On August 21, Hong Kong-listed RoboSense released its financial results for the second quarter and first half of 2025. The company reported stronger profitability, with Q2 revenue climbing to RMB 460 million (USD 64.4 million), up 24.4% year-on-year and 38.9% from the previous quarter. Its robotics segment surged, generating RMB 150 million (USD 21 million) in revenue on shipments of about 34,400 units, an increase of 631.9% from a year earlier and 189.1% from Q1.

Gross margin rose to 27.7% in Q2 2025, up from 12.3% in Q1 2024, marking six consecutive quarters of quarter-on-quarter improvement. The robotics segment delivered a margin of 41.5%.

RoboSense has been expanding its robotics business across industrial warehousing, autonomous delivery, and other verticals, and now serves more than 3,200 customers worldwide. Growth has been fueled by demand for its digital LiDAR (light detection and ranging) products.

In lawnmower robots, RoboSense secured exclusive supply agreements with several major global companies, with orders in the seven-figure range. In autonomous delivery, it formed long-term partnerships with Coco Robotics, two North American delivery platforms, and Chinese firms including Meituan, Neolix, and Rino.ai.

In embodied intelligence, it is working with more than 20 robotics companies worldwide, including Unitree Robotics, Dobot, and X-Humanoid. Several of these products were showcased at this year’s World Artificial Intelligence Conference and World Robot Conference.

During the earnings call, CEO Qiu Chunchao said that while first-half performance was strong, large-scale robotics deliveries are expected to concentrate in the second half, particularly in Q4. For lawnmower robots, production will peak over the next six months for the 2026 sales season. Demand is projected to rise from late Q3 2025 through Q1 2026, with deliveries peaking between Q4 2025 and Q1 2026.

The robotics segment currently holds a 41% gross margin, above the industry’s typical 35–40% range. RoboSense attributed the advantage to its digital product architecture and the fragmented, customization-heavy robotics sector, which remains at an exploratory stage. With rising delivery volumes, the company expects economies of scale to stabilize margins.

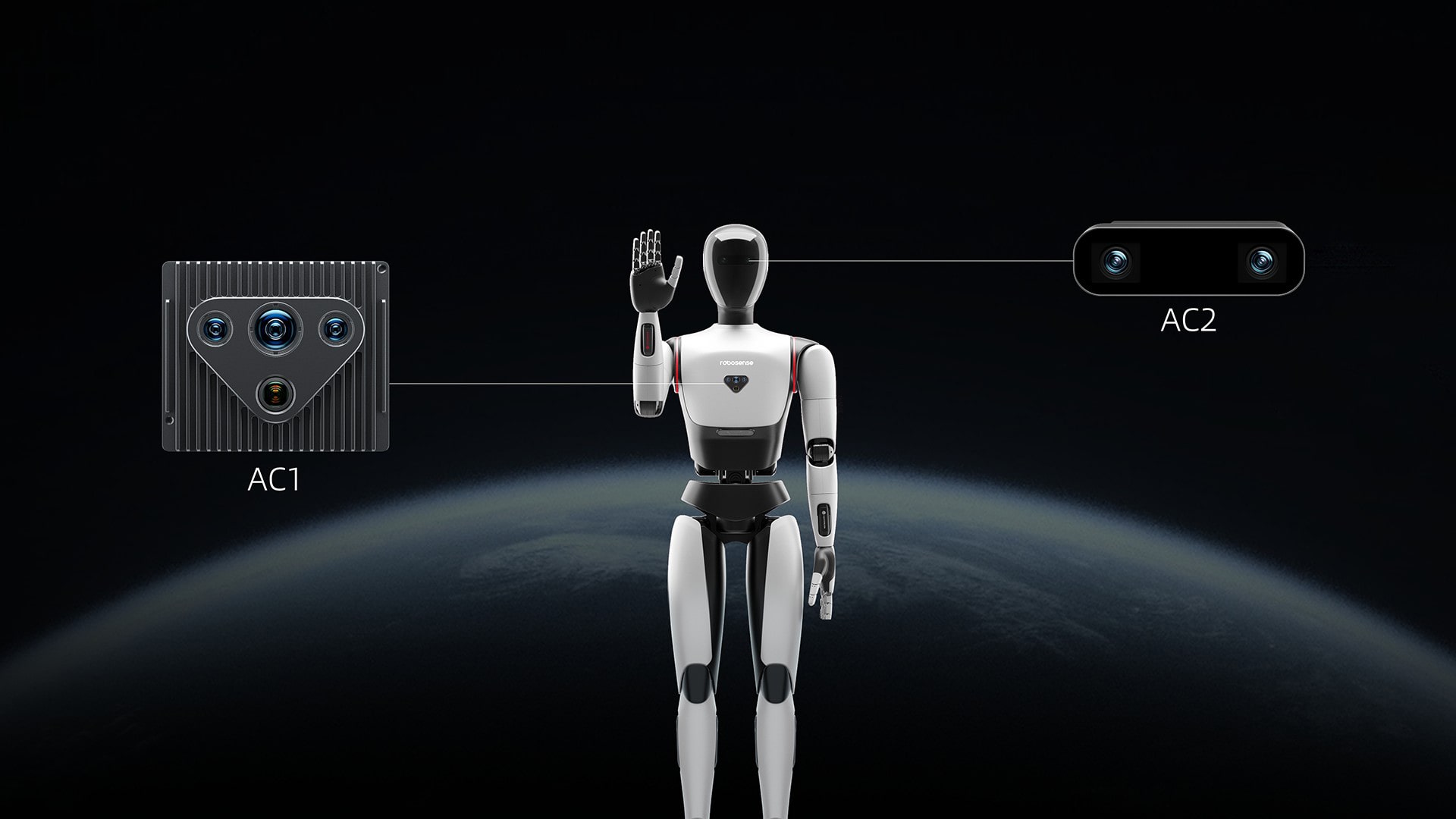

On the product and technology front, RoboSense has launched the “Active Camera” (AC1), a new category designed for robotic perception. AC1 integrates camera, LiDAR, and IMU (inertial measurement unit) inputs to output RGBD data. It supports robotic perception, mapping, localization, and grasping across multiple scenarios. Combined with an artificial intelligence-ready ecosystem, it is designed to help developers test and deploy technologies more quickly.

So far, RoboSense has gathered feedback from more than 400 universities, robotics firms, and developers, including Tsinghua University, the University of Hong Kong, and Stanford University. A second version, AC2, is scheduled for launch in the second half of 2025 to meet demand for higher-precision robotic perception.

Looking ahead, RoboSense plans to expand its AI and robotics work by increasing R&D investment in chips, algorithms, and digital architecture. With products such as the Active Camera, it aims to speed up the commercialization of embodied intelligence at scale.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Huang Nan for 36Kr.