Singapore’s sovereign wealth fund GIC is leaning more heavily on private markets to sustain returns, as it posted its best performance since 2015 during its last fiscal year.

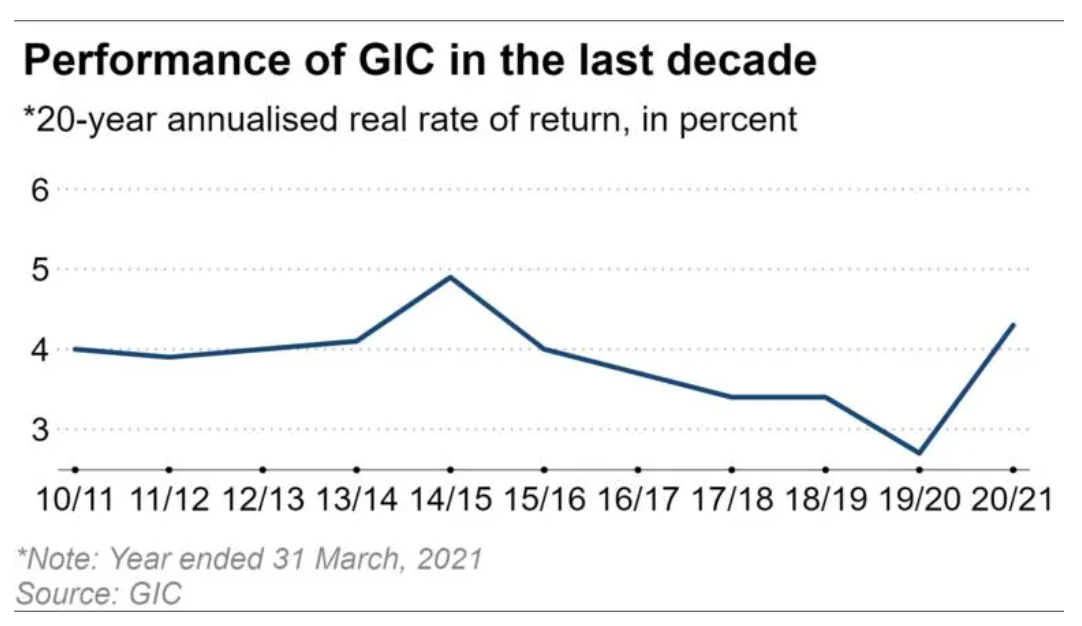

The investor on Friday said that after accounting for global inflation, its portfolio achieved an annualized real rate of return of 4.3% over a 20-year period that ended on March 31 this year.

GIC, one of the world’s most prolific institutional investors, uses this benchmark to gauge its performance, explaining that over the past two decades, from April 2001 to March 2021, it was able to achieve an average annual return of 4.3%—over and above the global inflation rate.

“The rolling off of a year of poor returns arising from the dot-com crash coupled with a strong rebound in risk assets over the past year has contributed meaningfully to this year’s 20-year return,” said Jeffrey Jaensubhakij, Group Chief Investment Officer at GIC.

The dot-com crash occurred at the turn of the millennium, when investments in internet-based companies prompted a feverish rise in US technology stock equity valuations, resulting in a bubble.

GIC does not release one-year performance figures or reveal the total size of its portfolio, to help preserve the secret of the exact size of the Singapore government’s assets, which it mainly manages.

The last time it did better than its annualized real rate of return of 4.3% was during its 2014 and 2015 fiscal year, when it recorded 4.9%.

With the onset of the coronavirus pandemic and the resulting global economic slump, GIC last year reported an annualized 20-year real rate of return of 2.7%—down from 3.4% the year before—which marked the worst showing for that metric since 2009 during the global financial crisis.

The fund, just like its Singapore peer Temasek, has been reaping the benefits of a rebound within broader equity markets. Earlier this month, state investor Temasek reported an annual return of 24.5% for the year ended March 31, a significant recovery from the minus 2.28% seen in the preceding year and its best performance in a decade.

Its net portfolio value rose almost 25% to a record SGD 381 billion (USD 283 billion), up from SGD 306 billion in its previous report.

Both investors, while active in public markets, are increasingly eyeing the realm of private equity—which covers the domain of fast-rising technology companies—as a vehicle for generating returns.

Temasek for instance, has over the years increased its bets on emerging industries in the consumer, media and technology, life sciences and agri-food, and nonbank financial services sectors.

That cluster took up just 5% of its portfolio in 2011, but now make up 37% a decade later—forming a larger proportion than its other focus areas like telecommunications, real estate, and transportation.

GIC, on the other hand, increased the proportion of its exposure in private equity from 13% to 15% in its latest report, while decreasing the ratio of its hold on nominal bonds and cash from 44% to 39%, although those still took the lion’s share of the portfolio.

The fund counts Razorpay, an Indian startup in the digital payments space, and Amplitude, a San Francisco-based analytics upstart, as tech companies it has invested in.

“We are positive on the micro prospects, given new areas of growth that are driven by increasing emphasis on sustainability, accelerating technological transformation, and growing needs for businesses to reconfigure their supply chain,” said Lim Chow Kiat, Chief Executive Officer of GIC, referring to micro prospects as trends expected to drive markets and open up new areas of growth in the long-term.

By geographical exposure, the US formed the biggest proportion of GIC’s portfolio at 34% as of the latest report, down from 36% previously. Its stake in Asia, excluding Japan, has increased, rising to 26% from 20%. GIC does not give the breakdown for its exposure to China, the world’s second-largest economy after the US, preferring to include it under the Asia category.

In contrast, Temasek has its portfolio concentrated in Asia, based on its exposure to underlying assets. China, at 27%, and Singapore, at 24%, remain the company’s two largest countries of investment, based on its latest report.

While Singapore’s share did not change in the past year, China’s exposure dropped from 29% previously.

Looking ahead, although optimism has risen with COVID-19 vaccinations expected to contribute to a global recovery, GIC said it was still cautious on the macro environment due to uncertainties around the trajectory of the pandemic, inflation concerns, the slight rise in bond yields, and elevated equity valuations.

It noted that the unprecedented speed and scale of policy intervention globally has helped to support jobs, incomes, and capital markets, and is looking to expand its private market capabilities, having expanded its teams in this area by about 10% to 20% over the years.

“We have been able to add meaningful value to our partnerships and investments, and look to do more,” said GIC’s Jaensubhakij. “We believe partnerships are critical to finding good investment opportunities amidst the uncertain macro environment.”

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.