-later service “makes sense given the consumers will often see a holiday as a big-ticket item, where spreading the cost over a period would be quite appealing,” said Angus Mackintosh, founder of CrossASEAN Research. “Extending this to a credit card type arrangement also makes sense once you have established the credit worthiness of the customer. This means you now have them on the hook for purchases off the Traveloka platform, which provides opportunities to further improve returns.”

Running a growing fintech business is quite a transition for Traveloka, a startup that began life as a search engine for flight tickets when it was founded in 2012. But Indra said that from an early stage the company had realized that an underbanked population was an issue in Indonesia.

“The most popular method at that time was bank transfer… A lot of people [booking travel] had bank account[s] but no access to credit,” he said. “That explained [to us that] there was a big gap in [the] market with access to credit. Credit card penetration is 10% across Thailand, Vietnam, and Indonesia, but a lot of people had bank account[s], and we wanted to solve this problem.”

The move into credit services was “natural” as they have “good synergy” with travel, Indra said, noting that those who can afford big-ticket items like overseas travel typically have good credit worthiness.

In addition, Indra said a travel company like Traveloka can “do well” in the area of KYC, or “know your customer,” which is a crucial element in decision-making on providing credit. “For example, when you board a flight or check into a hotel, you need to fill in the right information and present your ID at the check-in counter,” he said. “We have an advantage by having a very accurate profile about our customer.”

Traveloka is also looking to expand its PayLater service outside Indonesia, Indra said, with Thailand and Vietnam being viewed as the first markets. Combined, they have an underbanked population of 32 million, according to the 2019 Google report, and together with Indonesia, make up 80% of the underbanked population in Southeast Asia. “I think the market has a similar consumer characteristic, structural gap and challenges [to Indonesia] that we believe [we] can address well,” he said.

Tech companies moving into fintech businesses aren’t a rarity in the region, with major players like Gojek, Grab and Singapore’s Sea all having payment arms. Nadiem Makarim, founder of Gojek and currently Indonesia’s education minister, previously said a payment service is “so important” because it is “the glue that connects” all services on a given platform, and increases transactions within the ecosystem.

Traveloka PayLater has seemingly achieved that. Indra said that PayLater users have grown 7.5 times since launch, and the startup has facilitated close to 7 million loans via the service. “When looking at the overall transaction[s] on Traveloka, 8% is done via PayLater,” he said.” A user who uses PayLater versus those who don’t, on average transacts 25% more often on our platform. The average transaction value also increased over 30% versus those who don’t have PayLater.”

One area where other tech companies have gone but Traveloka hasn’t is banking, seen as a natural progression from payment services; GoTo owns just over 20% of Bank Jago, a local digital bank, while Sea now wholly owns an Indonesian bank, renamed as Bank SeaBank.

But Indra says Traveloka is taking a prudent approach for now. “We currently don’t have any plans [to move into digital banking],” he said. “We believe in partnership and focusing on building [our] fintech capability.”

With or without a bank, having a growing fintech service should hold Traveloka in good stead when it conducts its IPO, especially with travel slowly recovering. A reason for optimism is that Finaccel, a Singapore-based fintech company with Indonesia as its main market, was valued at USD 2.5 billion in a special purpose acquisition company deal announced in August.

Traveloka had initially planned to list in the US through a merger with Bridgetown Holdings, a SPAC backed by billionaires Richard Li and Peter Thiel, but talks reportedly broke down. A source privy to the matter said Traveloka is now looking to list in the US next year via a conventional IPO, adding that the Indonesian company “should be [valued] more” than Finaccel’s valuation.

“This is probably not a bad time to list, looking into a [travel] recovery and the fact that the company is probably looking to develop its other lifestyle businesses plus buy now, pay later, which require additional capital,” said Mackintosh of CrossASEAN Research. “Adding these additional businesses can add additional value but it is probably too early to say how much.”

Traveloka’s existing investors include Singapore sovereign wealth fund GIC, Qatar Investment Authority, Expedia, and local venture capital firm East Ventures, among others.

Indra declined to comment on the IPO as well as the reported breakdown in merger talks with Li and Thiel’s SPAC.

“What we’ve been always telling the market is… the same [message],” Indra said. “We use fintech as an enabler of Southeast Asia consumers to upgrade their lifestyle and that’s built on top of our strong travel business, and with that we hope more and more consumers will have access to credit or modern financial products.”

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.