When Chen Hui, general manager at Sunwoda, reflects on the company’s early years working with Li Auto, one moment stands out: “There were times when we had to take calls from bathhouses to figure out how to fix problems.”

“After fighting side by side with Li Auto for five or six years, every moment is still crystal clear,” he said.

Li Auto is now preparing to launch the Li i8, a large six-seat all-electric SUV with a presale price of RMB 350,000–400,000 (USD 49,000–56,000). Built on an 800-volt platform, the vehicle offers two battery options, 90.1 kilowatt-hours and 97.8 kWh, delivering CLTC-rated ranges of 670 km and 720 km, respectively, with a maximum energy consumption of 14.8 kWh per 100 km.

Unlike the Li L8 launch, when the company had a first-mover advantage in the extended-range segment, hybrid category growth is now plateauing. To sustain momentum, Li Auto needs a breakthrough in the fully electric segment.

The Li i8 is its first major effort to make that leap.

Li Mega, the brand’s flagship EV priced above RMB 500,000 (USD 70,000), was never designed to drive volume. But the i8 is, and so are the rest of Li Auto’s upcoming battery electric vehicles.

But scaling won’t be easy.

This year, Tesla is rolling out an extended version of its SUV segment leader, the Model Y L. The Onvo L90 will make its entry with battery-as-a-service (BaaS) pricing that brings its base model under RMB 200,000 (USD 28,000). Meanwhile, the all-electric version of the M8 registered over 10,000 preorders within its first eight hours of presale.

So how will the Li i8 stand out in the increasingly competitive six-seat SUV segment?

Li Auto is banking on its edge in smart driving. integrate advanced assisted driving, long range, 5C ultra-fast charging, and low energy consumption, while maximizing cabin space through high system integration. Achieving this depends on tight collaboration with suppliers.

Redesigning LiDAR with a user-first mindset

The Li i8 runs on Li Auto’s proprietary Mind VLA assisted driving architecture and comes standard with Hesai’s ATL LiDAR (light detection and ranging) system, designed specifically to meet Li Auto’s safety redundancy standards.

In fact, the “L” in “ATL” stands for “Li Auto.”

Discussions around ATL began in mid-2023, when Li Auto began developing its battery EV platform. Given range concerns, the company pushed for a compact, low-power LiDAR design.

It also wanted to reduce wind resistance by steepening the windshield angle relative to its extended-range models. That required a sleeker sensor aligned with the vehicle’s overall design.

Bridging concept and execution, however, proved technically difficult.

Liang Feng, vice president of R&D at Hesai Technology, explained: “Shrinking the LiDAR’s volume and lowering its power draw requires reducing its optical aperture. But that’s like making a camera with a smaller lens, whereby the image quality suffers.”

Hesai overcame the issue with two major innovations.

First, the company designed an extremely compact optical path. “You can see the new lens in teardown diagrams,” Liang said. “That allowed us to shrink the unit without compromising optical efficiency.”

The bigger breakthrough was in chip design.

“The chip largely determines the upper limit of LiDAR performance,” Liang said. Hesai had been investing in LiDAR chip R&D since 2017, and when Li Auto issued new requirements, the company developed its fourth-generation chip. “The new chip, combined with an optimized laser and detector, offsets the performance loss that typically comes with a smaller design.”

The final result: ATL is 60% smaller and consumes 55% less power than Hesai’s turnkey AT128 while delivering twice the performance.

Liang attributed the outcome to Li Auto’s unusually collaborative approach.

“The two sides held so many co-creation meetings that eventually our security guards stopped asking Li Auto employees to badge in. They just waved them through,” he said.

Most original equipment manufacturers (OEMs), Liang noted, are far less involved. “But Li Auto doesn’t just hand down specs, instead bringing in a user-centric mindset.”

It also shifted Hesai’s engineering approach. “In the past, we prioritized specs over experience. But Li Auto forced us to think from the user’s perspective,” Liang said.

One example: the LiDAR scanner emitted low-level vibration and noise. “As engineers, we’d normally scale up the scanner to meet performance targets. But that would have made the noise worse,” he said. “From a user perspective, NVH (noise, vibration, harshness) performance was more important than theoretical peak specs.”

Reengineering silicon carbide modules from scratch

Energy efficiency and range remain top priorities for EV buyers. The Li i8 addresses both with a choice of batteries and an in-house silicon carbide (SiC) motor, achieving energy consumption as low as 14.6–14.8 kWh per 100 km.

The compact motor layout also frees up an extra 24 millimeters of legroom in the third row.

At the center of this motor is an SiC chip developed by Sike Semiconductor, a joint venture between Li Auto and Sanan Semiconductor. Li Auto owns 70% of the venture and is its only customer.

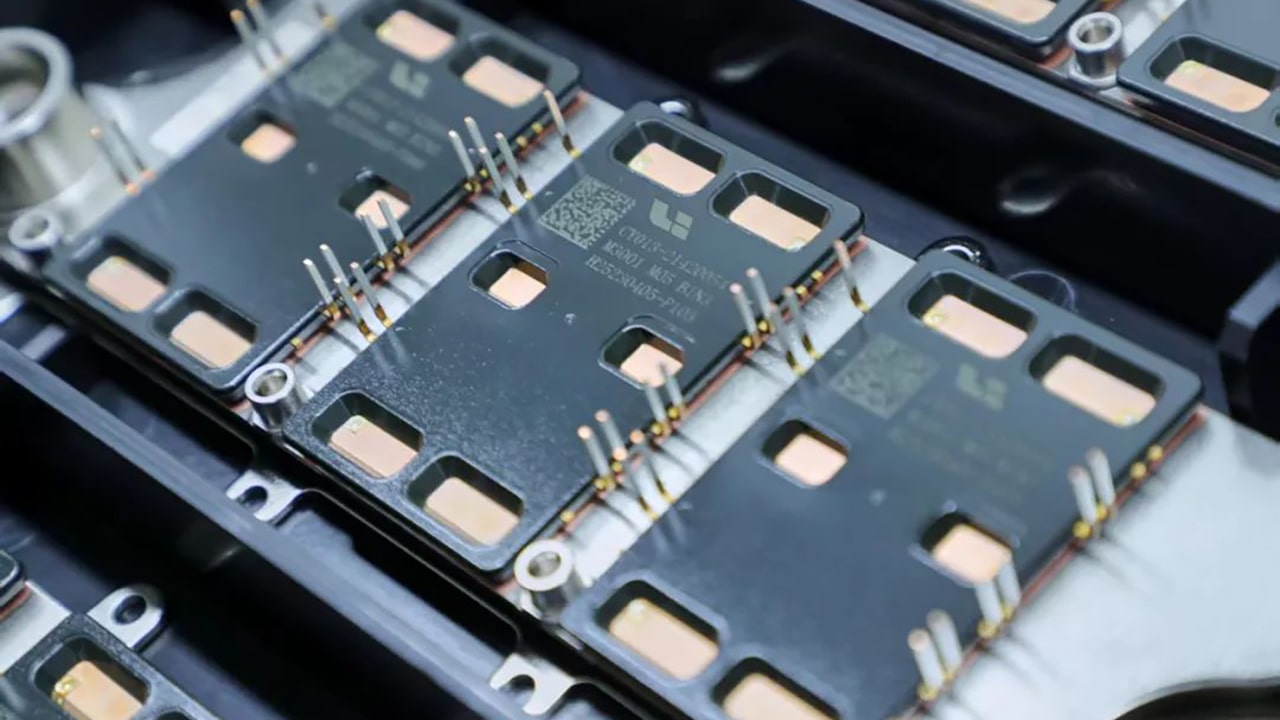

The module features an “open-window” design that’s rare in the industry.

According to Tang Huayin, head of EV products at Li Auto, this structure improves efficiency and reduces wiring footprint, freeing cabin space.

“You can think of it like hands reaching out from the module to control the motor,” Tang said. “If those hands are shorter, they take up less space, and with shorter paths, you get lower resistance and less energy loss. It’s like plumbing: shorter, insulated pipes reduce turbulence.”

Sike said that conventional SiC modules can increase range by about 6% compared to older IGBT (insulated-gate bipolar transistor) modules. With the open-window design, that rises to 7%, or an additional 47 km of range for the same battery capacity.

But there’s a reason the design isn’t widely adopted.

“It’s risky,” said Gao Xian, general manager at Sike. “The open-window region involves multiple materials. Under high heat and pressure, stress builds up at the edges, increasing the risk of delamination and moisture ingress.”

Gao praised the product for its innovations in technology, materials, and processes. “No one had done this before, so we had to figure it out step by step,” he said.

Co-developing 5C batteries for faster charging

Even with greater range and efficiency, fast charging remains critical. The Li i8 features a 5C battery co-developed with Contemporary Amperex Technology (CATL) and Sunwoda, capable of delivering 500 km of range from just ten minutes of charging, according to the company.

To optimize space, Li Auto and CATL also designed a conformal battery structure tailored to the i8’s chassis. “It improved space utilization,” said Wu Zhenhua, CATL’s chief passenger car technologist.

The battery also features an inverted design that isolates thermal and gas risks from the cabin. A shared exhaust and bottom plate lower the floor and add over five mm of headroom.

It wasn’t a simple design process. The project started in early 2022 and required revising the vehicle layout and frame strength calculations.

“It was during lockdown,” Wu said. “Some of our engineers isolated themselves in the tech building for two weeks to finalize the specs. That was the only way we could move forward.”

Sunwoda also committed heavily. In April 2023, it created a dedicated business unit for Li Auto, growing the team from 1,300 to nearly 1,700 people.

“It’s the first time we’ve done this for one client,” Chen said. Sunwoda even invited Li Auto executives to speak about company culture. “They operate around tasks, not hierarchy,” he said. “That’s powerful.”

The two companies now share vehicle data directly and use predictive models to identify potential issues before they reach customers.

“Our business unit operates like a joint venture co-managed with Li Auto,” Chen said. “We’re fully embedded.”

Prioritizing process control over cost-cutting

Years of close collaboration have shaped Li Auto’s supply chain strategy.

Rather than focusing on cost-cutting, the company prioritizes process control, especially in nascent technologies like SiC.

Sike, for example, pioneered a chip-level KGD (known good die) test to detect defects early. “Other companies don’t even know what to test,” one insider said.

Li Auto also uses production data from suppliers to prevent issues, rather than relying solely on customer feedback. It’s a shift from reactive to proactive quality control.

As one Li Auto executive put it: “Everyone wants better products and higher quality. But not every company knows how to get there.”

The edge may lie in the details. And it’s through those details—from thermal shielding and chip inspection to 24 mm of extra legroom—that Li Auto hopes to pull ahead.

If these lessons prove scalable, the i8 could give the company a fighting chance in the EV race.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Fan Shuqi for 36Kr.